Household consumption grew 2.9% year-on-year in February, according to the CAC.

Household consumption in Argentina grew by 2.9% in February and credit is rebounding strongly

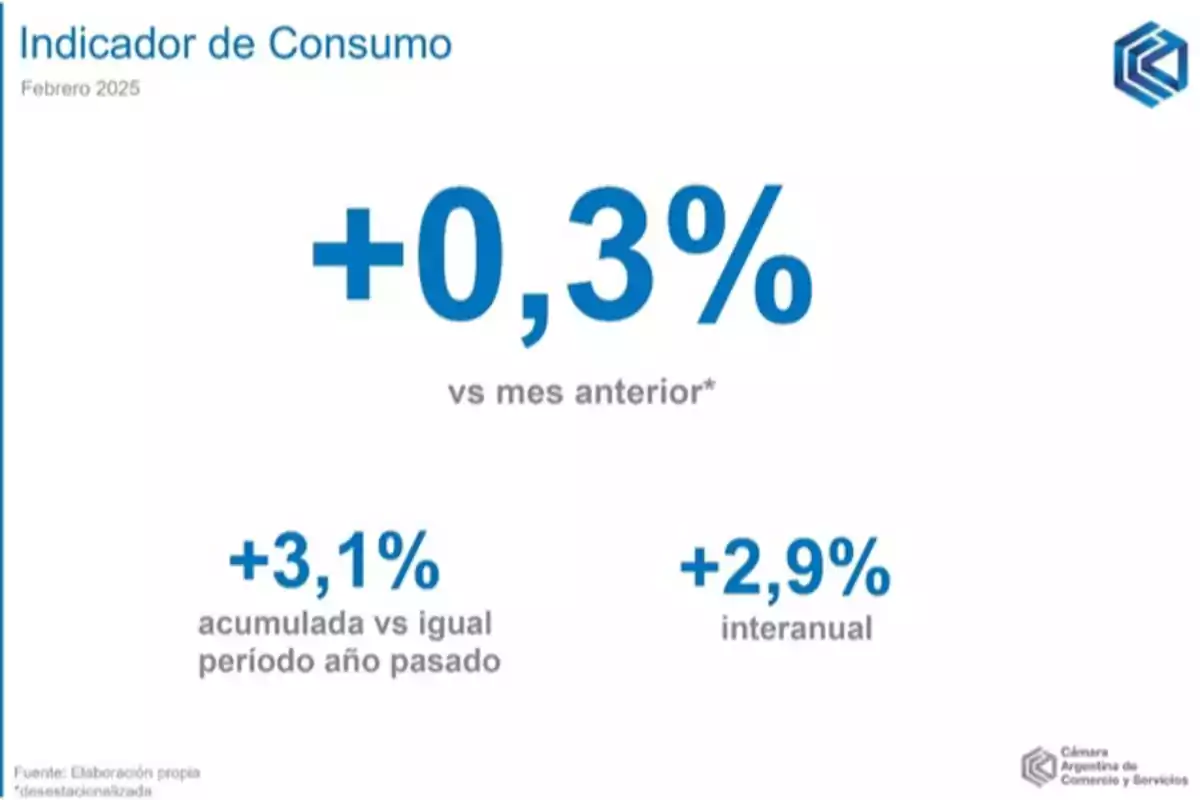

According to the Consumption Indicator (CI) of the Argentine Chamber of Commerce and Services (CAC), in February there was a 2.9% year-on-year (y.o.y.) increase and a 0.3% seasonally adjusted increase compared to January.

With these results, the first two months of the year accumulated a 3.1% expansion compared to the same period in 2024, indicating a continuity in the recovery of consumption under the Government of Javier Milei.

Factors driving consumption growth

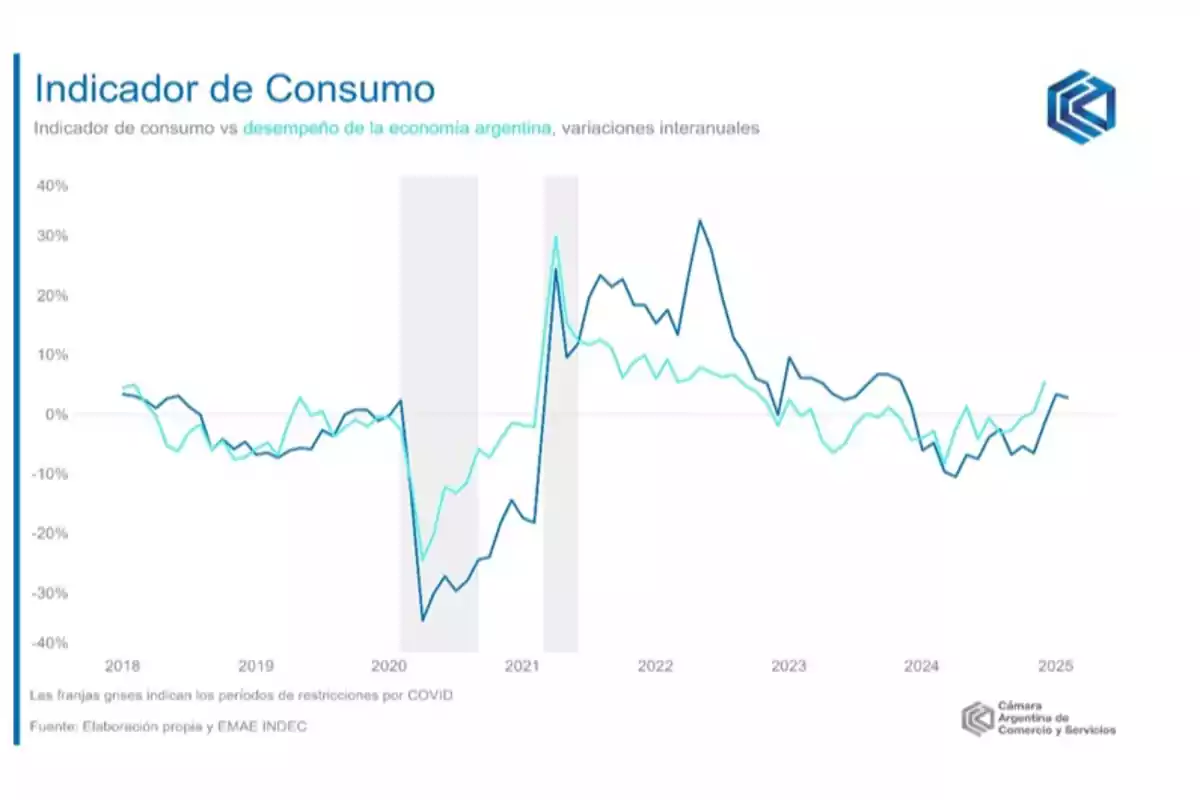

Consumption behavior closely follows the evolution of economic activity in general. During 2024, both the CI and the Monthly Economic Activity Estimator (EMAE) reflected year-on-year declines, but in December the trend reversed with a 5.5% y.o.y. growth in the EMAE and a seasonally adjusted 0.5% increase compared to November. This rebound was also reflected in consumption, which ended the year with a sustained monthly improvement.

Among the factors explaining this recovery, the price stability stands out, implying that the deceleration of inflation allowed for a recovery of purchasing power and has encouraged financing.

Consequently, after hitting bottom in April 2024, credit in real terms has shown constant increases, which has driven the consumption of durable goods. The greater economic stability has facilitated a change in household consumption structure, with an increase in the purchase of higher-value goods.

Sectors with the highest growth in February

Consumption has shown improvements in various areas, with notable increases in key sectors:

- Transport and vehicles: +3.7% y.o.y., driven by a 68% increase in car registrations.

- Recreation and culture: +5% y.o.y., reflecting a greater willingness to spend on entertainment.

- Clothing and footwear: +3.3% y.o.y., managing to reverse the negative trend of previous months.

- Appliances: In December 2024, the sector recorded a 54% year-on-year growth, consolidating the recovery in durable goods.

Meanwhile, the housing, rentals, and public services sector showed a more moderate growth of 0.8% y.o.y., while the rest of the sectors recorded a 3.0% y.o.y. advance.

In February, the monthly inflation was 2.4%, with a year-on-year accumulated of 66.9% and an annual record of 4.7%. The stability achieved in recent months has allowed for a recomposition of real income, which translates into an improvement in consumption.

In this context, credit continues to play a essential role. Credit card debt and personal and pledge loans have surpassed the levels of February 2023, allowing for the recovery of durable goods consumption.

Additionally, mortgage credit has shown positive signs since April 2024, with an increase in deeds in February 2025, reaching the highest level since 2018.

The household consumption pattern shows a structural transformation; increasingly more families are allocating their purchasing power to the purchase of durable goods instead of daily consumption goods. This trend reflects a greater confidence in the country's economic future.

With a recovering disposable income and increasing economic stability, this trend is expected to continue in the coming months, driving sustained growth in the demand for goods and services.

More posts: