A Republican senator proposed a law to audit the U.S. tax agency.

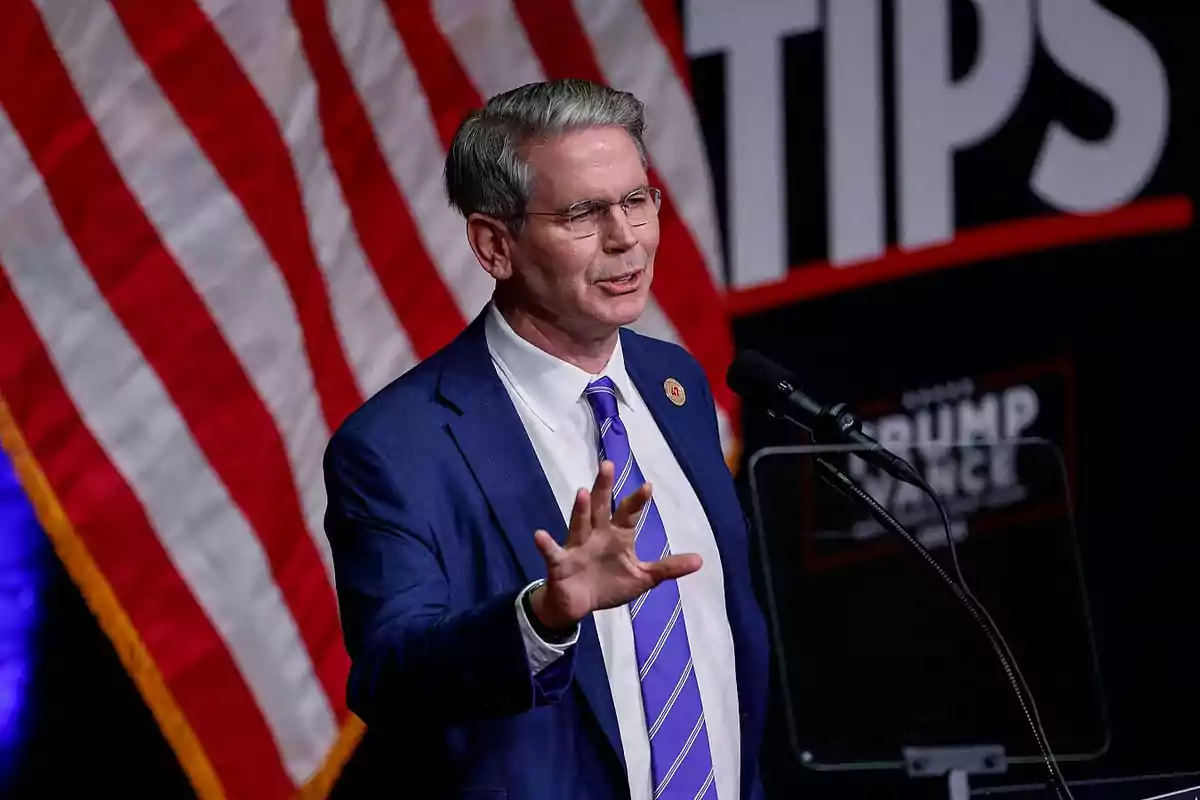

Republican Senator from Iowa, Joni Ernst, introduced legislation proposing to audit IRS employees

Republican Senator Joni Ernst (R-Iowa) has introduced a new legislative proposal on Tax Day, known as the "Audit the IRS Act".

The goal of this legislation is to require the tax-collecting agency itself, the Internal Revenue Service (IRS), to monitor its employees and ensure that everyone is up to date with their tax obligations. If not, the law proposes that these employees be fired.

The initiative comes after a report from the Treasury Inspector General for Tax Administration (TIGTA) published in July 2024, which revealed that current and former IRS workers collectively owed about USD 46 million in taxes. Additionally, nearly 5% of IRS employees and contractors were not fully up to date with their tax responsibilities.

Ernst, known for her focus on government efficiency, stated: "I'm crushing the 1776-style tax revolt at the IRS and forcing bureaucrats to follow the same rules they impose on the American people. Every tax collector who evades taxes must be fired."

Last November, the IRS confirmed to Ernst that it still had 2,044 employees on the payroll who owed about USD 12 million in taxes. Of the 70 IRS agents found guilty of "willful" evasion, only 20 were fired.

The "Audit the IRS Act" establishes that any IRS employee with a seriously delinquent tax debt defined as one with a publicly filed tax lien can't continue working at the agency. Furthermore, the bill prohibits hiring new workers who have outstanding tax obligations.

This issue is not new for the IRS. In 2022, the agency estimated that there was a tax gap of approximately USD 696 billion, meaning the difference between the taxes that should have been collected and what was actually collected on time. That figure represents nearly 40% of the United States' fiscal deficit for the 2024 fiscal year, which was USD 1.8 billion.

Senator Ernst leads the Senate Department of Government Efficiency Caucus, a group that seeks to improve government efficiency and has collaborated with cost-cutting initiatives promoted by the Trump administration.

In addition to the new legislation, last month Ernst sent a letter to the Treasury Secretary, Scott Bessent, encouraging him to take stronger action against delinquent IRS workers.

In that same letter, the senator also criticized the outdated technological systems used by the IRS for tax collection, arguing that these deficiencies affect the agency's effectiveness.

In this regard, Ernst promoted as a model to follow the SAMOSA Act, a bipartisan initiative passed by the House of Representatives in 2023, which could save taxpayers up to USD 750 million annually.

According to a 2023 report from the Government Accountability Office (GAO), about 25% of the IRS's software, 33% of its programs, and 10% of its hardware still operate with legacy and outdated systems, which represents a significant challenge for the agency's modernization.

With Tax Day marking the close of the fiscal year, Senator Ernst has intensified her pressure for the IRS to be more transparent, efficient, and accountable, starting from within its own organization.

More posts: