The Government removes tax barriers for direct sales from Tierra del Fuego

The measure aims to strengthen competitiveness, lower consumer prices, and reduce smuggling

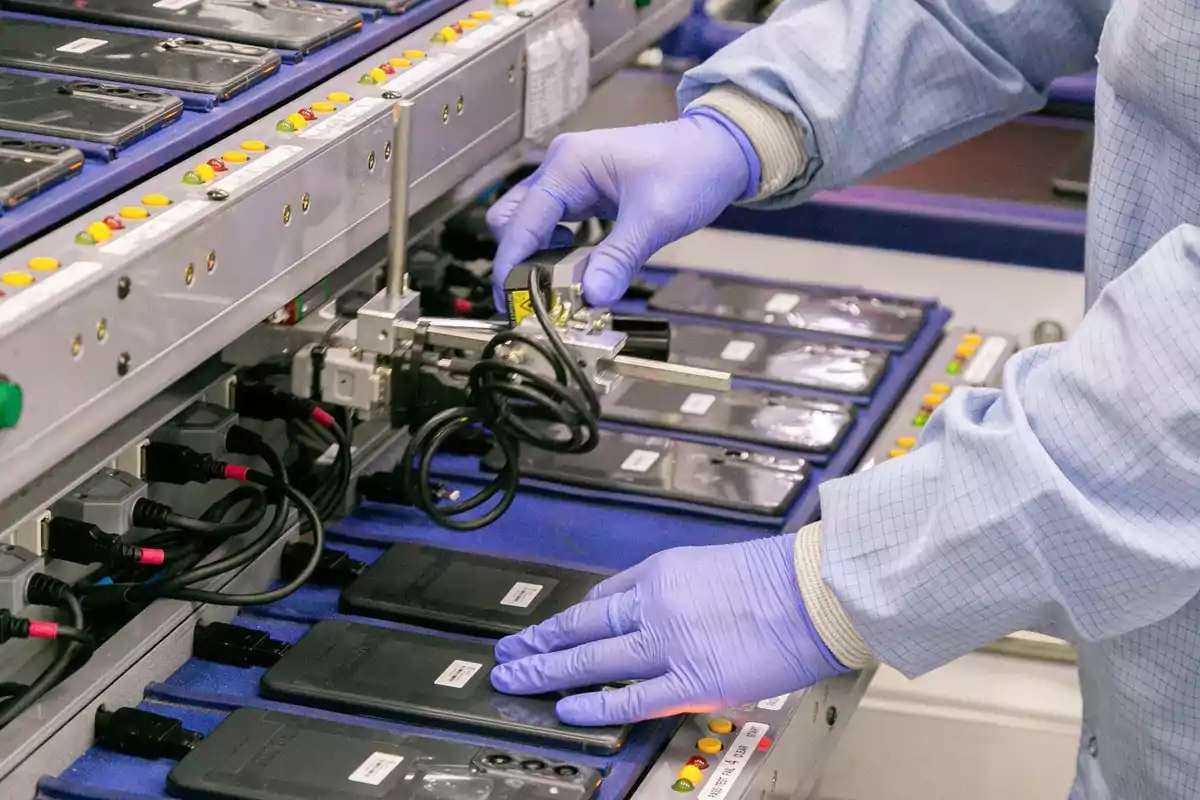

The national government has formalized the elimination of a fiscal limitation that prevented companies based in the Industrial Promotion Regime ofTierra del Fuego from generating tax credits for VAT and Income Tax on direct sales to end consumers.

The provision was published this Monday through Decree 535/2025 in the Official Gazette.

According to sources from the Secretariat of Commerce, this measure is part of "policies aimed at strengthening national production, increasing the supply of available goods and guaranteeing consumer access, all with a significant impact on the widespread reduction of prices".

Until now, companies that sold their products through third-party retailers retained the full VAT tax credit.

With the new regulation, in direct sales to the end consumer, they will be able to retain approximately 3%, in line with a staggered tariff reduction of 8% already implemented and another 8% that will take effect in January.

According to official estimates, these changes provide three additional points of competitiveness compared to a cumulative tariff reduction of 16 points, with the aim of favoring the direct channel and improving prices for the public.

From the Argentine Association of Electronics Terminal Factories (AFARTE), they emphasized that the measure eliminates "intermediations and extra costs" that reduced the competitiveness of products manufactured in the province. They also stressed that"this is a way to recover that lost competitiveness. Two things are sought: that companies in Tierra del Fuego can sell directly to the end consumer, but also that through retailers less is paid in advance and charged to the factories. Retailers will be a vehicle".

The decree complements the new regime for direct purchase from Tierradel Fuego, recently announced, which eliminates intermediaries and the payment of VAT. According to the sector, the combination of both measures will allow companies to recover part of the competitiveness lost due to the reduction of tariffs applied to imported cell phones.

Meanwhile, business sources emphasized that the incentive for direct sales could contribute to reducing smuggling. Currently, one out of every three cell phones circulating in the country comes from the informal market.

With more competitive prices, they project a rise in formal sales, which in turn would have a positive impact on tax collection.

This way, the government seeks to balance the impact of the gradual opening to imports with measures that strengthen national companies and improve competitive conditions in the domestic market.

More posts: