Banco Nación asked Congress to halt the elimination of benefits for SGRs.

The entity warned that the measure, with partial approval, puts the financing of thousands of SMEs at risk

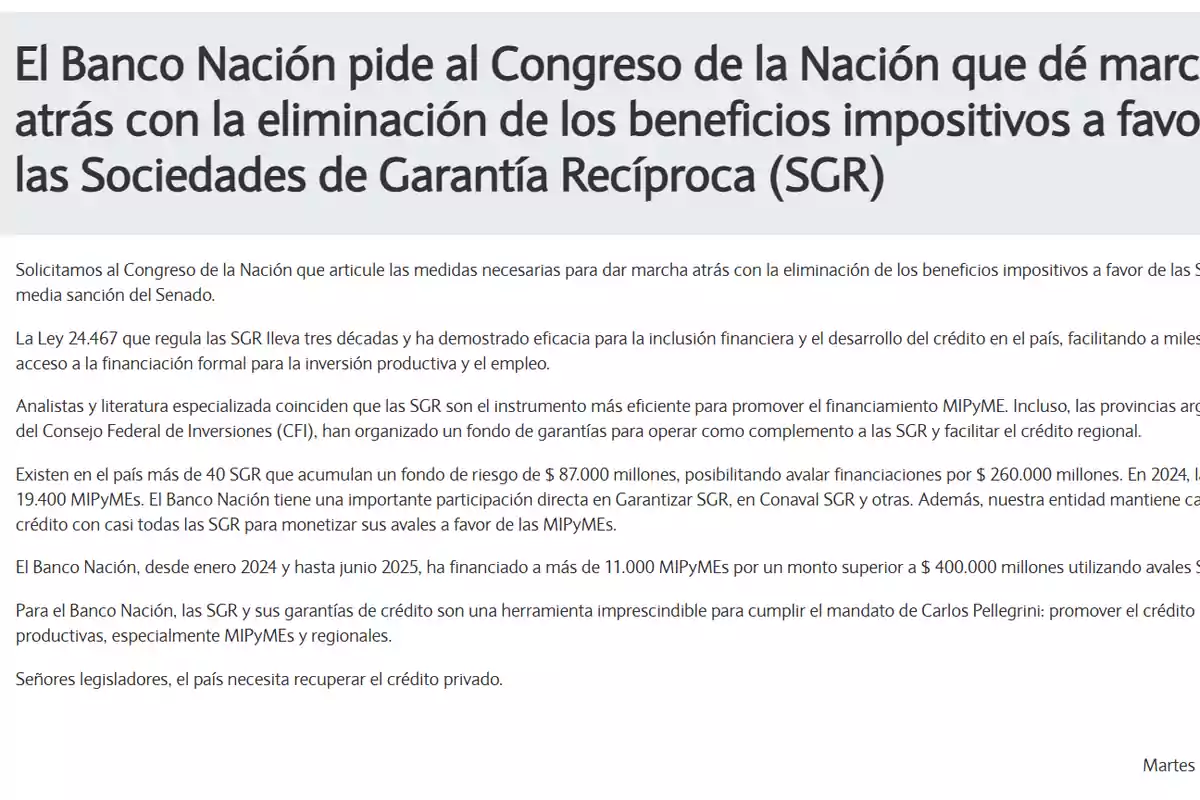

In a statement addressed to the National Congress, Banco de la Nación Argentina requested the reversal of the elimination of tax benefits for Reciprocal Guarantee Societies (SGR), a measure that has already received preliminary approval in the Senate.

According to the institution's argument, this decision would seriously affect the guarantee system that enables thousands of micro, small, and medium-sized enterprises (MIPyMEs) to access formal financing.

A proven system for productive development

Law 24,467, in force for 30 years, regulates the operation of SGR, and has been recognized for its effectiveness in promoting SME credit and financial inclusion. Various technical studies and specialized literature agree that this is one of the most efficient instruments to promote financing for MIPyMEs.

- There are currently more than 40 active SGRs in Argentina.

- The total risk fund amounts to $87,000 million.

- In 2024, SGRs guaranteed loans for $260,000 million.

- 19,400 MIPyMEs have benefited so far this year.

Additionally, several provinces use funds from the Federal Investment Council (CFI) as a complement to further leverage productive credit.

Strong participation from Banco Nación

Banco Nación keeps direct participation in several SGRs, such as Garantizar and Conaval, in addition to working with most of the system through credit ratings that allow it to monetize its guarantees.

Between January 2024 and June 2025, the institution granted more than $400,000 million in loans to over 11,000 MIPyMEs with SGR guarantees, reaffirming its role as the country's main public bank and financial support for productive companies.

"The country needs to recover private credit"

The statement concludes with a call to legislators: "The country needs to recover private credit", in line with the historic mandate of the bank's founder, Carlos Pellegrini, to promote productive financing with special attention to federal and SME development.

The institution emphasizes that SGRs are "an essential tool" and warns that eliminating their benefits would mean a setback in access to credit for thousands of companies that currently depend on this scheme to invest, grow, and create jobs.

More posts: