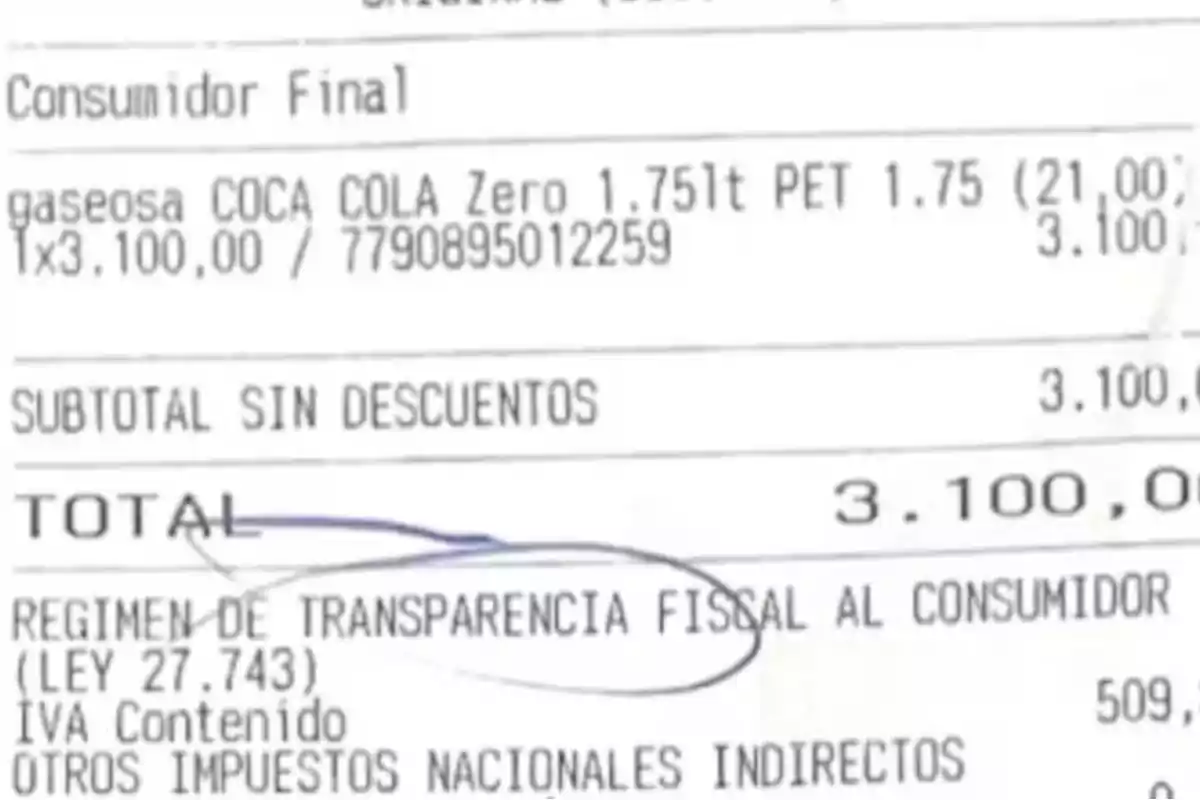

Fiscal Transparency: Five provinces already display the tax burden on receipts

The system will allow purchase tickets to detail provincial and municipal taxes.

The provinces of Ciudad de Buenos Aires, Chubut, Entre Ríos, Mendoza, and Misiones were the first to adhere to the Consumer Fiscal Transparency Regime, a measure that seeks to detail taxes such as Gross Income and municipal rates on purchase receipts. The system, driven by the NGO Lógica, aims to generate greater fiscal awareness among citizens and make the tax burden on consumption more transparent.

Implementation and provincial adherence

- The measure was approved within the Bases Law and regulated at the end of 2024.

- From January 1, 2025, large taxpayers must detail VAT and internal taxes on issued receipts.

- Starting April 1, the obligation will extend to all businesses and they must also detail taxes on:

- Shelf strips

- Web pages

- Signage and advertising

More provinces are expected to join in the short term, while some jurisdictions have already presented adherence projects in their legislatures.

Reactions of provincial governments

After the regulation of the regime, the NGO Lógica sent a letter to the 24 governors with two questions:

- Will they promote adherence to make local taxes transparent on receipts?

- Will they apply sanctions to businesses that voluntarily decide to report these taxes?

The five mentioned provinces replied affirmatively and assured that they will not sanction businesses that detail taxes on receipts.

- Ciudad de Buenos Aires: Based its adherence on the constitutional principles of access to truthful and transparent information. It seeks to promote a specific law to ensure the correct implementation of the system.

- Chubut: Governor Ignacio Torres highlighted that, in addition to adhering to the regime, the province will promote transparency in public spending to encourage private investments.

- Mendoza: Considers that the measure strengthens institutional trust and the bond between the State and citizens. It is analyzing technical issues regarding its implementation.

- Entre Ríos: Governor Rogelio Frigerio justified the adherence as a mechanism to foster citizen participation in fiscal matters.

- Misiones: Is evaluating the best way to apply the regulation to provincial and municipal taxes.

The impact on fiscal awareness

The president of Lógica, Matías Olivero Vila, told Infobae that the lack of fiscal information has led citizens not to demand greater responsibility in public spending.

- He highlighted that the regime will allow hidden taxes such as Gross Income and municipal rates to be made visible.

- He stated that Argentina has "a historic opportunity to provoke a change in the society's fiscal awareness."

Lógica's initiative began in 2023 with a petition on Change.org and a commitment signed by then-presidential candidates Javier Milei, Patricia Bullrich, and Juan Schiaretti. Once in government, Milei promoted Law 27.743, known as the "Lógica Law," which provided a legal framework for the proposal.

Perspectives and adherence of other provinces

Although there is no mandatory deadline for adherence, more provinces are expected to join to ensure a uniform implementation of the system.

- Currently, there are adherence projects in Provincia de Buenos Aires, Santa Fe, La Pampa, and Río Negro, although without support from provincial governments.

The Consumer Fiscal Transparency Regime represents an important step in making the tax burden on prices visible, promoting greater citizen control over fiscal pressure.

More posts: