From economic shamanism to order: Argentina under reconstruction

The fiscal and monetary adjustment is beginning to yield results and marks the end of an unsustainable model

After decades of chronic fiscal imbalances, structural inflation, and improvised economic policies, Argentina is beginning to leave behind the logic of perpetual deterioration. The current administration, led by President Javier Milei, took office in December 2023 with a critical legacy: triple-digit inflation, record poverty, unsustainable fiscal deficit, a Central Bank without reserves, and an economy paralyzed by controls and regulations.

In just eighteen months, the government has achieved unprecedented progress: financial surplus, reduction of public debt, monetary order, external stability, and recovery of real wages, all while laying the foundations for a new sustainable economic regime.

The legacy of economic shamanism: deficit, debt, and poverty

It is no coincidence that the sectors criticizing this direction today are the same ones that led the governments which consolidated a model based on uncontrolled spending, unbacked money issuance, selective default, and a suffocating tax structure.

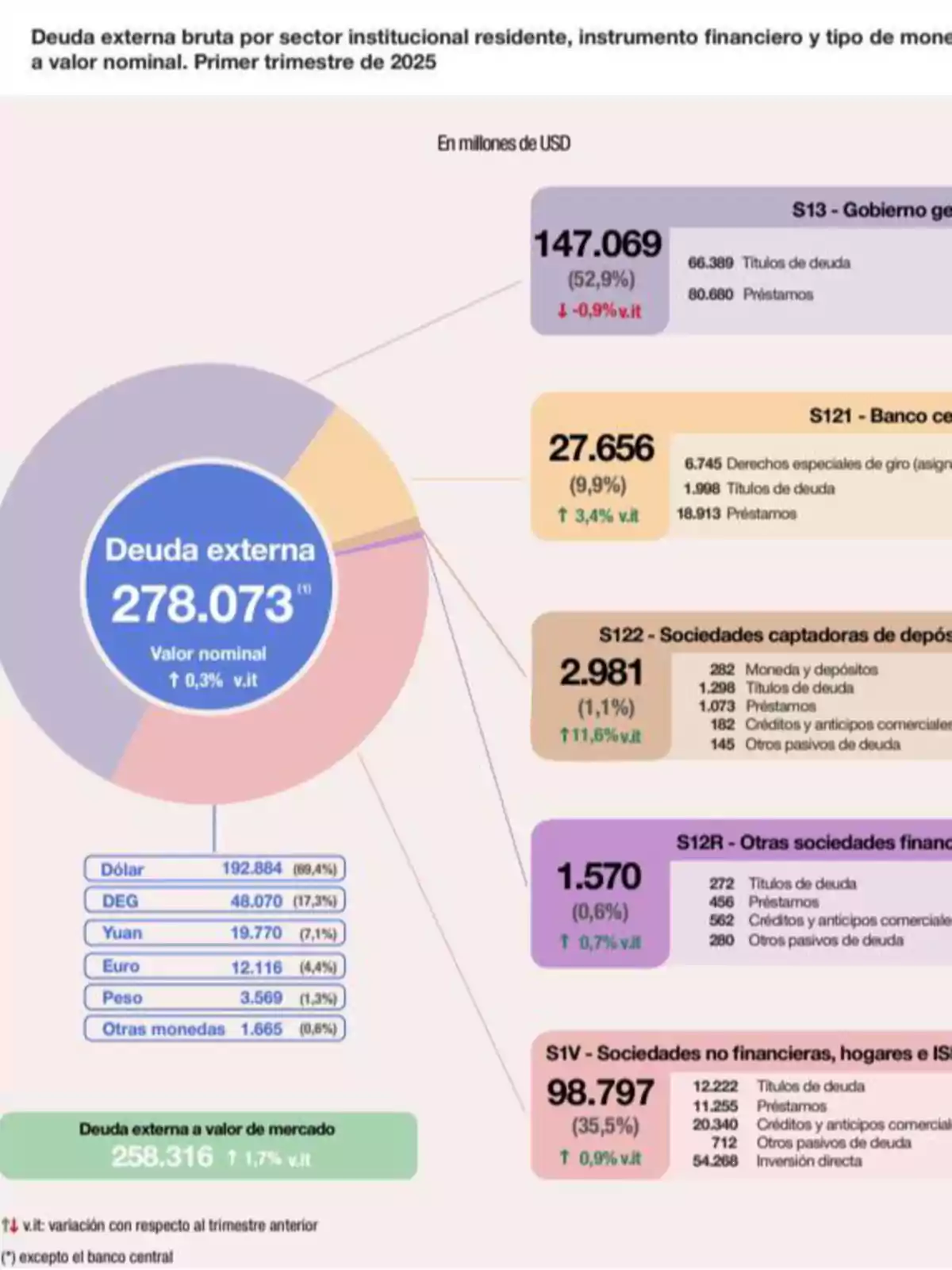

The ministers who represented that model left an unmistakable mark: between November 2019 and November 2023, the consolidated public debt of the Treasury and the BCRA grew by USD 156,441 million, rising from USD 330,782 million to USD 487,223 million. This figure, added to the indebtedness from the 2008-2015 period, brings the total committed to more than USD 300,000 million.

During those years, there was no productive public investment or structural reforms; resources were diluted in poorly designed subsidies, uncontrolled spending programs, and populist fiscal policies that increased dependence on the State and destroyed the incentive for work and production.

2024-2025: stabilization and order

Faced with this critical situation, the current government began a deep process of macroeconomic cleanup. Distortive subsidies were eliminated, political spending was reduced, relative prices were corrected, and fiscal accounts were reorganized.

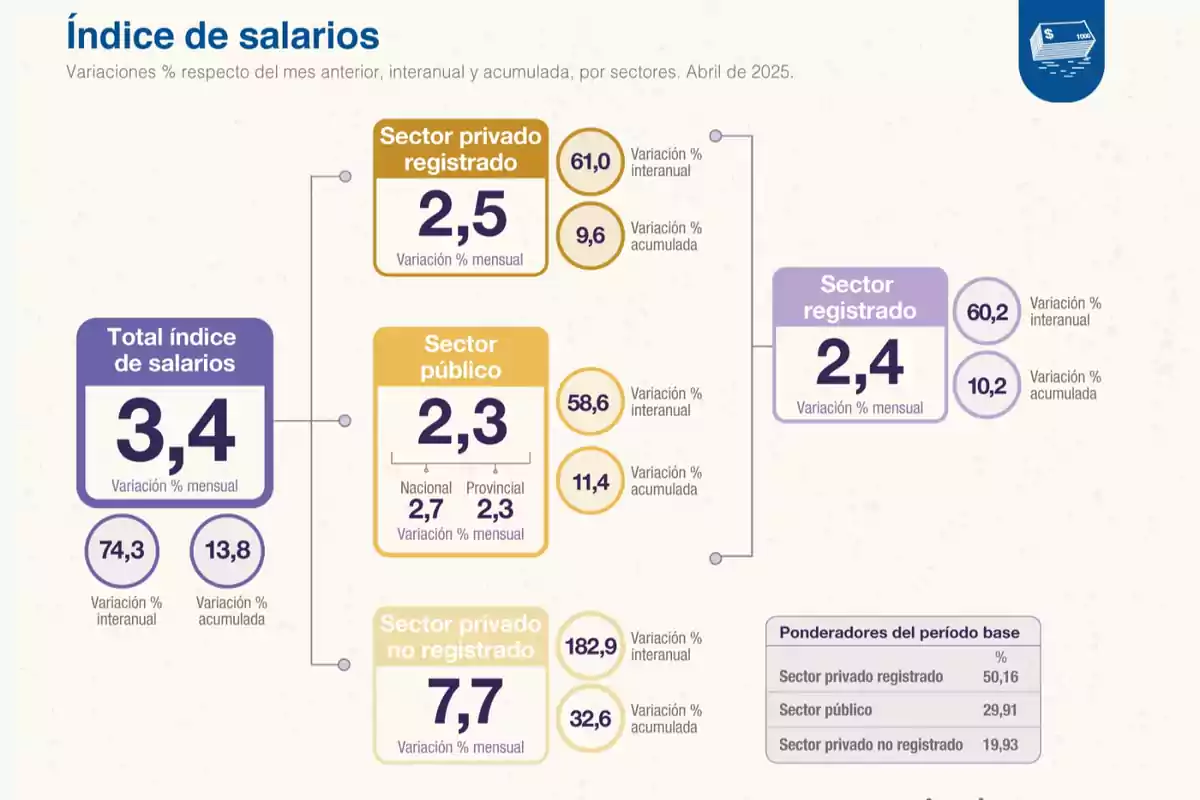

The results began to show quickly. According to official data, INDEC's Wage Index for April 2025 shows a solid monthly increase of 3.4%, with a notable accumulated year-on-year increase of 74.3%, reflecting a clear recovery of real wages driven by a more stable economic environment.

The growth of the unregistered private sector stands out, with a monthly increase of 7.7% and a year-on-year rise of 182.9%, indicating a significant improvement in purchasing power among the most vulnerable segments. This rebound is a direct result of the policies implemented by President Javier Milei's government, which managed to stabilize the economy, organize public accounts, and restore purchasing power to workers.

Meanwhile, the Composite Economic Activity Index (ICA-ARG) confirms the beginning of a new stage of sustained economic expansion. After the turning point in March 2024, activity began to grow solidly, surpassing the levels of 2020 and 2021 and advancing on much healthier essentials. This dynamic reflects a scenario conducive to the development of employment, investment, and private consumption, with firmer foundations and without resorting to structural imbalances.

Historic reduction of public debt

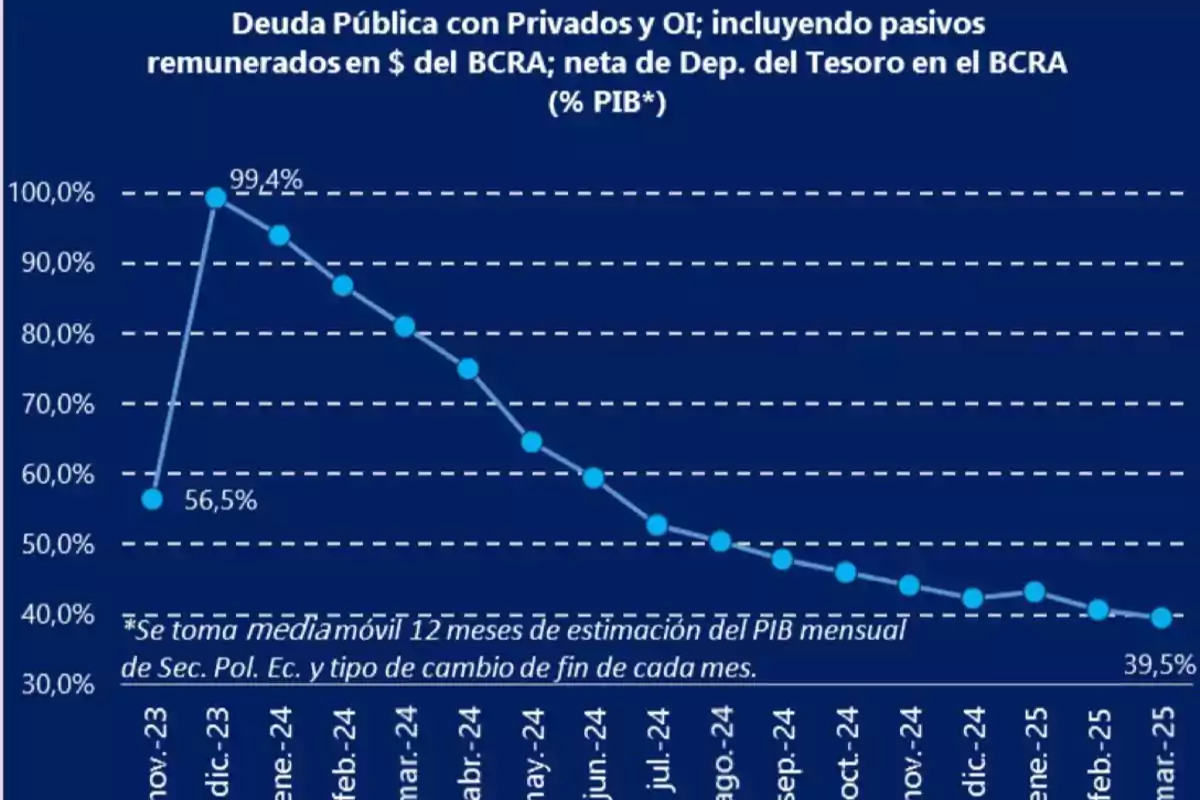

One of the most notable milestones of this stage is the reduction of public debt, both in absolute terms and relative to GDP. According to official data, the total debt of the Treasury and the BCRA fell from USD 487,223 million in November 2023 to USD 437,187 million in May 2025, that is, a reduction of more than USD 50,000 million.

In terms of product, the debt/GDP ratio fell from 99.4% in December 2023 to 39.5% in March 2025, marking a historic improvement that restores sustainability to the fiscal framework and reputation to Argentina in international markets.

It is key to highlight that this process did not involve taking on new net debt, but was achieved thanks to the fiscal surplus, the revaluation of GDP in dollars, and the repurchase of bonds in the secondary market, including AL30 and GD30 securities.

A new macroeconomic regime

Monetary policy was redirected toward strict control of the monetary base, which allowed inflation to slow sharply without resorting to the exchange rate anchor. The orderly exit from the currency controls, under a managed float scheme between bands, restored confidence and set the conditions for a new, more transparent monetary regime with greater stability and predictability.

In addition, the reopening of the dollar debt market brought very positive signals. With successful issuances totaling USD 1,500 million, subscribed by international investors, Argentina managed to regain access to external financing without compromising its sovereignty or repeating past mistakes.

These issuances were neutral in terms of net indebtedness, meaning they were not used to finance new spending, but to optimize existing maturities and reduce exposure to financial risks.

A development model based on private investment

The new Argentine economic framework aims to unleash the potential of the private sector as the engine of growth. By eliminating distortions, reducing regulations, lowering the tax burden, and guaranteeing clear rules of the game, the country positions itself as an attractive destination for productive investment.

This environment is what allows for sustained growth in private consumption, investment, and formal employment, not as a result of artificial public spending, but as a consequence of capital accumulation and improved competitiveness.

Argentina has left behind an exhausted model that only offered inflation, poverty, and debt. Today, it is on a demanding but promising path, where results are beginning to become clear: real wages recovering, debt declining, inflation falling, and activity expanding.

This is the result of a deep and courageous shift, which restores dignity to effort, stability to savings, and a horizon to work. The new course is set. For the first time in a long time, Argentina has a future again.

More posts: