Milei reduces public debt by almost USD 12,000 million

Milei managed to halt the uncontrolled growth of debt, eliminate inherited liabilities, and restore international credit

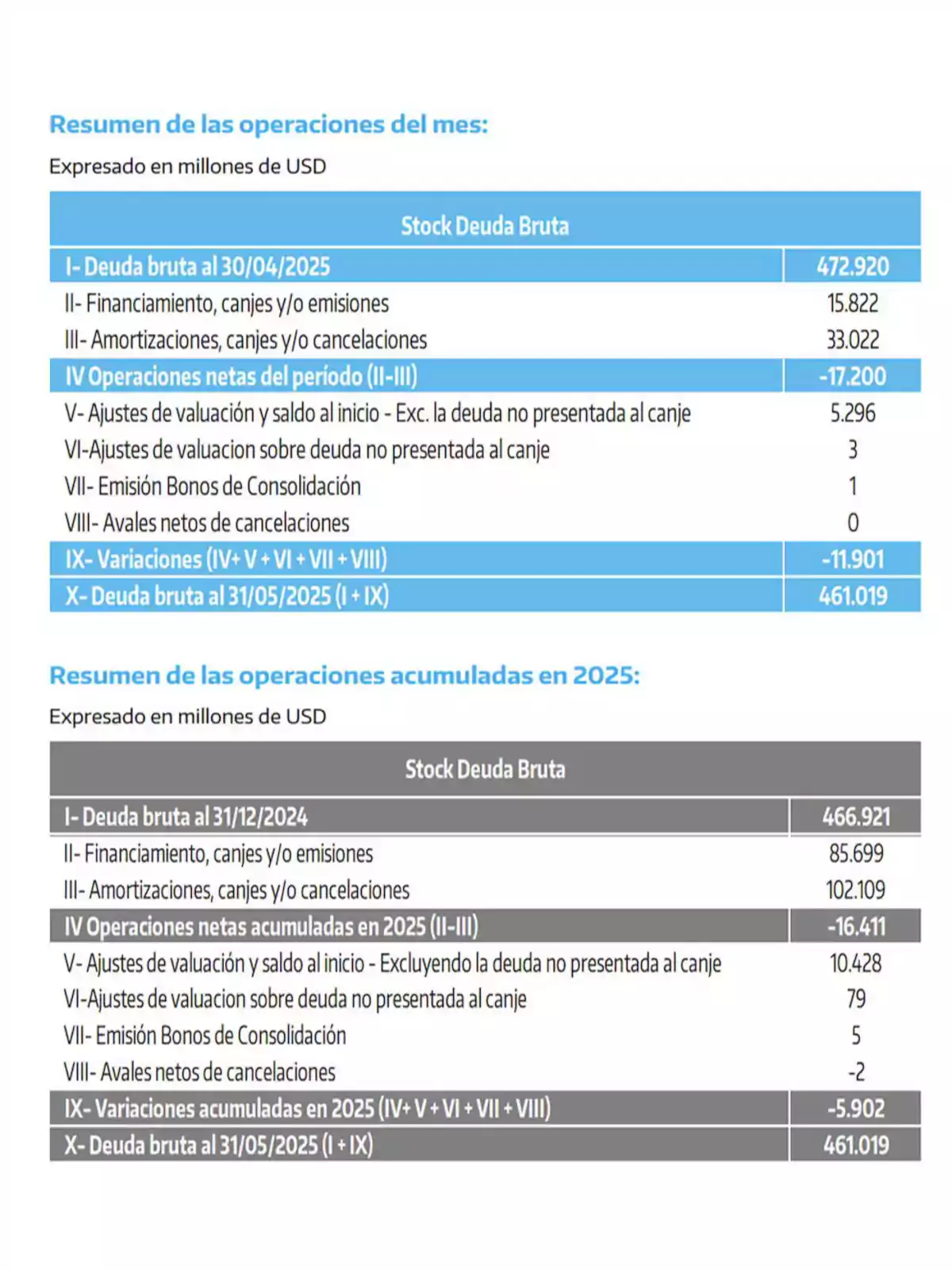

The Finance Secretariat reported that the gross public debt of the Central Administrationdecreased by USD 11.901 billion in May, standing at USD 461.019 billion, which represents a drop of 2.53% compared to the previous month. This is the second decrease in 16 months and the third since the beginning of Javier Milei's administration, a concrete sign of the fiscal and monetary order that the President promised from day one.

This historic result was achieved mainly due to the inflow of USD 12.000 billion as a result of the agreement with the International Monetary Fund (IMF) and other multilateral organizations. These funds were strategically allocated to cancel Non-Transferable Notes held by the Central Bank for USD 13.617 billion and other obligations for USD 3.583 billion, as part of a process to clean up liabilities that weakened the BCRA for years.

In addition, positive valuation adjustments of USD 5.296 billion were recorded, while financing operations totaled USD 15.822 billion, compared to debt cancellations of USD 33.022 billion, resulting in a net decrease of USD 17.200 billion during the period.

According to Finance, headed by Pablo Quirno, it was detailed that the debt buyback was a key maneuver to strengthen international reserves and pave the way for the lifting of the exchange controls, announced on April 11 and implemented on the 14th of the same month.

In this context, there was also an increase of USD 560 million in debt under foreign legislation, and a reduction of USD 12.461 billion in local currency debt, as a result of internal reorganization and the cleanup of inherited instruments. However, the month ended with a technical increase of USD 2.014 billion, explained by the capitalization of bonds for USD 5.526 billion, the adjustment of CER-indexed debt (USD 1.439 billion) in a context of peso appreciation, and negative exchange rate differences of USD 1.670 billion.

Another relevant event was the successful placement of the Bonte 2030, the first bond aimed exclusively at the international market in seven years. This issuance made it possible to raise USD 1.000 billion and was received as a clear sign of confidence by international investors. In the words of Economy Minister Luis Caputo, this is a key step to "refinance local currency debt principal," something that, as he explained, "the vast majority of countries do as a matter of course, but for Argentina it was not possible, given the inherited economic chaos."

Caputo also emphasized that "this operation doesn't imply an increase in gross debt, nor in net debt. Only an increase in the BCRA's dollar reserves and a significant extension of the duration of local currency debt". The operation made it possible to absorb $1.15 trillion at a nominal annual rate of 29.5%, maturing in five years.

Main monthly variations:

Boncap issuance: +USD 6.366 billion

Boncer adjustment due to exchange rate differences: –USD 5.582 billion

BCRA FDA Note: –USD 10.563 billion

BCRA Note: –USD 3.054 billion

IDB credit: +USD 588 million

BCRA temporary advances: –USD 68 million

Lecap: +USD 1.641 billion

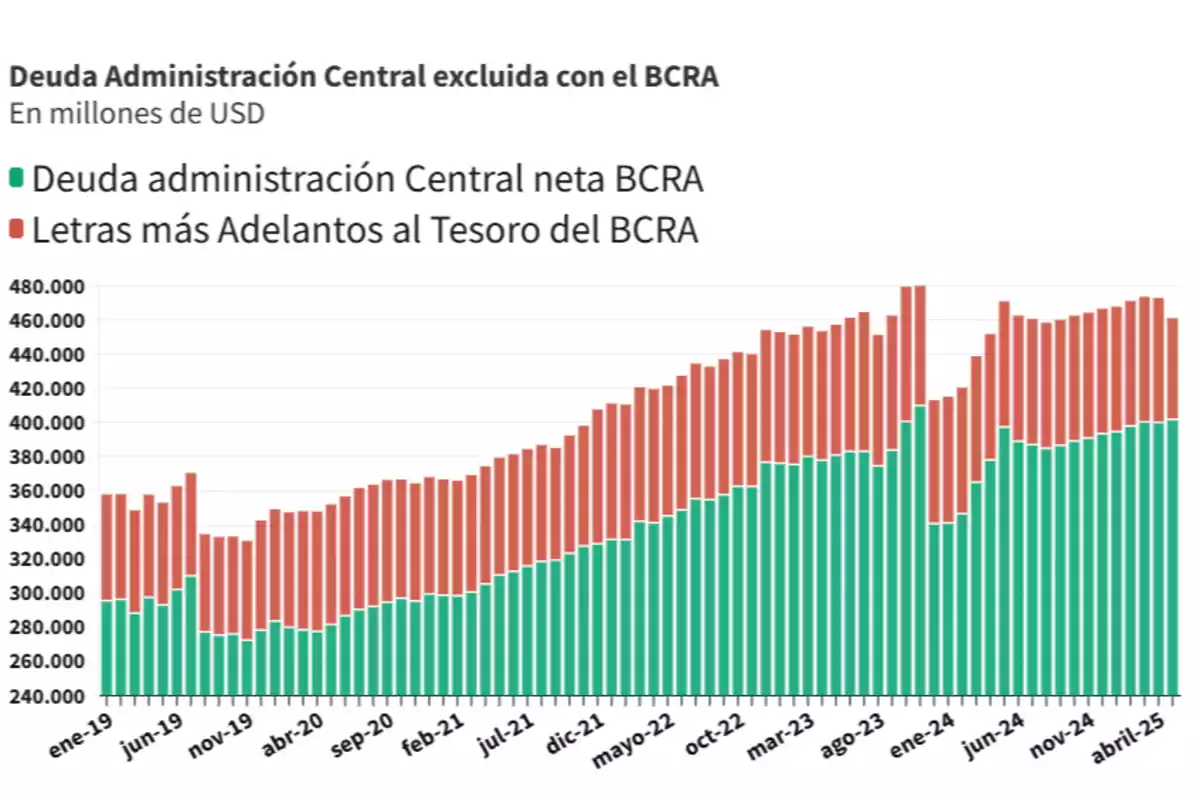

In the cumulative total for the administration, between December 2023 and May 2025, gross debt increased nominally by USD 35.726 billion. However, when considering BCRA liabilities absorbed by the Treasury and official deposits in the banking system, the consolidated stock shows a real decrease of USD 39.152 billion.

That is, while the fiscal front is being organized, the State's accounts are being made transparent, and the Central Bank's balance sheet is being cleaned up. In this regard, it is worth noting that in November 2023, BCRA's remunerated liabilities amounted to USD 61.657 billion, and were drastically reduced, with a net decrease of USD 20.543 billion in the first five months of the administration, an unprecedented figure in the last four administrations.

More posts: