Argentine triumph: Milei's government avoided paying USD 500 million to a vulture fund

New York's Justice supported the government's defense and rejected Aurelius Capital's claim in the 'GDP Coupon' case

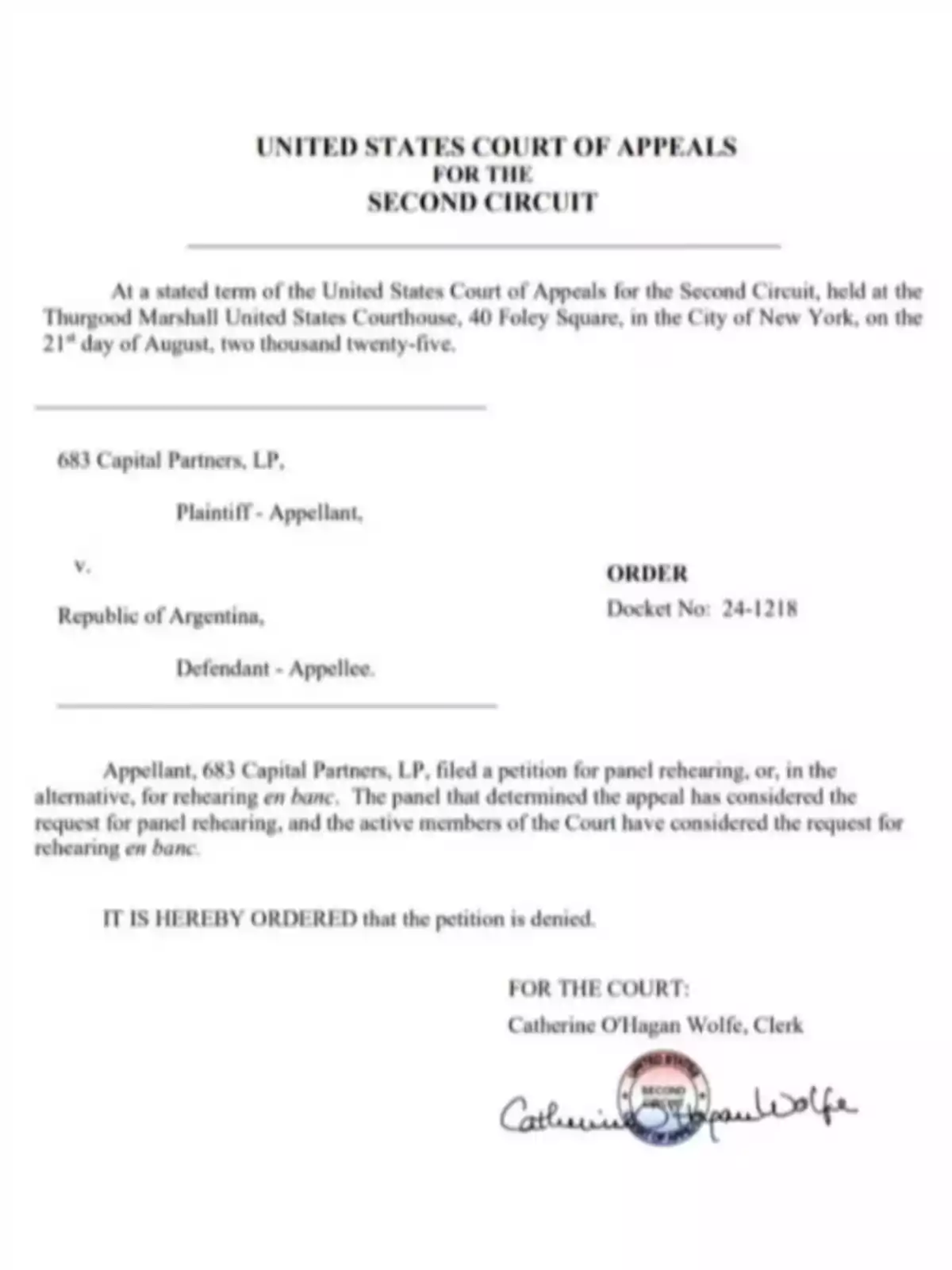

In a high-impact judicial event international, the United States Second Circuit Court of Appeals, based in New York, once again ruled in favor of the Argentine Republic and rejected the request for reconsideration filed by the vulture fund Aurelius Capital Management in the context of the "GDP Coupon" case. With this decision, the country avoided a potential payment obligation estimated at USD 500 million, a legal victory that strengthens the position of the Javier Milei administration against financial speculators who have historically sought to take advantage of state weakness.

The ruling, officially communicated by the National Treasury Attorney's Office, reaffirmed the decision issued on July 16, when the same court upheld Judge Loretta Preska's ruling in July 2024, which had already dismissed the plaintiffs' claim. The key was the "No Action Clause," which the funds violated by initiating the lawsuit, essentially invalidating their claim for payment.

"The decision constitutes the confirmation of a recent legal victory for the Argentine Republic, by preventing a potential payment obligation estimated at approximately USD 500 million. The Treasury Attorney's Office, under the leadership of President Javier Milei, reaffirms its commitment to firmly defend the interests of the Nation and its citizens in all judicial proceedings", the official body highlighted in a statement.

The claim was brought by Aurelius Capital Management, one of the well-known vulture funds that had joined the debt restructuring agreement signed with the Mauricio Macri administration in 2016. However, in 2019 the firm decided to initiate a new lawsuit against Argentina, alleging that during 2013 the country manipulated economic growth statistics to avoid extra payments to holders of GDP-linked bonds.

These financial instruments had been issued in the 2005 and 2010 debt restructurings, linking performance to the national economy's performance. Aurelius keeps that, by changing the base year for GDP calculation, the growth recorded in 2013 was artificially reduced "by half", which allegedly deprived bondholders of an extraordinary payment. According to the fund, this maneuver was deliberate and attributable to then Minister of Economy Axel Kicillof, who allegedly altered INDEC's metrics to avoid multimillion-dollar obligations.

In its submission, Aurelius argued: "When INDEC changed the base year for prices, real GDP for 2013 almost doubled in pesos measured at constant 2004 prices; and real GDP growth fell by about half. Of course, Argentina's economy didn't suddenly double, and its annual growth rate didn't suddenly fall by half. However, the measuring stick changed".

Although the Court of Appeals closed this chapter in favor of Argentina, analysts such as Sebastián Maril (Latam Advisors) warned that Aurelius could attempt a new filing in Judge Preska's court, "correcting the technicality" that led to this adverse ruling. "After the Court of Appeals' rejection in the USD GDP Coupon case to reconsider last month's ruling (reconsiderations are rarely granted by judges), Aurelius Capital and other funds are expected to file the case again in Judge Preska's court correcting the No Action Clause", he explained.

More posts: