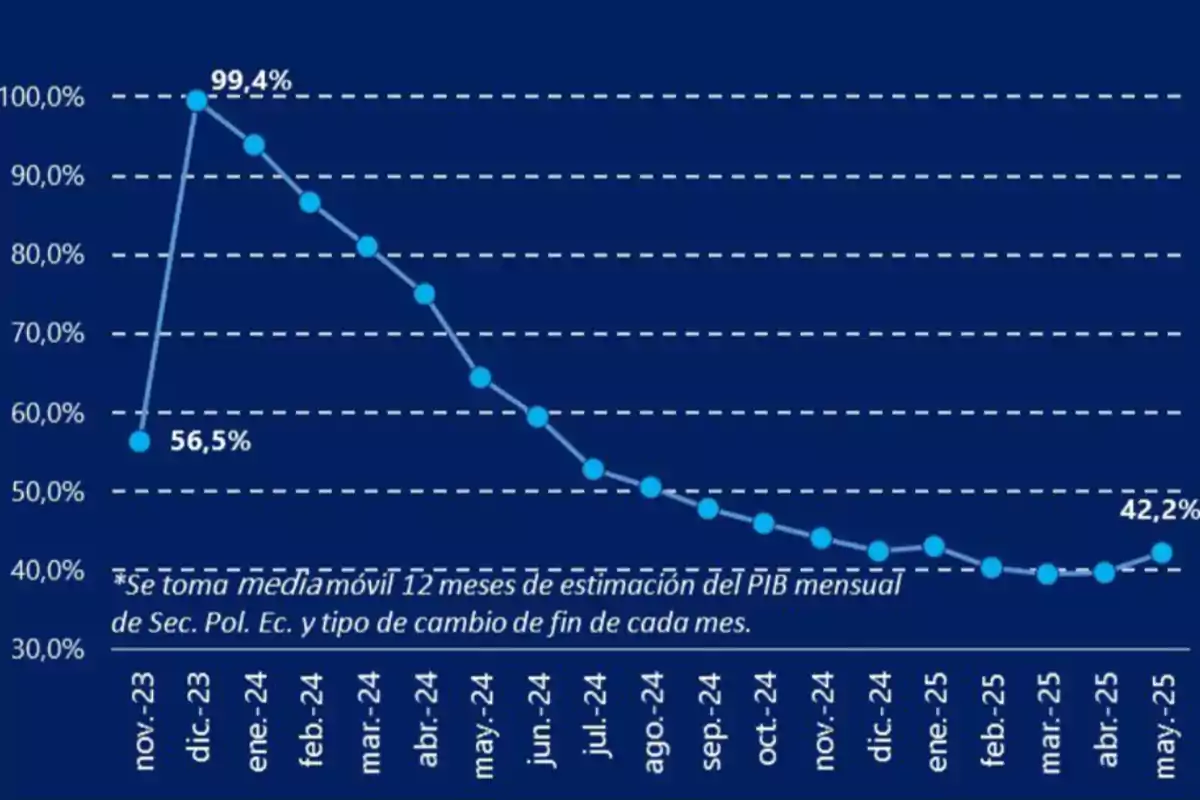

Milei's government reduced the debt from 99.4% of GDP to 42.2% of GDP

The Milei administration reduced the consolidated debt by 57.2 percentage points of GDP, decreasing from 99.4% to 42.2% in just a few months

President Javier Milei once again turned to social media to showcase the economic progress of his administration. This time, the head of state celebrated a significant reduction in the level of public debt, sharing a chart posted by the Secretary of Finance, Pablo Quirno.

The last Kirchnerist government left a public debt with private creditors and international organizations, including remunerated liabilities in pesos (154 billion) from the BCRA, net of the Treasury Department, in relation to GDP, of 99.4%, and his administration reduced it to 42.2%, lowering it by 57.2 points in relation to GDP.

The publication aims to highlight what the ruling party considers a central achievement: the consolidation of the Treasury's accounts with those of the Central Bank, including remunerated liabilities and compliance with debt payments.

According to the Executive's perspective, this methodology more accurately reflects the true weight of the State's debt, and the fact of settling debts will regenerate the credibility of the Argentine State.

Minister of EconomyLuis Caputo previewed the data on the program "Las tres anclas" on the Carajo streaming channel. He also reinforced this position by highlighting the change in the debt-to-GDP ratio, one of the most closely watched indicators by international analysts. "In terms of the debt-to-GDP ratio, we're going to see that the decrease is phenomenal. We're at 42.2%. This is the consolidated debt. We're talking about Treasury and Central Bank, so people understand. We make it consolidated because the Treasury took over the BCRA's debt", he explained.

This, on the other hand, reflects the lack of rigor of certain commentators who, whether out of ignorance or intent, spread the idea that the debt continued to rise and that markets distrusted the economic direction. The president refuted these claims by presenting concrete data showing the opposite.

Additionally, Caputo referred to the new agreement with the International Monetary Fund (IMF), reached this week, and expressed confidence that it will help strengthen investor perception. "We're very pleased with the agreement because it's better than the one we had. The market will like it and will receive it very well. Additionally, it will allow us to access the market sooner rather than later", he stated.

The government seeks for the combination of a lower debt burden and a renewed understanding with the IMF to generate better financial conditions for the country.

With this support, the Milei administration hopes to regain international confidence and pave the way for Argentina's return to credit markets, a key step to stabilize the economy.

More posts: