Inflation breaks through 2% in June and reaches the lowest monthly figure since 2020

Javier Milei achieves the lowest rate in years and projects a stable 2025

The month of June will mark a milestone in the recent history of Argentina's economy. According to the latest Market Expectations Survey (REM), prepared by the Central Bank, monthly inflation will stand at 1.9%, thus reaching its lowest level since May 2020. This figure not only confirms the downward path initiated by Javier Milei's government, but also projects a scenario of sustained inflationary stability.

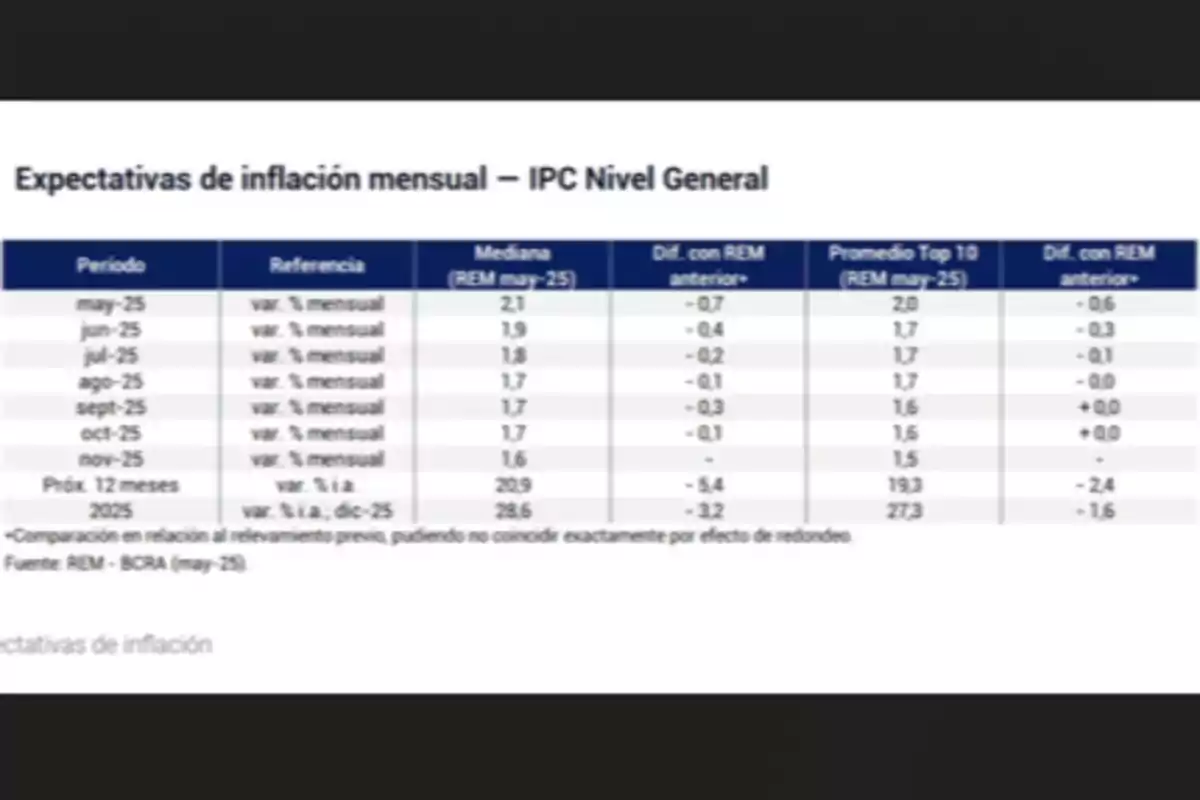

The estimate for May already indicated 2.1%, but what is truly disruptive is the forecast for the coming months: analysts anticipate that inflation will remain below 2% until at least November. The detailed breakdown leaves no room for doubt: 1.8% in June, 1.7% in August, September, and October, and 1.6% in November.

This scenario is significant considering that the country is coming from an accumulated inherited inflation of 117.8% in 2024. For 2025, projections consolidate a drastic decrease with a Consumer Price Index (CPI) of 28.6% annually. This figure represents an unprecedented slowdown in a country accustomed to living with chronic inflation.

The decline in inflation is accompanied by a gradual reduction in interest rates. The BCRA estimates that the TAMAR rate—reference for large fixed-term deposits—will be 33.03% in June,will drop to 32.09% in July, and will continue to decrease until reaching 28% in November. This trend aligns with the anti-inflationary logic of the economic team led by Luis Caputo and lays the groundwork for a sustainable credit recovery.

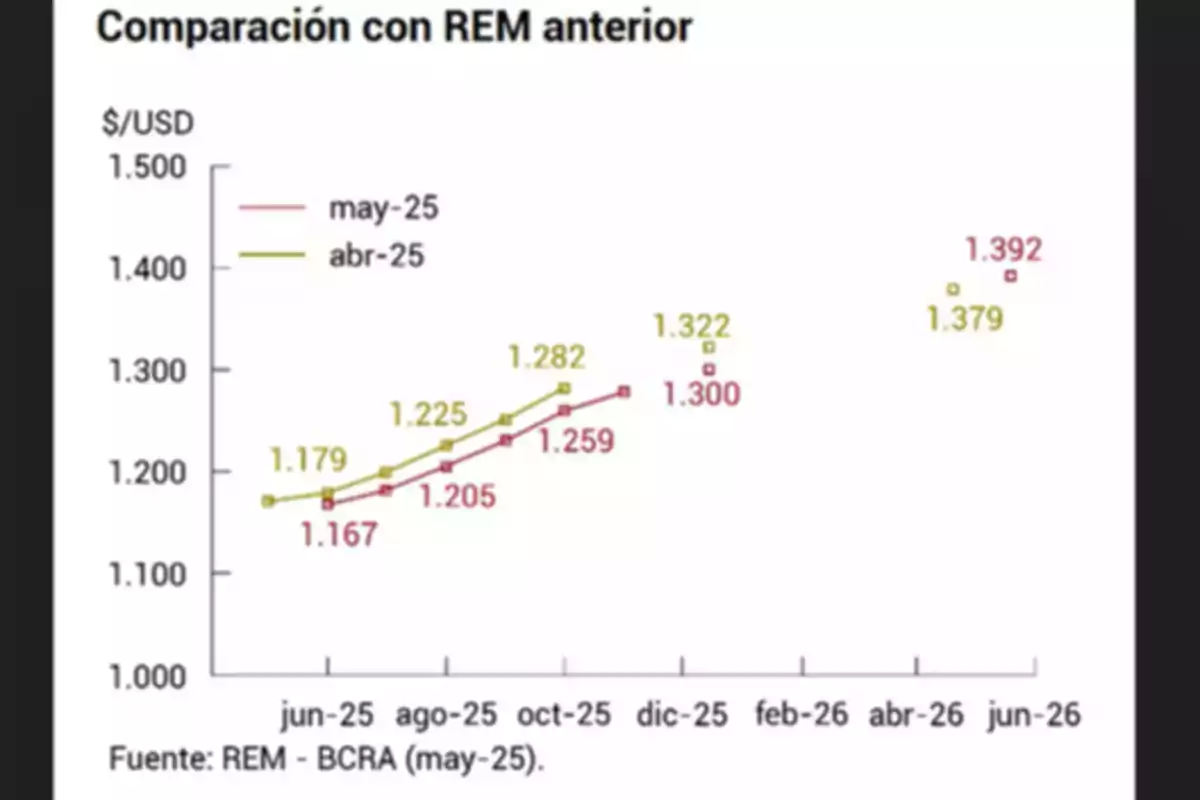

The nominal exchange rate also remains under control. Projections for the wholesale dollar indicate a gradual path: $1,167 in June, $1,182 in July, and it will only surpass the $1,200 barrier in August, reaching $1,205. For December 2025, it is expected to reach $1,300. It is worth noting that these figures were revised downward compared to the April REM, when a rate of $1,179 for June and $1,322 for year-end was estimated.

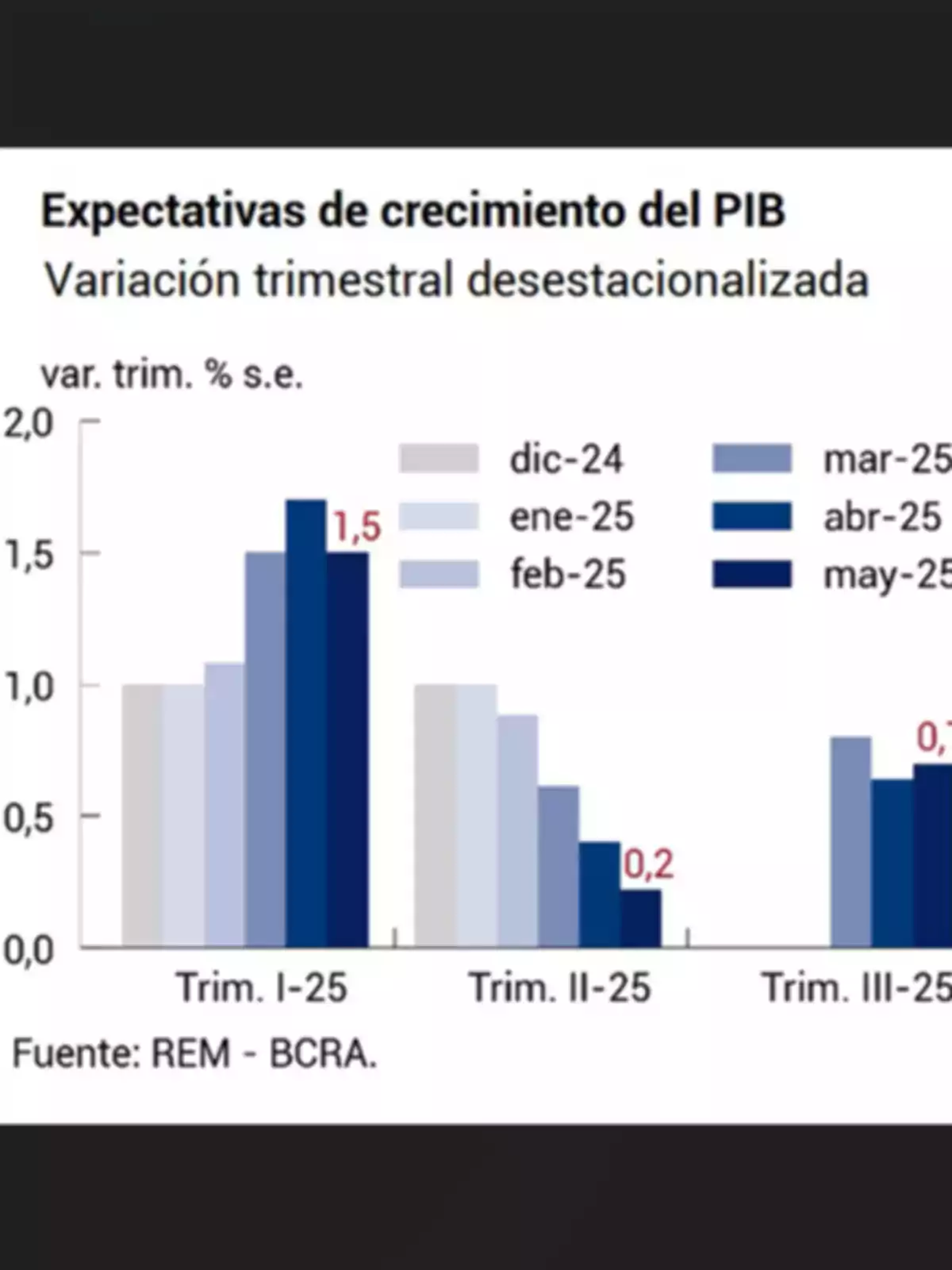

In terms of economic activity, forecasts are encouraging. Although the first half shows a moderate recovery, the annual outlook is optimistic: GDP would grow 5.2% in 2025 according to private consulting firms, aligning with the 5% projected by the national government and very close to the 5.5% projected by the International Monetary Fund (IMF).

For the first quarter of the year, experts estimate a positive variation of 1.5% compared to the previous quarter, although they revised their previous projection (1.7%) downward. In the second quarter, expectations were also moderated: from 0.4% to 0.2%. However, for the third quarter, an acceleration is anticipated, with an increase of 0.7%, even surpassing the April estimate (0.6%).

More posts: