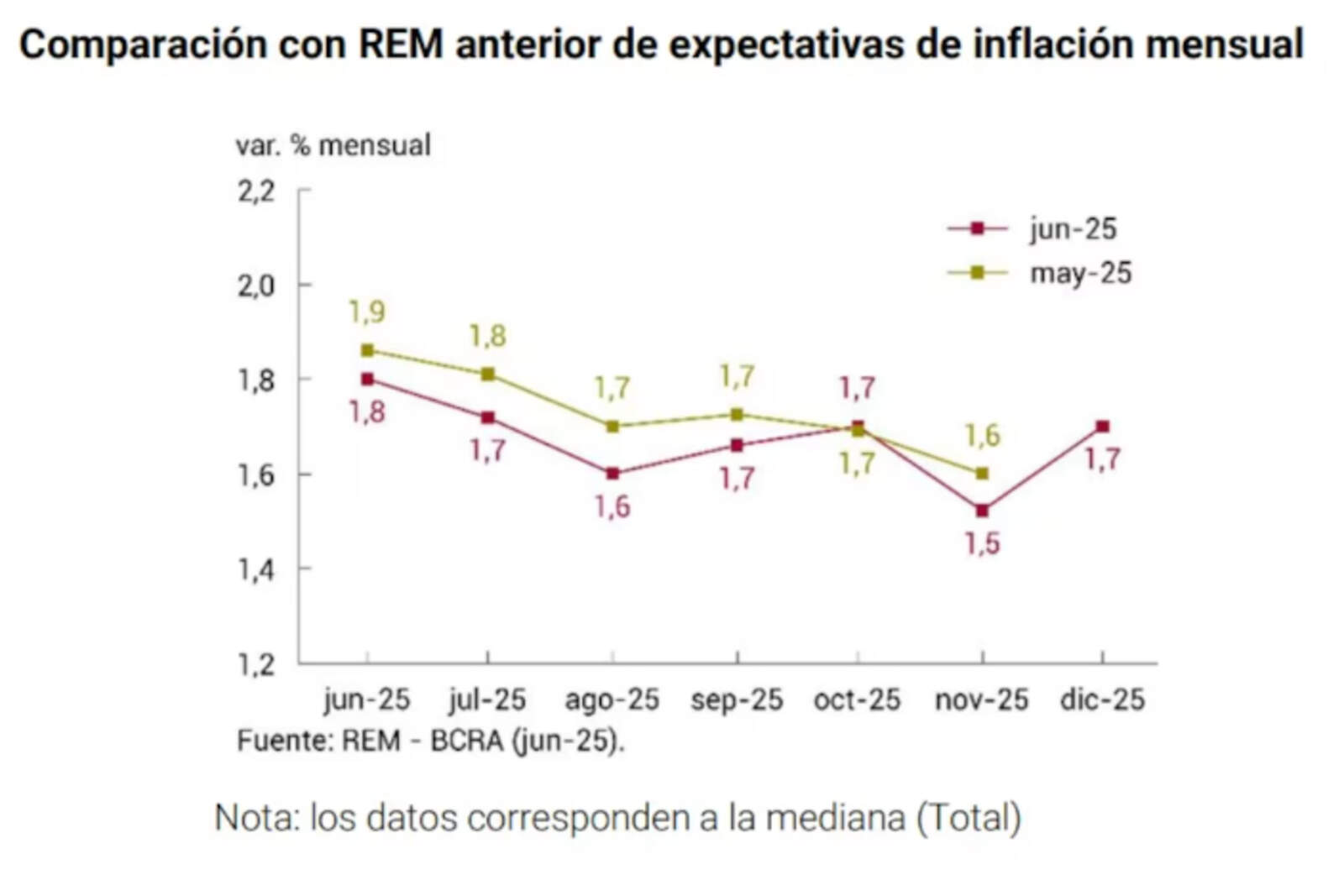

In a historic turn that marks a turning point in Argentina's economic policy, private analysts consulted by the Central Bank of the Argentine Republic (BCRA) project that inflation will remain below 2% per month throughout the remainder of 2025. This strong forecast, drawn from the June Market Expectations Survey (REM), confirms the success of the stabilization plan led by President Javier Milei.

In detail, the report anticipates inflation of just 1.8% for June, which represents a drop of one-tenth compared to the previous survey. For the second half of the year, the projections show a clear continuation of disinflation: July (1.7%), August (1.6%), September (1.7%), October (1.7%), November (1.5%), and December (1.7%). If this scenario materializes, inflation would close the year at around 27%, a decrease of 1.6 percentage points compared to previous estimates.

This data becomes even more relevant considering that just seven months ago, Argentina was facing imminent hyperinflation with monthly levels close to 30%. Today, with the implementation of a severe fiscal adjustment, the reduction of public spending, and monetary discipline, Milei has achieved a milestone that once seemed unattainable.

Analysts also foresee a continuous improvement for 2026: although the report doesn't provide month-by-month details, it does estimate a year-on-year inflation rate of 20.8% for the next twelve months. In other words, a significant decrease in price dynamics is projected, consolidating a scenario of stability.