In a clear show of international confidence, the International Monetary Fund (IMF) approved a key review of the program agreed with Argentina, readjusting the requirements for international reserves and endorsing the economic direction led by President Javier Milei. The decision resulted in the immediate disbursement of USD 2 billion, after the organization acknowledged the "positive performance" of fiscal policy, the halt in monetary issuance, and concrete progress in reducing inflation.

The new agreement recognizes that, as of June 13, the net reserves of the Central Bank were USD 4.7 billion below the originally stipulated level, whose target was just USD 1.1 billion negative. Despite this noncompliance, the IMF granted a waiver in light of the "corrective measures implemented" and the "launch of a multifaceted reserve accumulation strategy".

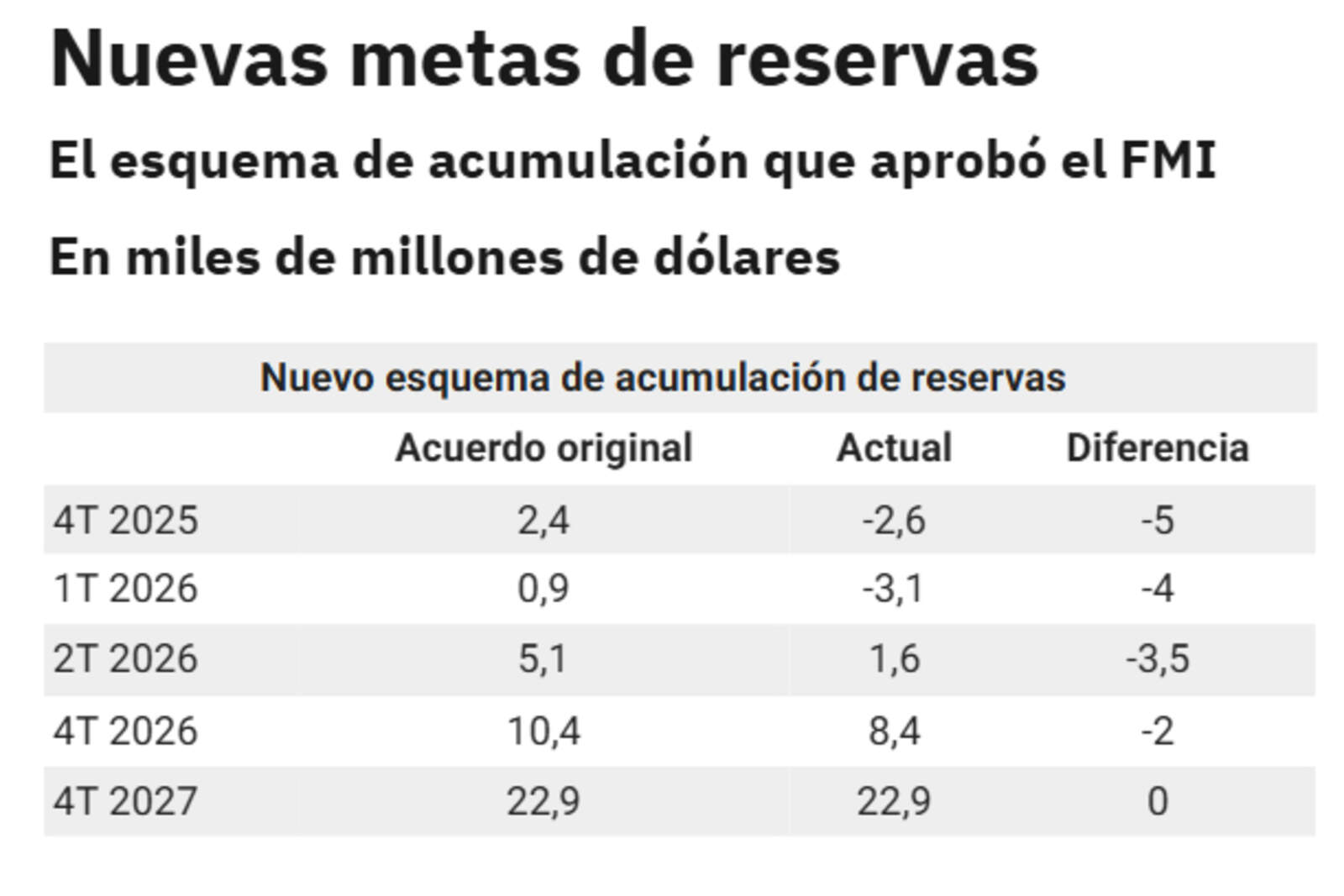

The technical document released by the IMF staff confirms a change in strategy that had already been anticipated by the Minister of Economy, Luis Caputo. "The USD 5 billion reduction in targets will be well received by the market", the official stated days ago amid exchange rate tensions. The new schedule postpones the organization's next review to January 2026, which provides greater predictability for the Government and immediately clears the financial outlook.

According to the new framework, the BCRA will no longer be required to reach USD 2.4 billion positive by the end of 2025, but the new floor will be USD 2.6 billion negative. By the end of 2026, the target is reduced by another USD 2 billion. Nevertheless, the target of USD 22.9 billion in positive net reserves by the end of 2027 remains, an ambitious goal that will coincide with the end of Milei's term.

In addition to the relaxation of targets, the Fund explicitly praised the Executive's fiscal approach, which achieved a primary surplus ahead of schedule, without Central Bank assistance and without neglecting the social safety net. "The program had a solid start and, overall, positive performance", officials in Washington stated.

The new measures to increase reserves include both the issuance of bonds and direct bulk currency purchases, which allowed an additional USD 2 billion to be added since early June. Looking ahead to the remainder of the year, the Fund expects the process to continue with the support of privatizations, asset sales, and concessions, along with the backing of official creditors.