The government announces purchases and sales of dollars in the free market.

The Treasury will begin operating in the foreign exchange market as another player with the IMF's approval

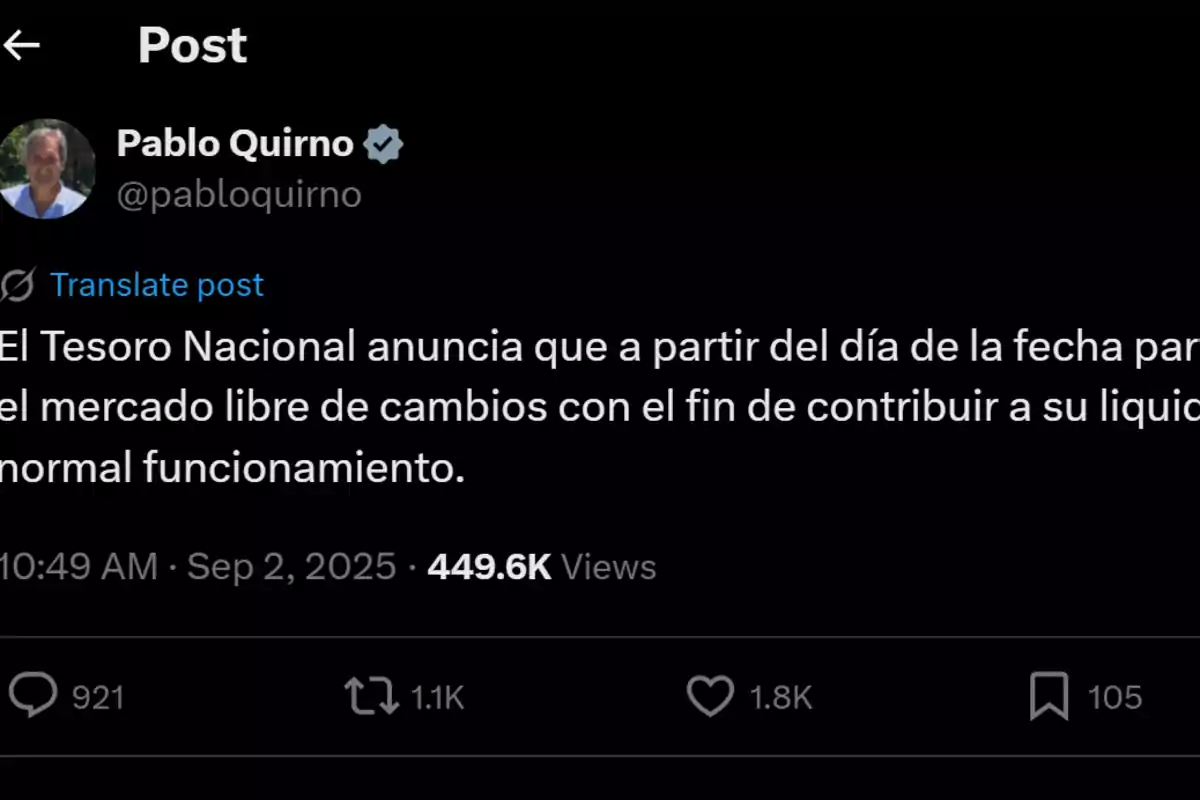

The Government confirmed that the National Treasury will intervene in the foreign exchange market starting today. The decision was communicated by the Secretary of Finance, Pablo Quirno, through the social network X (formerly Twitter). The measure aims to stabilize the dollar's exchange rate and provide greater liquidity to the financial system.

"The National Treasury announces that, as of today, it will participate in the free exchange market in order to contribute to its liquidity and normal functioning", Quirno posted on his official account.

Change in exchange rate policy

With this decision, the Government is making a shift from the floating band scheme agreed with the International Monetary Fund (IMF). Until now, the Treasury or the Central Bank could only intervene when the dollar reached the upper limit of the band, which currently stands at $1,470 per unit.

However, the wholesale dollar was at $1,370 shortly before the announcement, still far from that limit. The intervention is therefore taking place outside the previously established margins.

The IMF's role

Sources from the Ministry of Economy confirmed that the Government consulted the IMF before announcing the measure. The international organization reportedly gave its approval, although at the time of the announcement, no official statements from its spokespersons had been released.

The Fund's endorsement is key to maintaining the credibility of the new scheme.

Market impact

The Treasury's entry into the foreign exchange market means that the Government will be able to buy and sell dollars as another market participant. The objective is to moderate pressure on the exchange rate and prevent the volatility that also affected peso interest rates from continuing.

The impact of the measure on the wholesale dollar's exchange rate and on the different exchange segments is expected to be reflected in the coming days.

More posts: