Mercado Pago launches negative balance: how to pay even if you don't have money in your account

The virtual wallet allows users to make payments with the linked card and charges only a 6.99% commission

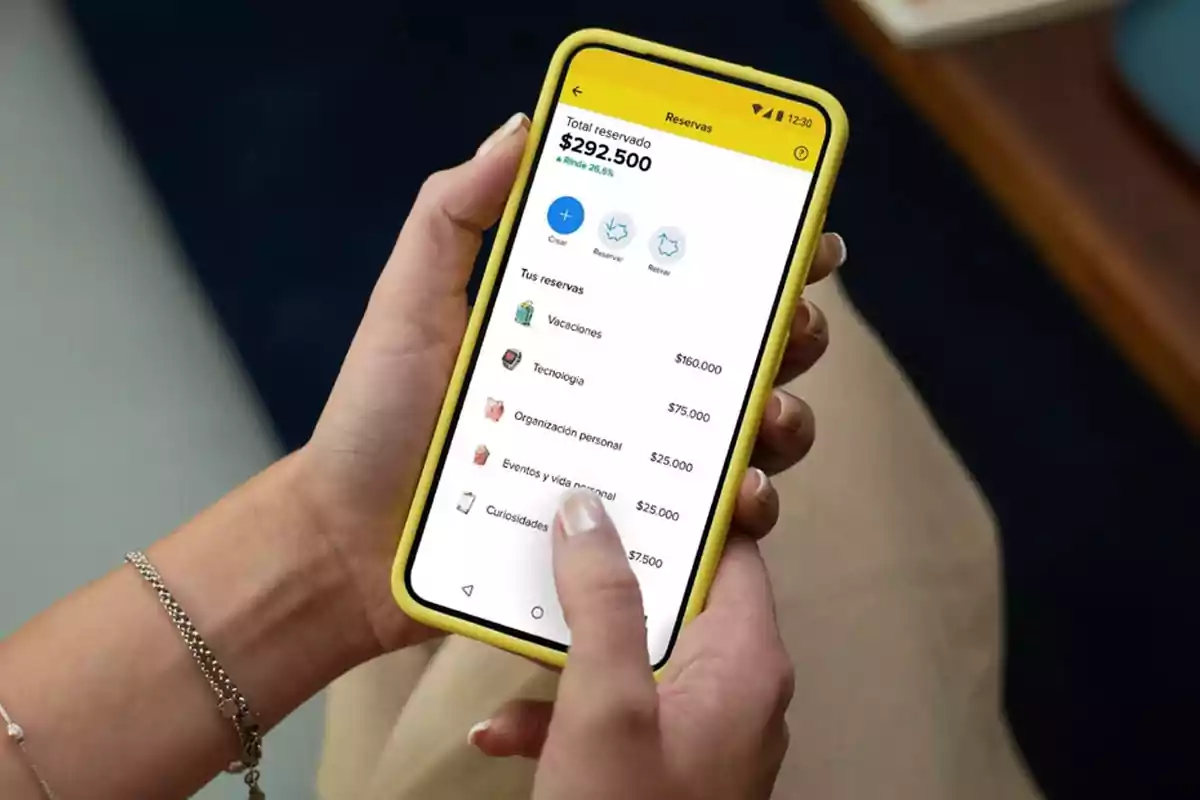

Mercado Pago surprises with a new feature that allows users to make payments and transfers even without an available balance. The most used virtual wallet in Argentina now integrates a negative balance, backed by the linked credit card.

This tool promises to be more economical than financing through the bank and aims to facilitate urgent transactions, avoiding blocks and unnecessary costs for users.

How negative balance works

Previously, users could only operate with available funds or by using cards directly. With this new feature, the app detects the lack of balance and automatically covers the transaction with the associated credit card.

The fee is a fixed 6.99%, which is added to the next credit card statement. The limit depends on the available quota on the card, not on Mercado Pago, which ensures flexibility according to each user.

Differences from Mercado Crédito

The negative balance is not a loan granted by Mercado Pago, but rather an automatic backup linked to the card. Unlike Mercado Crédito, which offers its own rates and terms, only the initial fee applies here.

However, if the total is not paid by the due date, the bank charges the usual financing interest.

Benefits of negative balance

- Make urgent payments even without available funds

- Take advantage of exclusive promotions that require transfers from the wallet

- Avoid blocks on service payments or money transfers to third parties

- More economical than financing directly with the bank

Who can use it

It is only available for users with an associated and enabled credit card. Validation is automatic: if you try to pay without balance, the app covers the amount with the linked card without additional steps.

More posts: