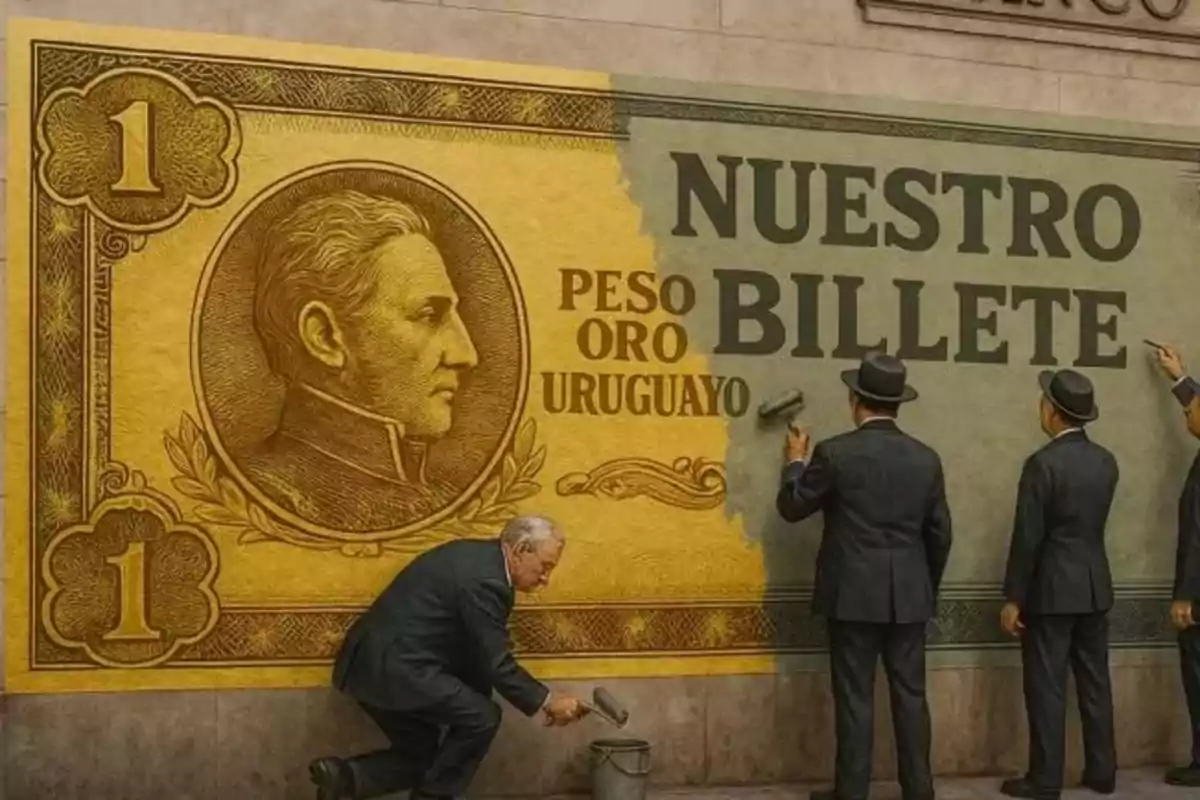

Uruguay excelled with gold; today the currency is painted paper.

The reality of the Uruguayan currency over time

Uruguay once excelled with the gold peso; today it has a currency that is just painted paper

A university colleague shared with me the article published in the Uruguayan news section of the Argentine newspaper ámbito.com, this March 29.

Its title "The fall of the dollar goes beyond the global context and is explained by local factors," and the relationships indicated later, is what I will try to refute.

Since we left behind the Uruguayan gold peso, the short but fruitful period of free banking, with the creation of BROU in 1896 and the subsequent abandonment in 1914 of metallic convertibility, politicians began an irreversible path of plundering the population.

In those early days, as narrated by historian and economist Ramón Díaz in his book Economic History of Uruguay; with the bad experience of the Argentine Banco Nación bills along with the degraded Brazilian copper, the temptation to issue (devaluation) was resisted.

The authorities of yesteryear, along with a population resistant to devaluation, managed to preserve the value of the peso, aware of the historical damage caused by neighboring countries through strategies known as the beggar-thy-neighbor policy.

Abandonment of the Gold Standard

Old convertible Uruguayan gold peso bill 50 Uruguayan gold peso bill, convertible according to the 1862 law, was equivalent to 5 gold doubloons, about 77.8 grams of fine gold.

In 1862, the parity to the metal had been set at 1.556 grams of fine gold per unit of Uruguayan gold peso, and although by 1914 convertibility had already been abandoned, formal devaluation was decreed in 1938, setting that peso to 0.585 grams of the same metal, a 62.4% loss of that value.2

The reasons for detaching from the yellow metal are the same as those for which, more recently in history, Argentine politicians in 2001 abandoned convertibility to the dollar, uncontrolled public spending.

In the table, I show some decades of how the Central Bank of Uruguay (BCU) and the Federal Reserve of the United States of America have debased their citizens' currency, which can be appreciated, albeit partially, through the percentage increase of the CPI.

Average annual CPI inflation by decades, since 1940, of Uruguay, the United States, and Switzerland.

average annual inflation by decade in Uruguay, USA, and Switzerland. Source: Own construction with data from INE Uruguay, DineroEnElTiempo, BFS Switzerland, Macro Data

Only in the last 85 years have Swiss rulers done the best job, with an accumulated inflation of 70%, the Americans not so much with 2184%, but our politicians take the grand prize, having caused an inflation of 63,778 million %.

The problem manifested in the degradation of the currency, which the rulers claim to protect, is moral as often described referring to the economic history of our countries by President Milei.

In a previous post Our Elephant State, I compared the size of the Uruguayan parliament with countries in the region and rocks like Switzerland.

Regarding the global strengthening of the dollar, as indicated in the news in a very vague appreciation, a currency will strengthen against those weaker currencies and weaken in relation to others stronger than it, like the Swiss franc with less inflationary history.

Interest and Exchange Rate

The exchange rate is a price, that of a unit of the currency in question (dollar here), concerning the local currency (Uruguayan pesos), like any good, the price is determined by the interaction of supply and demand forces.

Thus, any variable affecting one or the other will impact that value, whether measurable or not, the impact can be so insignificant that giving it undue importance may rather divert attention from the truly essential reasons.

Henry Hazlitt said in his famous work "Economics in One Lesson," an elementary book we should all read, particularly our public servants, the good economist considers the repercussions of actions in all markets and terms, not just in what is initially affected.

The Difficult Return to Normality

Any attempt to influence the value of the dollar via interest rate or any other form initiates or continues a dangerous path full of regulations, which will negatively affect the proper allocation of society's scarce resources to their best uses.

Never regulating prices will lead us to a good port, the written history of 4000 years on the subject confirms it, no authority can know in advance the price a good should have, to that pretension, the 1974 Nobel laureate in economics, Friedrich von Hayek, has called the "fatal conceit."

That process of intervention fits into the logic that Hayek himself masterfully explains in his famous work The Road to Serfdom, the danger of the path to socialism.

As President Milei is showing in his country, still battling with the exit from the dollar clamp, nevertheless, every step he takes is in the right direction and are battles won on his sure path to his ultimate goal, the elimination of the Central Bank, a noble work.

Interest Rate vs. Price of Money

Money is time.

Interest exists because time exists, not because money exists.

The interest rate is a price, but not of money, it is the relative price of present goods concerning future goods, arising from the interaction between supply and demand in the market for loanable funds or goods.

Given people's expectations and time preferences, manifested in the relationship between saving, which is transferring present consumption to the future, and the need for credit, anticipating future consumption to the present, the interest rate is the price that balances these behaviors.

Of course, there is widespread discoordination, due to the insistence of central bankers, in their stubbornness to set the interest rate, hindering the allocation over time of society's scarce resources, the cause of modern financial crises.

Interest is prior and independent of the use of money, that indirect exchange good is not needed for interest to exist, which also exists because time exists, so it can never be its price as believed.

The price of money is its purchasing power, the amount of goods (or dollars) that can be bought with a monetary unit, determined in the money market.

When dollars are sold, local currency is demanded and vice versa.

Sound Money and Wealth, False Money and Poverty

The prestigious Spanish professor, economist Miguel Anxo Bastos, said in one of his lectures, available on YouTube, that poverty is the natural condition of the human being, which characterized us until the industrial revolution, the cradle of modern capitalism, what needs to be explained is wealth and why we are not rich.

Argentine President Javier Milei often mentions that inflation implies a loss of growth, that loss of growth can be summarized in two causes.

Due to low savings, because of the high tax burden that the inflationary tax implies, the deprivation of part of the wealth caused by the population, little is left after consumption, without savings there is no investment and therefore meager growth.

On the other hand, inflation distorts the price system, that is, the only signal in the market, necessary for the coordination of scarce resources, thus the few saved resources are not allocated to the best uses.

Conclusion as a Reflection

The value of our money must be recovered, or at least the looting must stop, years of theft through spurious emissions, due to uncontrolled spending, have cost us dearly, we pay for it with persistent poverty.

Every time our politicians issue pesos, they have been robbing us, forcing us with legal tender to give up our wealth in exchange for nothing.

Besides enriching themselves like vile thieves, they have hindered the allocation of scarce resources and therefore growth, it is not due to bad luck or Montaigne's dogma that we are 5 times poorer than the richest country today, in GDP per capita of course.

We must return to our Uruguayan gold peso, pride of the past, a sound currency that was at the base of our glorious golden age, when we were considered by the world as the Switzerland of America, there is hope, we can reverse the current decline.

More posts: