ARCA: they control transfers exceeding this amount in March 2025

Discover the limits of transfers between own accounts and how to avoid issues with ARCA in 2025.

In March 2025, the Revenue and Customs Control Agency (ARCA), formerly known as AFIP, will begin scrutinizing transfers between own accounts that exceed certain amounts.

If you plan to carry out any significant operation, it is essential that you know the established limits to avoid inconveniences with this agency.

|

What are the limits to avoid problems with ARCA?

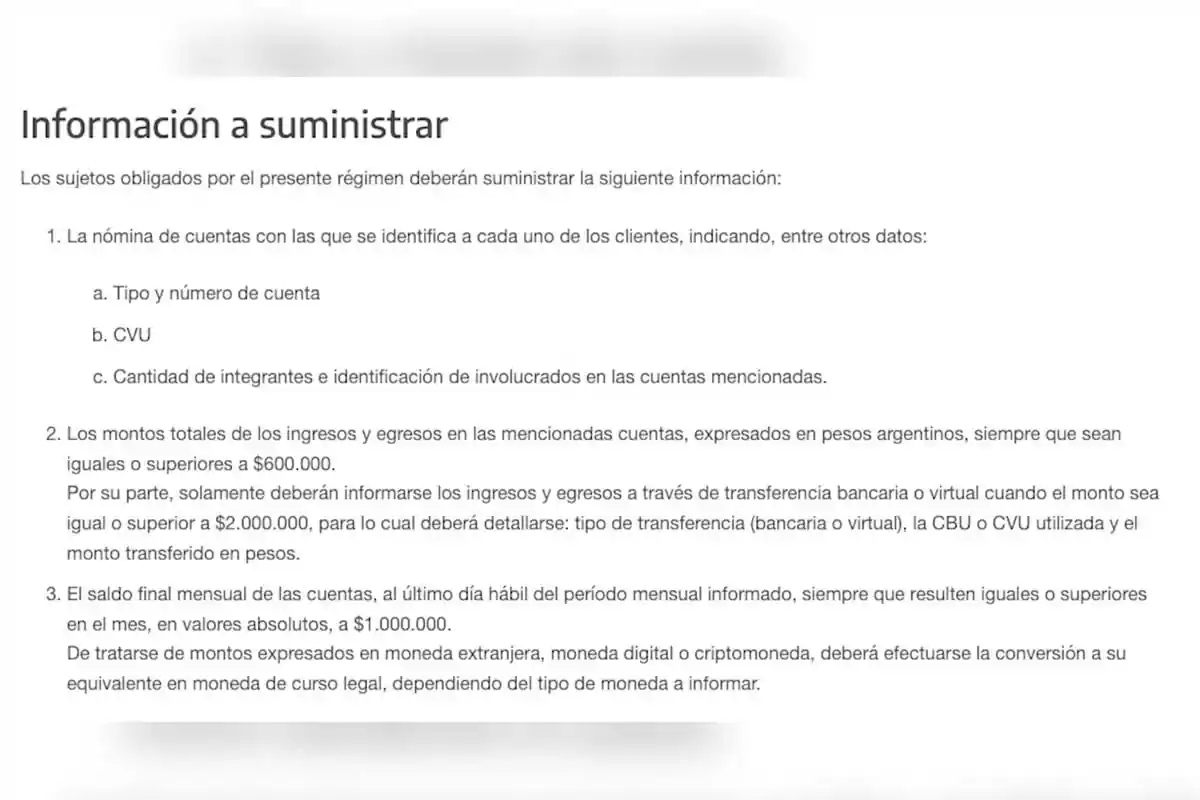

According to current regulations, ARCA will pay attention to:

- Transfers exceeding $600,000 between own accounts.

- Monthly balances exceeding $1,000,000 in bank accounts.

- Operations carried out through virtual wallets for amounts exceeding $2,000,000.

Common mistakes that can trigger ARCA's supervision

To avoid being investigated by the agency, it is important to consider some common mistakes when making transfers:

- Not responding to requests from banks or fintech: if a financial entity requests information about the origin of the funds, it is essential to respond quickly. Not doing so may result in a report to the Financial Information Unit (UIF).

- Lack of documentation on the origin of the money: it is always necessary to have receipts that support the operations. If you do not have declared income, both banks and ARCA may request explanations.

- Exceeding the established limits without justification: although banks have increased operational limits, each entity has its own restrictions. It is important to know these limitations to avoid unexpected blocks or audits.

- Financial movements without support: if you carry out operations for large amounts without being able to justify their origin, you could be audited by ARCA.

|

Documentation required by ARCA in March 2025

If required by ARCA, you must be prepared with the following documents to support your transactions:

- Purchase and sale receipts for goods or services.

- Receipts for the sale of shares or a company.

- Pay stubs or retirement income receipts.

- Billing for the last few months, showing your income.

- Monotax certificate if you are a monotax payer.

- Certificate of funds issued by a public accountant, if it is necessary to validate the origin of the funds.

To avoid complications with ARCA, it is essential to comply with these regulations and maintain proper justification of financial movements.

More posts: