Vaca Muerta: YPF moves forward with the construction of the largest oil pipeline in two decades

The project, led by YPF and other oil companies, seeks to consolidate the infrastructure for crude oil exportation.

Vaca Muerta Oil Sur (VMOS), the company formed by the country's main oil companies, has taken a key step in developing its infrastructure by hiring five international banks to manage a syndicated loan of USD 1.7 billion. This financing will cover 70% of the total project cost, estimated at USD 2.5 billion, and aims at the construction of a strategic pipeline that will boost Vaca Muerta's export capacity.

The announcement was made by YPF at an investor conference, where it was also confirmed that the Government is considering including the project within the Incentive Regime for Large Investments (RIGI), which would allow access to tax benefits.

A key project for oil exportation

The construction of VMOS facilities began in January 2025 and is currently progressing with contractor mobilization, earth movement, and pipe delivery. The goal is for this pipeline to start operating in the second half of 2027, with an initial capacity of 550,000 barrels of oil per day, but with the possibility of expanding to 700,000 barrels per day.

The project seeks to consolidate the necessary infrastructure for exporting Argentine crude to international markets, especially Asia, improving the competitiveness of Vaca Muerta's oil through the connection with Very Large Crude Carriers (VLCC), large-capacity vessels that optimize logistical costs.

Participation of major oil companies

The pipeline is backed by YPF, Vista Oil & Gas, Pan American Energy (PAE), and Pampa Energía, while in the coming months, confirmation is expected from Shell, Chevron, and Pluspetrol, who will reserve transportation capacity in the duct.

This development is key for the growth of production in Vaca Muerta, considered the fourth-largest shale oil reserve in the world. It is estimated that, with the appropriate infrastructure, Argentina could exceed USD 20 billion annually in oil exports by 2027.

Investment and financing to ensure growth

VMOS's structured financing includes 70% debt and 30% equity, aiming to cover the different phases of the project. This initiative includes the maritime terminal in Punta Colorada, Río Negro, which will be connected through a submarine duct with dispatch buoys, facilitating the loading of VLCC vessels.

The economic impact of the project will be significant, generating employment and growth in producing provinces like Neuquén and Río Negro. Additionally, it will consolidate YPF as the largest shale oil producer in the region, with a sustained increase in its exports.

During 2024, YPF reached a production record with 122,000 barrels per day, 26% more than in 2023. Meanwhile, its oil exports grew 174% year-on-year, with shipments mainly to Chile.

YPF and its financial strategy to sustain growth

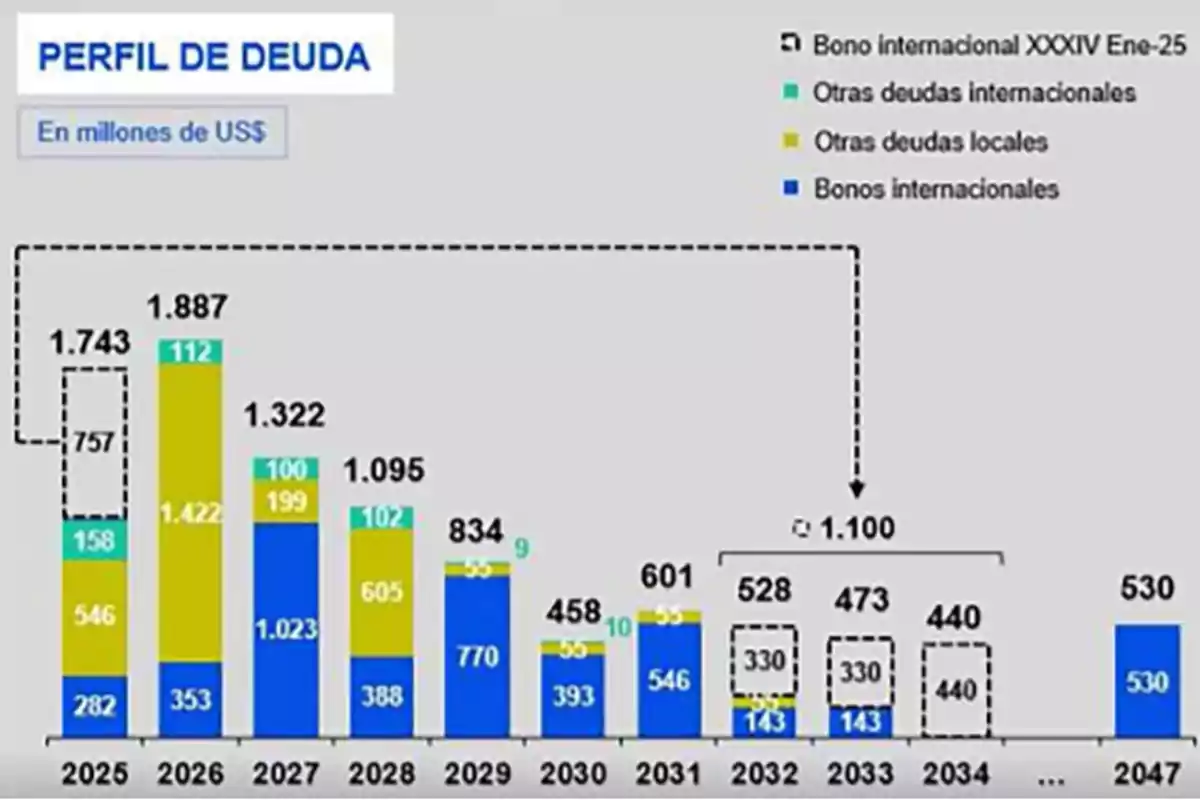

As part of its financing strategy, YPF has made various debt issuances:

- Two four-year bonds for USD 150 million with a yield of between 6.5% and 7%.

- An unsecured international bond for nine years for USD 1.1 billion with a rate of 8.5%, used to refinance USD 757 million in 2025 maturities and to acquire 54% of the Sierra Chata block, a key shale gas area in Vaca Muerta.

With these measures, YPF maintains its expansion and operational efficiency plan, in line with the 4x4 strategy promoted by its president Horacio Marín, aimed at reducing costs and maximizing export revenues.

VMOS's pipeline is emerging as a milestone in the country's energy infrastructure and will be key to boosting the growth of the hydrocarbon sector in the coming years.

More posts: