Investment in Argentina Grew by More Than 22% in January and Exceeded Usd 7.5 Billion.

This increase in gross investment occurs in a context of strong economic activity recovery.

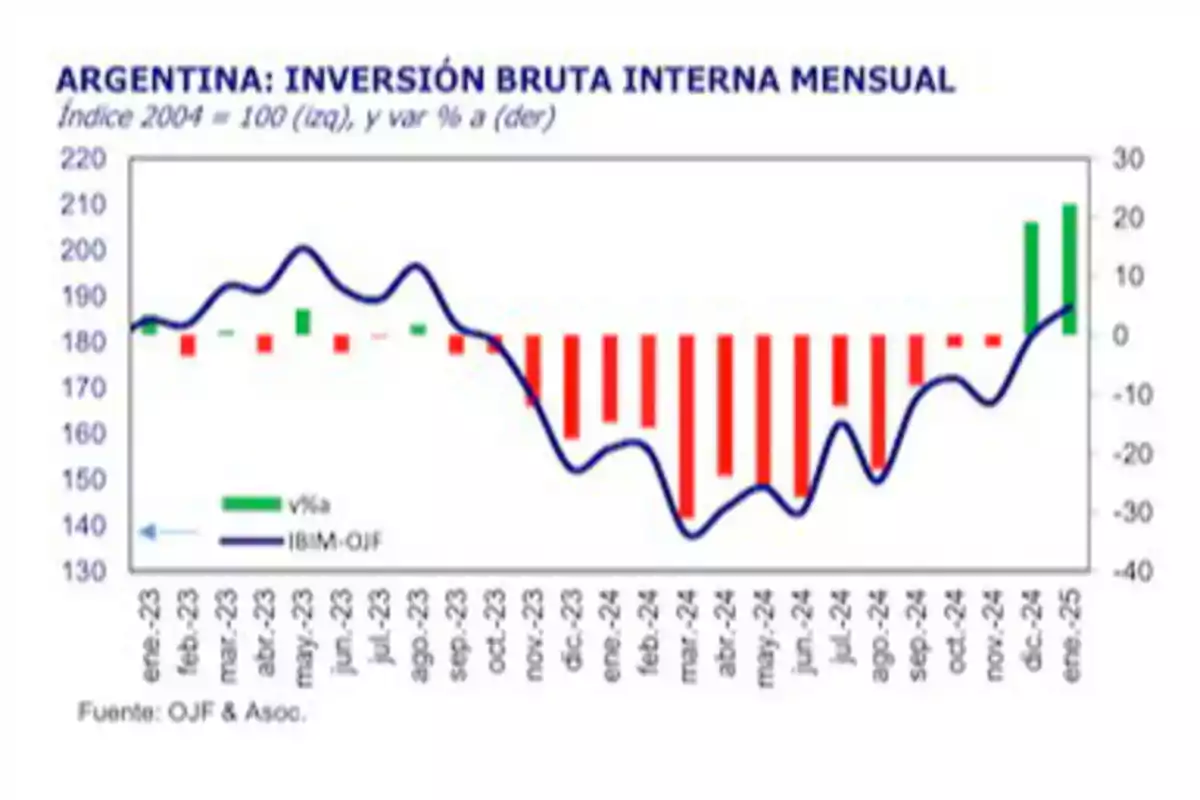

Meanwhile, as economic activity undergoes a strong recovery, the gross domestic investment experienced a 22.2% year-on-year growth in January, measured in physical volume, reaching a total of 7.529 billion dollars monthly. Importation continues to be the main source of investment income.

According to the consultancy OJF & Associates, in 2024, amid the economic crisis inherited from Kirchnerism, there had been a 13.7% drop, marking the lowest level since the pandemic.

On the other hand, investment in machinery and equipment showed in January a 41.9% increase, maintaining a high rate of expansion due to the importation of capital goods.

In this regard, the entry of machines and equipment from abroad increased by 60.6%, while investment in durable equipment of national production advanced 17.7%.

Regarding the construction sector, after 16 consecutive months of declines, investment in the sector grew again in year-on-year terms, with a 5.6% increase.

"Investment continues to regain ground. The bulk of the figure responds to the low comparison base, but investment levels have been gradually recovering from the low reached in March," detailed the report.

In the current scenario, "the main avenue for investment income is importation, largely driven by the perception of exchange rate lag. Looking ahead, we expect investment levels to remain high, also supported by an increase in private consumption," concluded the report.

It is also relevant to note that the flow of Foreign Direct Investment (FDI) reached USD 2.395 billion in the third quarter of 2024, according to data from the Central Bank. This figure represents a drop of about 64% compared to the same period of the previous year.

Despite this, ten projects entered the Incentive Regime for Large Investments (RIGI) for an amount exceeding USD 11 billion, with almost all funds directed to the energy and mining sector.

Strong economic recovery

It is important to highlight that this increase in gross investment occurs in a context of strong recovery of economic activity. For example, according to OJF & Associates, in January the economy expanded by 6.6% year-on-year and 0.1% compared to December.

"Among the sectors that stood out in the first month of the year were financial intermediation, mining and quarrying, and trade. We will continue to see large year-on-year growth figures in the first months of the year, supported by the favorable comparison, but we also expect a positive slope for the seasonally adjusted series," indicated the consultancy.

"The growth we expect is mainly based on the recovery we are already beginning to see in consumption, due to improvements in wages and credit to the private sector, although we also expect a positive impact from fewer regulations and lower tax pressure on the private sector, all in a context of slowing inflation and macroeconomic stability," it concluded.

More posts: