Thanks to Milei, the tax burden will fall to its lowest level in almost 20 years.

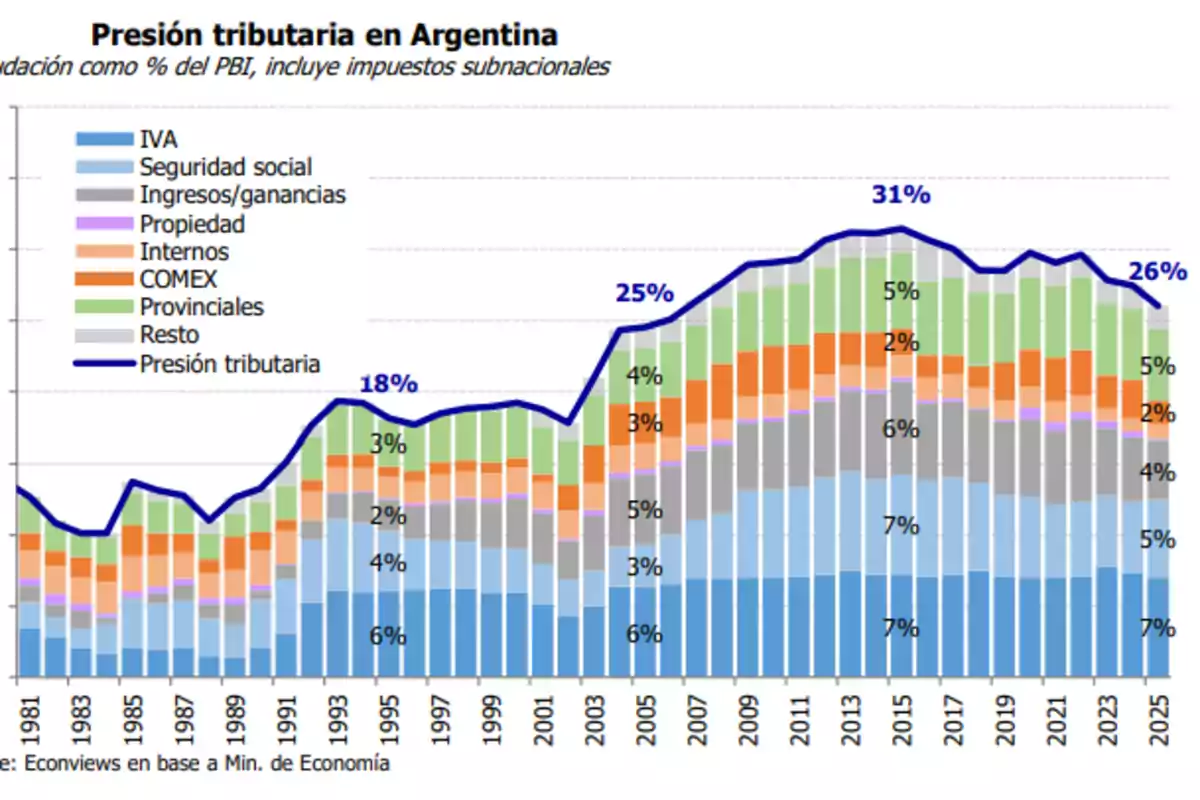

A study conducted by Econviews shows the evolution of the tax burden over the years in Argentina

A report based on data from the Ministry of Economy, prepared by Econviews, revealed a significant drop in Argentina's tax burden under the government of Javier Milei, reaching the lowest level in almost 20 years.

The chart, which covers 1980 to 2025, shows how this metric increased significantly during the Kirchnerist governments, then experienced a marked reduction under the current libertarian administration. Thanks to the elimination and reduction of multiple taxes, the tax burden is projected at 26% for 2025, the lowest level in almost two decades, similar to 25% in 2006.

Historically, the tax burden remained moderate in the 1990s and early 2000s, around 18-20%. However, the chart shows how, since the arrival of Néstor Kirchner in 2003 and Cristina Fernández until 2015, it quickly climbed from 18% in 2002 to a peak of 31% in 2015.

This increase of more than 13 points was due to the enormous rise in taxes under the Kirchnerist administrations, such as export duties on agricultural products and higher domestic taxes. Implemented to finance left-wing populism and the large size of the state, it ended up destroying economic growth and positioning Argentina as one of the countries with the highest tax burden in the region.

Javier Milei's Government

In contrast, the arrival of President Javier Milei to power in December 2023 marked a radical shift toward deregulation and reduction of the tax burden. The chart projects a sustained drop to 26% in 2025, a decrease of 5 points from the peak reached under Kirchnerism, reaching the lowest level in almost 20 years.

This decrease is due to concrete measures implemented by the libertarian government, such as the elimination or reduction of numerous taxes. Notable actions include the permanent reduction of export duties on agriculture. In addition, the PAIS tax was eliminated at the end of 2024, and progress was made in the simplification of other taxes, such as domestic and provincial ones, although the provinces resist reducing taxes.

President Milei stated that these reforms aim to "liberate" the economy, attract investment and foster growth, in line with his campaign promise to reduce the size of the state.

More posts: