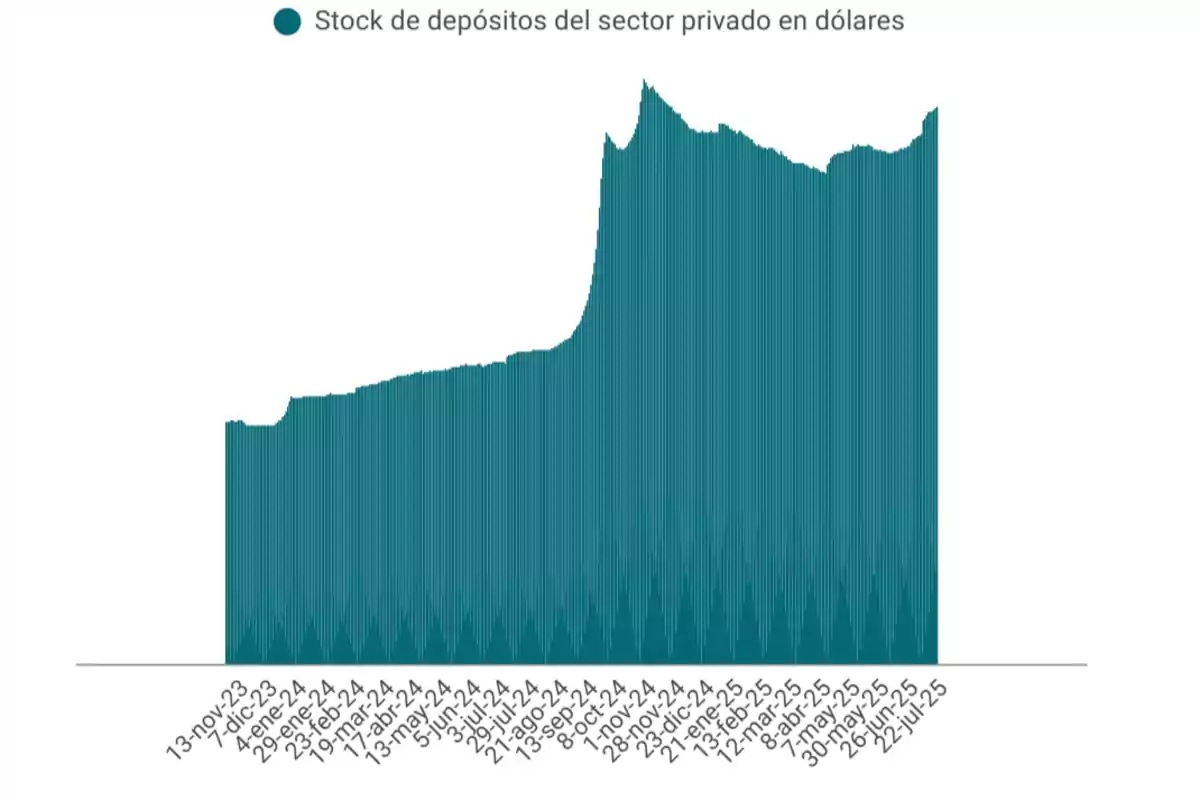

Dollar deposits have increased by more than USD 3.9 billion since April.

The removal of currency restrictions drove a sustained increase in foreign currency deposits

Since mid-April, private sector dollar deposits have been experiencing a sustained recovery, after several months of decline. According to the latest Central Bank report as of July 22, the stock of foreign currency depositsreached USD 32.965 billion.

This represents an increase of USD 3.918 billion from the low of USD 29.047 billion recorded on April 11, that is, a growth of 13.5% in just over three months.

This rebound coincides with the removal of restrictions for individuals to freely access the official foreign exchange market, a measure adopted in line with the national Government's strategy to liberalize the financial system and strengthen confidence in the banking sector. The decision allowed both individuals and large institutional players to channel their foreign currency transactions through the formal circuit.

The trend gains relevance considering that, in April, the deposit level had reached the lowest point of the year, after a decline that began following the strong inflow of dollars triggered by the tax amnesty implemented in 2024. That event caused a historic peak in the banking system, when deposits rose from less than USD 20,000 million in September to more than USD 34,000 million in November. However, between December and April, those levels began to decline progressively.

With the deregulation of the market, the outlook changed. In July alone, growth was particularly marked: between the 1st and the 22nd of that month, the stock rose from USD 31.006 billion to USD 32.965 billion, which implies a increase of USD 1.959 billion in just three weeks, equivalent to 6.3%. Over a 60-day period, from May 22 to July 22, the increase was USD 2.421 billion, with a variation of 7.9%.

A more detailed analysis of the composition of deposits shows that growth was concentrated in savings accounts, where the largest volume of dollar stock is held. As of July 22, this segment totaled USD 26.091 billion compared to USD 24.543 billion recorded a month earlier, an increase of USD 1.548 billion.

The increase was led by larger deposits. More than half of the growth in savings accounts correplied to placements over one million dollars, which rose from USD 4.578 billion to USD 5.423 billion in the period considered, which represents a jump of USD 845 million. This way, the share of this group within the total rose from 18.7% to 20.8%.

The trend became more pronounced when observing the behavior of the last two months: between May 22 and July 22, deposits above one million dollars grew by USD 447 million out of a total of USD 614 million, which accounts for 72.8% of the increase. The same dynamic was seen in dollar time deposits. While the total increased by USD 546 million in three months, deposits over one million grew by USD 580 million.

For economist Milagros Gismondi, from Bolsa Cohen, part of the flow can be explained by the reinvestment of dollars received from sovereign bond coupon payments. "There are also those who bought dollars after liquidating exports, although this is just a supposition", she indicated. At the same time, she ruled out a significant inflow of the so-called "mattress dollars": "I'm not seeing that", she stated.

Meanwhile, banks also played a relevant role. In recent days, the debate has resurfaced regarding the requirement to justify the origin of cash dollars, a practice that, although not mandatory, many banks continue to apply voluntarily. The Minister of Economy, Luis Caputo, reignited the discussion with a post on social media in which he questioned these requirements, although the financial sector pointed out that these are preventive measures.

The increase in dollar deposits is occurring in a context of growing economic openness and greater exchange rate freedom. Although the record levels of the tax amnesty have not been reached again, the recovery of the stock suggests a partial strengthening of the banking system, driven by certainty in monetary policy and the expectation of macroeconomic stability.

More posts: