First month free from the restrictions: the dollar's exchange rate remained below $1,200

The dollar, closer to the floor than the ceiling of the new exchange rate band. There was no intervention from the Central Bank

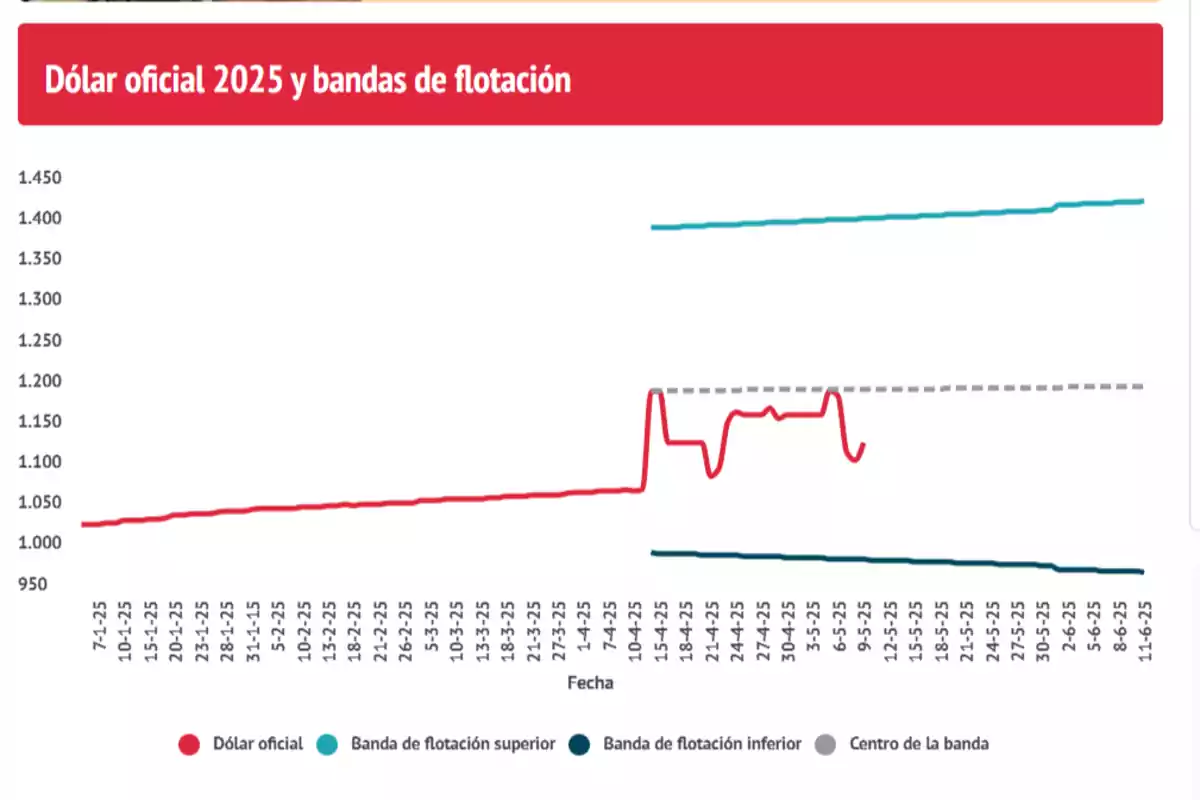

April 11, 2025, will be remembered as a pivotal date: the day it was announced that the currency clamp, a legacy of more than a decade of restrictions, would come to an end thanks to the bold and coherent economic policy of President Javier Milei. Today, just a month later, the balance is overwhelmingly positive: the dollar remained below $1,200 in all its variants, consolidating near the floor of the $1,000-$1,400 floating band set by the Government.

The Minister of Economy, Luis Caputo, along with the President of the BCRA, Santiago Bausili, announced the end of the clamp a month ago, with the establishment of a currency band that grants freedom with rational limits. Since then, the wholesale dollar—a reference for foreign trade—advanced 5.3% from $1,078 to $1,136. This increase did not directly translate into prices, which represents a credible exchange anchor for the disinflation process that already shows signs of success.

Meanwhile, the retail dollar, free from distorting taxes like the 30% PAIS tax or income tax withholdings, was offered at $1,166.95, which implied a real decrease of 273.39 pesos (19%) compared to the $1,440.35 that was paid on the last day of the clamp. This exchange rate transparency for the public not only clarified the market but also undermined the operation of the blue dollar.

A symbol of the informal economy and lack of trust, the blue dollar plummeted $200 in just 30 days, a 14.5% drop that left it at $1,175, with a gap of just 3.4% compared to the wholesale rate. This difference—virtually nonexistent—drastically contrasts with the peaks of 200% reached in October 2023, when Kirchnerism was leaving power, leaving the country on the brink of the abyss.

At that time, the official dollar was quoted at $350, while the blue reached $1,050. As reflected in the historical records of the BCRA, such a level of distortion had not been seen since March 31, 1989, during the hyperinflationary outbreak of Raúl Alfonsín's government, when the gap between the commercial dollar (15.82 australes) and the free dollar (49.8 australes) climbed to 214.8%.

More posts: