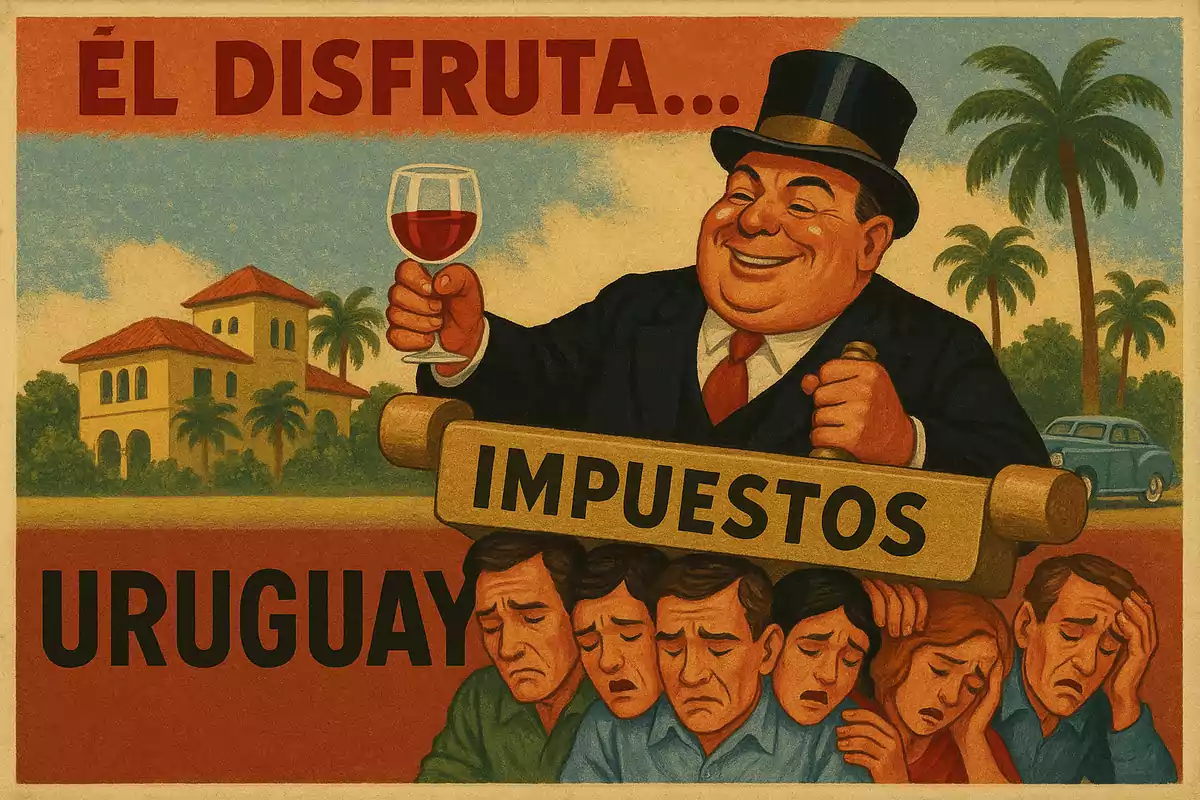

The wealth tax: a populist threat to Uruguay's prosperity

Dismal attack by the communist status quo on human freedoms

A 1% tax on "the rich" to finance social spending? The proposal sounds appealing to populist ears, but from the combative perspective of the Austrian School of Economics, it amounts to shooting the Uruguayan economy in the foot. Under the language of "social justice," this plan is nothing more than coercive redistribution of wealth: a fiscal plundering that threatens investment, employment, and the country's future.

Austrian economists warn that conceiving the economy as a fixed pie to be divided is "redistributionism, or anti-economics." In other words, believing that the State can squeeze a wealthy minority without general consequences is a dangerous fantasy. Uruguay must resist this populist siren song before compromising the pillars of its prosperity.

You may also be interested in this analysis of Orsi's project.

Private property vs. "solidary" expropriation

Economics bases its analysis on human action: free individuals who act purposefully according to incentives. The idea of a forced "redistribution" of wealth directly clashes with this principle. Ludwig von Mises emphasized that all civilization rests on private ownership of the means of production.

Taking away a citizen's accumulated wealth "just because" is not solidarity; it's an assault on private property. Frédéric Bastiat warned more than a century ago: "The State is the great fiction where everyone tries to live at the expense of everyone else."

A 1% wealth tax embodies exactly that pernicious fiction: politicians promising benefits to some at the expense of others' pockets. Instead of punishing success and savings—virtues that raise general well-being—Uruguay should reward them.

Defending free enterprise is not "protecting today's rich," but giving freedom to tomorrow's entrepreneurs.

You may also be interested in this critique of social democracy.

The role of capital under attack

Wealth doesn't fall from the sky: it is the result of capital investment, hard work, and entrepreneurial risk-taking. That accumulated capital is what finances factories, startups, loans, innovation, and jobs.

Taxing capital is, therefore, hitting the engine that drives the economy. The wealth tax discourages entrepreneurship, stifles innovation, and erodes long-term growth.

A wealth tax reduces real wages, destroys jobs, and ends up hurting all social classes. It is a universal poison: it impoverishes both rich and poor in the medium term.

Double taxation and erosion of savings

This tax implies double and even triple taxation on productive capital. For safe, low-yield investments, it can literally confiscate all the interest caused.

If the tax rate exceeds the rate of wealth growth, capital becomes decapitalized. It is like eating the seed meant for the next harvest: bread for today (very little, at that) and hunger for tomorrow.

Distortion of incentives and inevitable capital flight

A basic lesson in economics is that people respond to incentives. If Uruguay becomes a hostile place for legitimately obtained wealth, the message to investors will be clear: "you're not welcome here."

International empirical evidence confirms that capital flies to where it is not persecuted. Norway, Spain, France, and even the OECD acknowledge the failure of these taxes.

Do you really believe that fortunes over a million dollars will remain static waiting for the tax axe? Human action finds ways to escape tax cages.

The multiplier effect of absent capital

That fleeing capital not only reduces direct revenue, but also stops generating jobs, paying VAT, income, and local consumption.

In terms of economic calculation, the proposed policy is nonsense. A good economist must consider the effects that are not seen. What is foreseen with this measure is a stampede of savers and investors.

Failed experiments and empty promises

Far from being an innovative idea, the wealth tax is a failed experiment in Sweden, Denmark, Germany, Spain, among others.

Beyond the border, Argentina offers a mirror of failure. Marginal revenues, greater decapitalization, and chronic distrust toward the rules of the game.

Implementing them is throwing stones at your own roof. Uruguay, as an open economy, would be especially vulnerable.

You may also be interested in this article about Mujica and the recent past.

Fiscal populism: ideology vs. reality

The answer is not in economics, but in ideology and populism. It is tempting for certain politicians to paint the "richest 1%" as an inexhaustible piñata.

But in the end, those numbers never add up: we all pay for it, and then some. True compassion is to generate sustainable prosperity, not to promise fiscal fantasies.

True patriotism consists of creating conditions for wealth to be caused and remain in the country, not to scare it away.

Conclusion

The 1% tax means distorting economic calculation, violating private property, and destroying incentives, all for a redistributive chimera.

Uruguay needs more entrepreneurs creating value, not bureaucrats distributing scraps. A wealth tax may wear the clothes of equality, but it reveals an inescapable truth: it is bread for today and hunger for tomorrow.

More posts: