International consulting firm Rystad Energy, specialized in energy analysis, highlighted the sustained progress of Vaca Muerta as a growth engine for gas and oil production in Argentina.

In a recent report, it emphasized that the country is taking firm steps toward its consolidation as a strategic exporter of liquefied natural gas (LNG), with a long-term vision that includes multi-million-dollar investments and a global outlook.

Strong growth in oil and gas

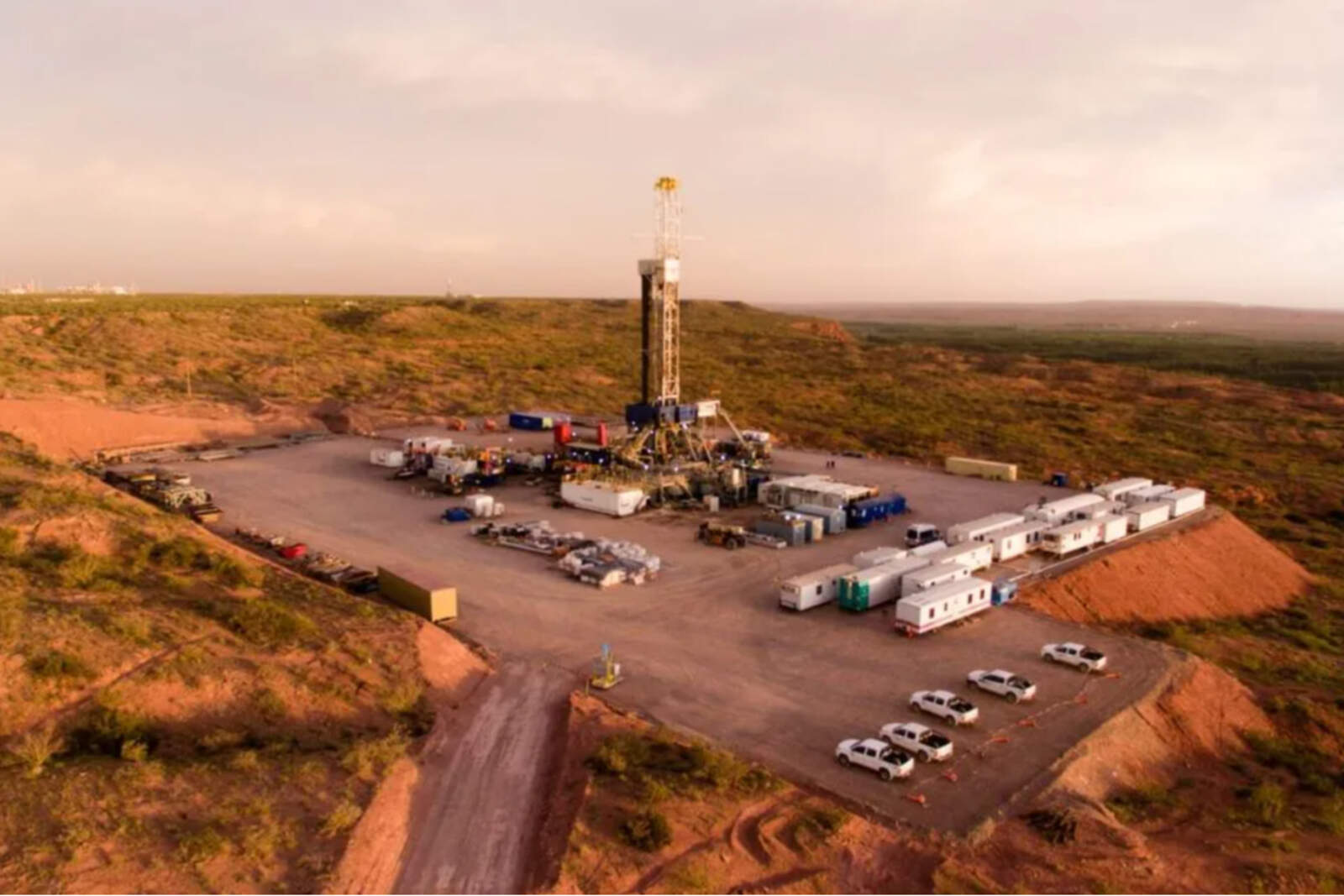

During the first quarter of 2025, oil production in Vaca Muerta grew by 26% year-on-year, surpassing 447,000 barrels per day (bpd) in March. The increase was driven mainly by YPF, accompanied by operators such as Vista Energy, Pluspetrol, and Phoenix Global Resources.

Meanwhile, dry gas production climbed 16% compared to the same period in 2024, reaching 2.1 billion cubic feet per day (Bcfd). This growth reflected a shift in Argentina's energy paradigm, with gas gaining prominence as a key export vector.

The national LNG strategy

Radhika Bansal, vice president of Upstream Research at Rystad Energy, stated that "Argentina is driving a multi-stage national LNG export strategy", which could reshape the international energy map.