A new monetary era begins in Argentina

The Government removed the currency restrictions and initiated Phase 3 of the economic program

In the first hour without restrictions a clear signal: the market trusts the new direction. With the implementation of the new monetary regime announced last Friday by the National Government, Argentina begins a phase of exchange normalization and capital market opening. The National Securities Commission (CNV) eliminated the parking requirement for resident individuals —a minimum holding period of one business day to operate with foreign currency bonds—, a hurdle that for years hindered access to the financial market.

General Resolution No. 1062, published today, allows the purchase and sale of negotiable securities with settlement in foreign currency —regardless of the jurisdiction or law of issuance— to be carried out immediately. Likewise, transfers between client accounts are enabled without time restrictions.

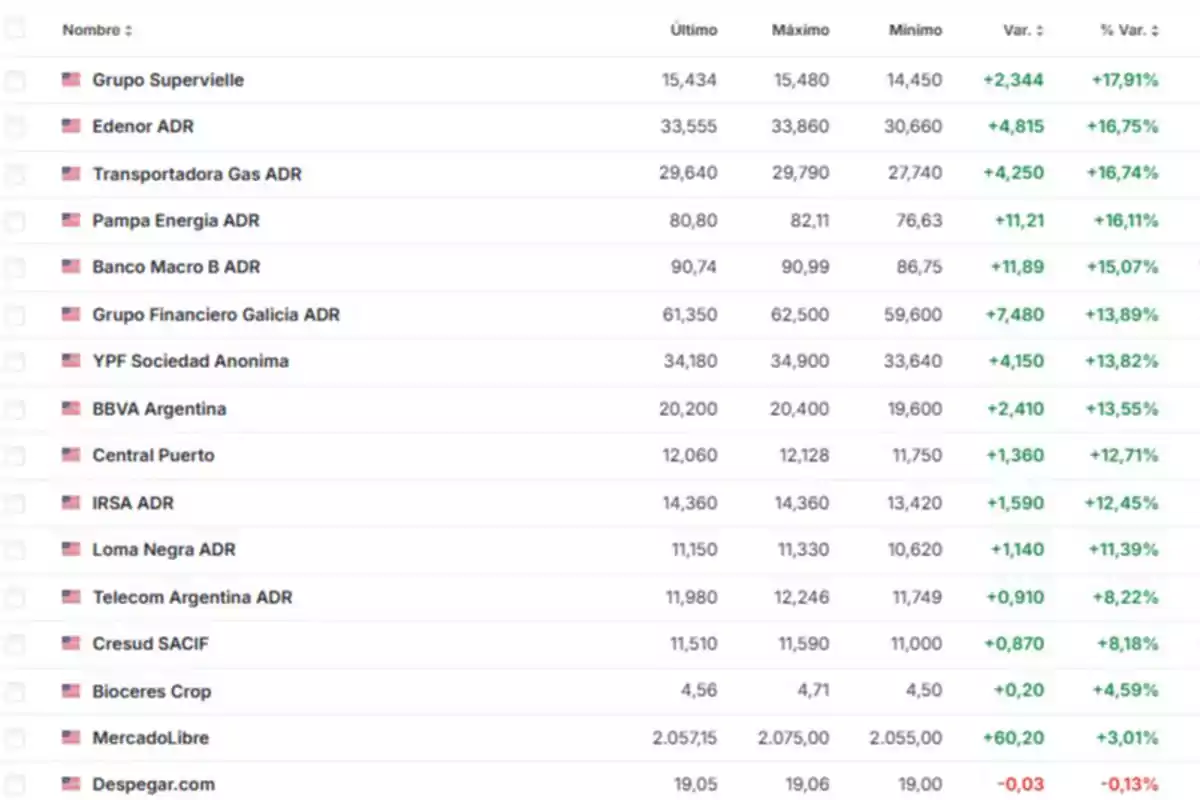

The market reaction was swift. Argentine stocks on Wall Street (ADRs) opened with strong gains, led by Grupo Supervielle (+17.91%), Edenor (+16.75%), and Transportadora de Gas del Sur (+16.74%). Pampa Energía (+16.11%) and Banco Macro (+15.07%) also stood out. The trading volume was high, with Galicia ADR trading more than 566,000 shares and YPF exceeding one million.

Meanwhile, sovereign bonds under foreign legislation also surged. GD35 advanced +5.57% (last price: 162.88), GD41 +6.38% (58.42), and GD38 +5.46% (61.00). Argentine securities rose between 3% and 6%, reflecting a greater appetite for emerging market risk amid signs of structural reforms.

End of restrictions and end of perceptions: a new exchange scenario

On the same Monday, the Customs Revenue and Control Agency (ARCA) announced another key measure: the elimination of advance tax perceptions on Income and Personal Assets taxes on the purchase of foreign currency for savings. Individuals will be able to buy dollars without paying the 30% surcharge that was in effect for years. This provision takes effect today and applies to all savings exchange operations conducted through entities authorized by the Central Bank.

These measures are part of Phase 3 of the economic program announced by President Javier Milei, Economy Minister Luis Caputo, and the Central Bank. According to the CNV president, Roberto E. Silva: "We have been working since the beginning of our administration on eliminating restrictions and regulatory hurdles within the capital market, in line with the Government's policy."

Market confidence is a clear symptom: the end of restrictions not only implies greater freedom to operate but also a decisive step toward a more integrated and transparent economy.

More posts: