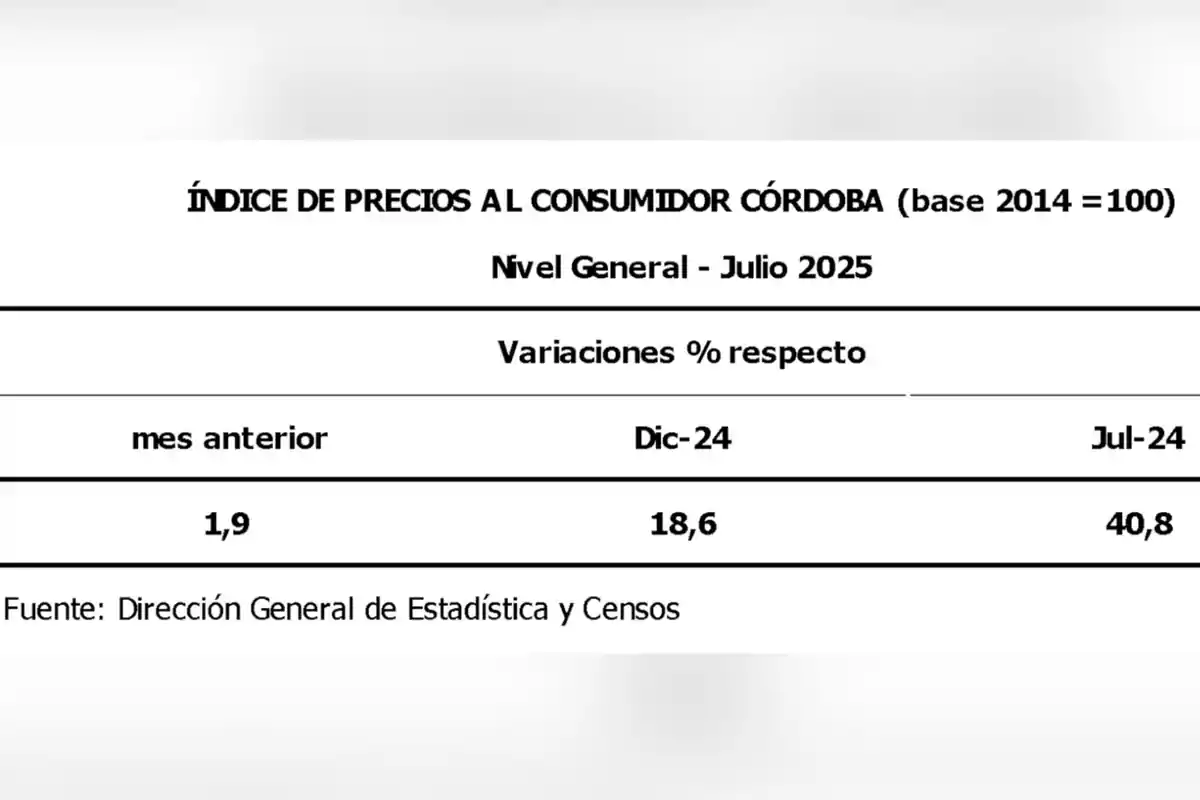

July 2025 inflation: Córdoba matched the national 1.9%, and services led the increase

Year-on-year inflation in Córdoba was 40.8%, with a strong impact from utility rates and rent on the cost of living

Córdoba closed July with 1.9% inflation, the same level as the national average. The data, reported by the provincial Directorate of Statistics and Census, show that the increase in utility rates and rents drove the index. In a year-over-year comparison, Córdoba accumulated 40.8%, well above the national year-over-year rate.

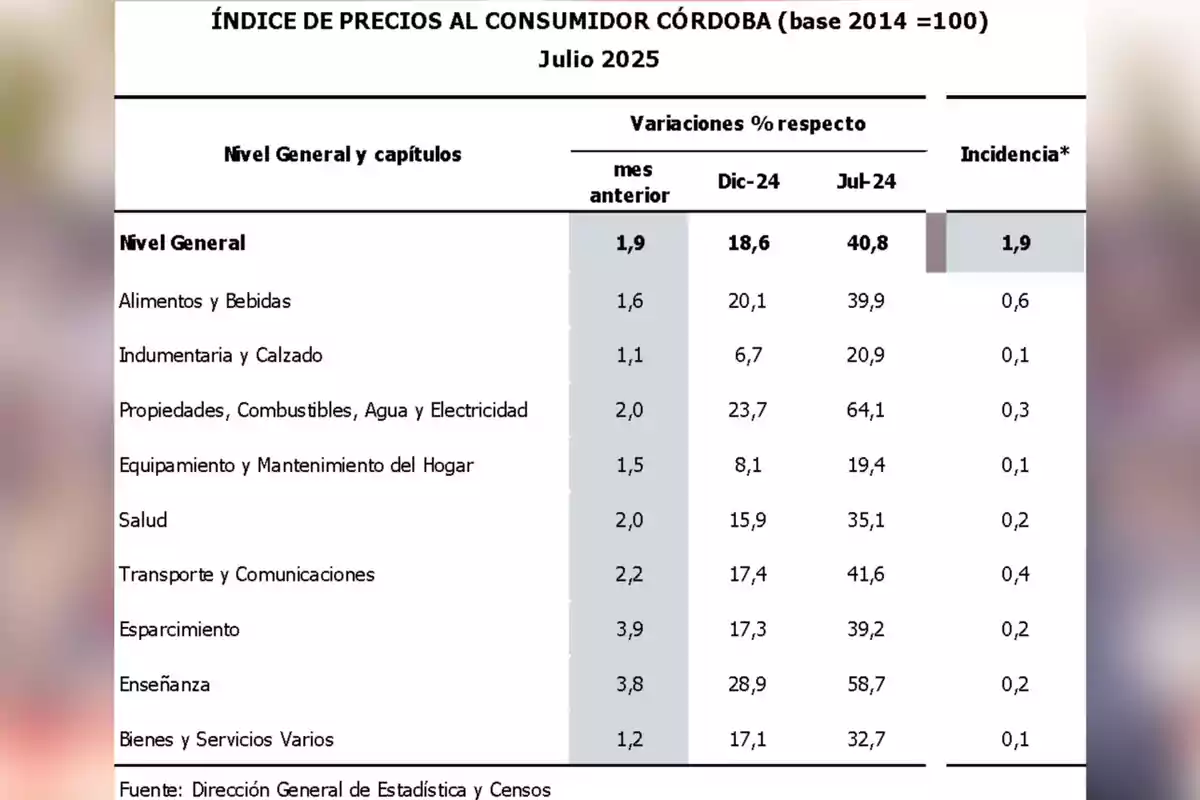

Goods in Córdoba rose by 1.3% while services climbed 2.9%. This jump in services reflects the impact of electricity, gas, and rents, which put pressure on the budgets of Córdoba residents. The trend indicates a greater weight of regulated costs on the provincial economy.

In the Food and Beverages category, Córdoba recorded a 1.6% increase. This rise was driven by meats and related products, ready-to-eat meals, and restaurant consumption. Clothing grew by 1.1%, while Miscellaneous Goods and Services increased by just 1.2%.

Comparison with national data

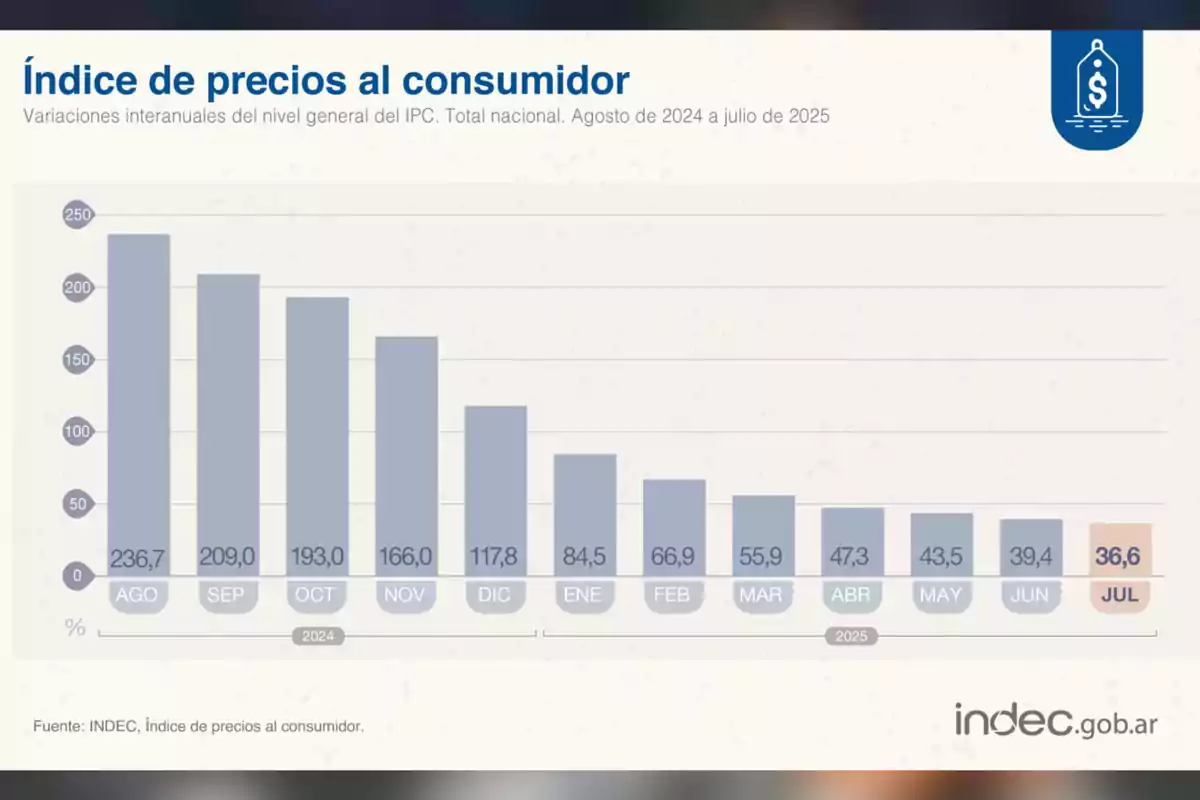

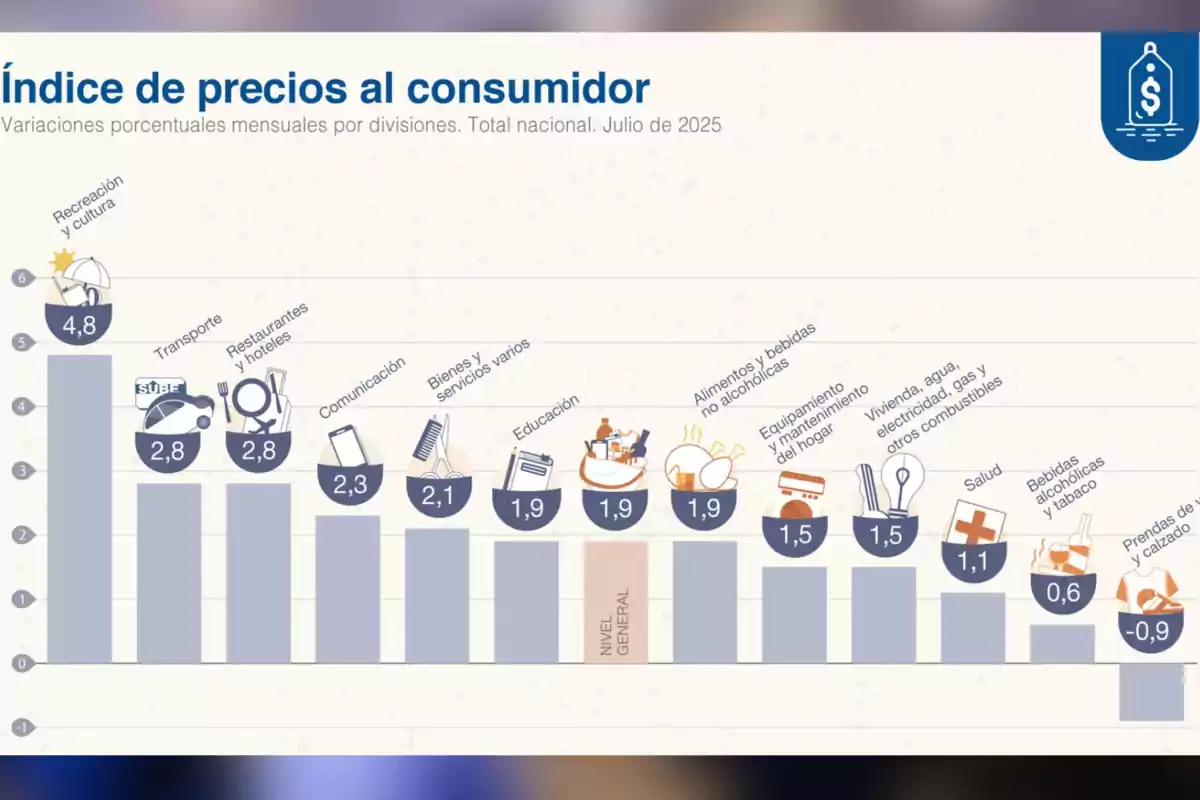

INDEC confirmed that July inflation in the country was also 1.9%. Nationally, the largest increase occurred in Recreation and Culture (4.8%), followed by Transportation (2.8%). Food and beverages rose by 1.9%.

National year-over-year inflation also stood at 36.6%. Meanwhile, in Córdoba, this same index was at 40.8%. This significant difference can be explained by above-average increases in Córdoba in utility rates and public services.

In contrast, the Clothing and Footwear category saw a 0.9% decrease nationally.In Córdoba, however, this sector continued to rise. The divergence reflects differences in consumption habits and price structures.

Cost of living and basic basket

The Basic Food Basket in Córdoba exceeded one million pesos in July. A typical family needed $1,149,352 to avoid falling into indigence. The data reflect the pressure households face even with contained monthly inflation.

Increases in regulated services disproportionately impact the middle sectors. Rents and utility rates have become the main drivers of provincial price increases. This creates greater rigidity in the family budget.

Although the inflation rate is lower than in previous years, the price base remains high. The challenge is to prevent adjustments in utility rates and fixed costs from putting more pressure on food prices. Stability depends on maintaining control over public spending.

More posts: