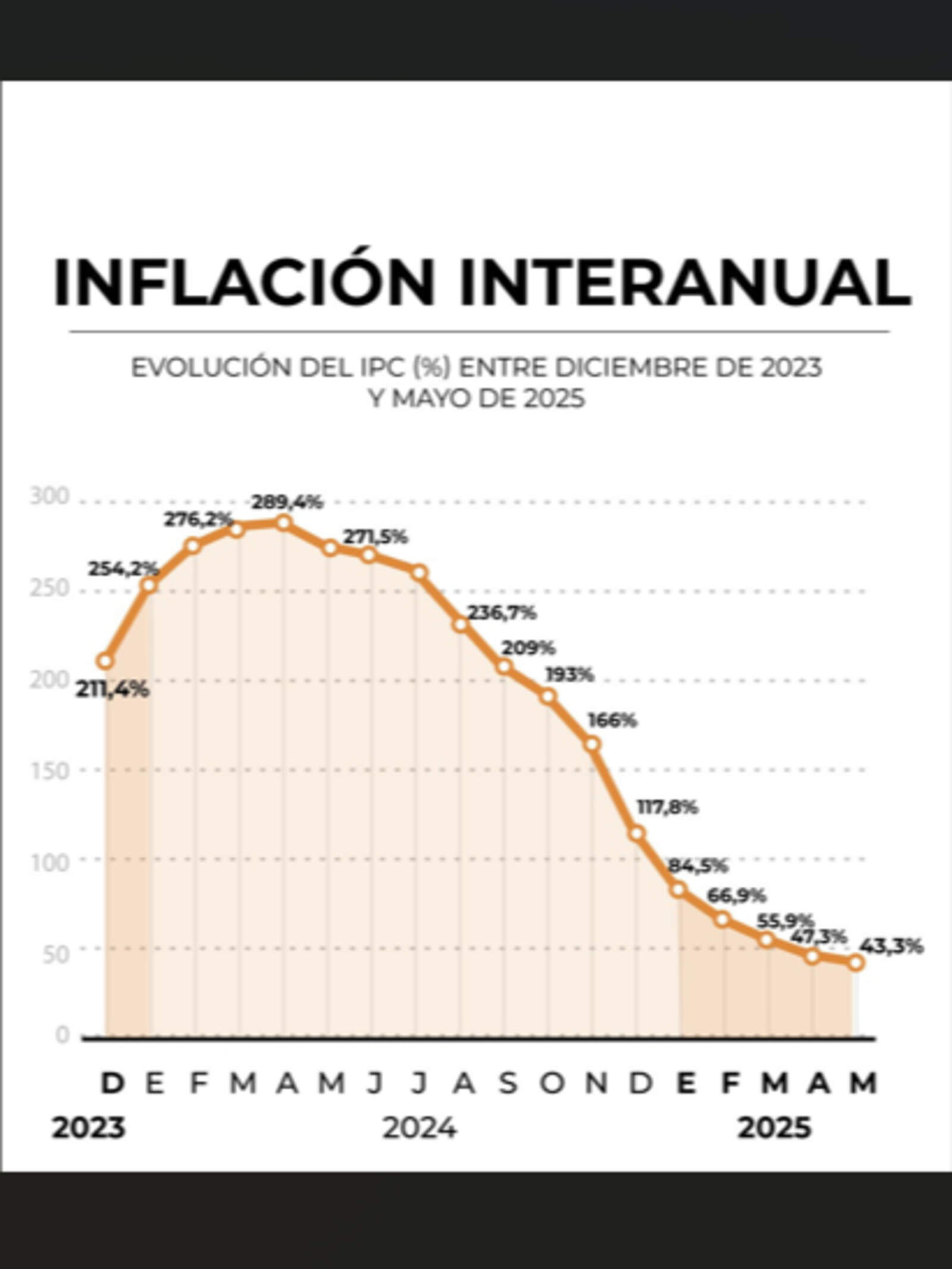

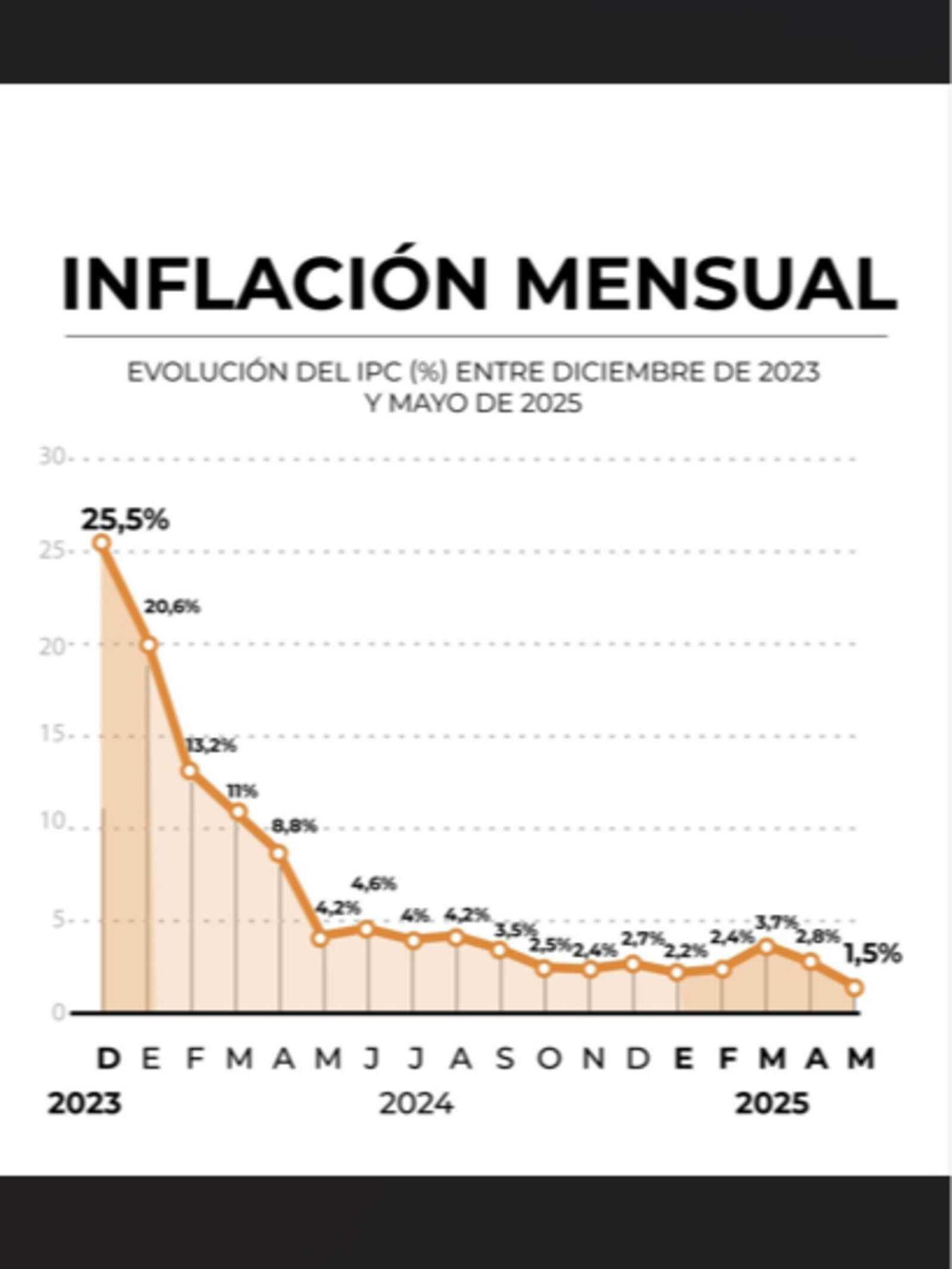

The economic turnaround promised by Javier Milei is materializing with concrete data. In May, the recorded inflation was 1.5%, the lowest rate in four years, according to INDEC. The figure not only exceeded the expectations of private consulting firms, which had forecast a slightly higher number, but also consolidated the disinflation path that the Government has been pursuing with determination since the beginning of its administration.

The May figure represents the lowest monthly increase of the Consumer Price Index (CPI) since May 2020. For analysts, the explanation goes beyond seasonality: it is a combination of consistent economic policy, fiscal discipline, and solid control of monetary issuance.

"The deceleration of inflation is no coincidence," stated Eugenio Marí, chief economist at the Fundación Libertad y Progreso. He justified: "It responds to two essential issues: the reduction of public spending to eliminate the fiscal deficit and the restoration of the Central Bank's balance sheet." In the same vein, Marí celebrated that BCRA no longer acts as the Treasury's financier, but instead focuses on providing Argentinians with a stable currency.

From C&T Consultores, its director Camilo Tiscornia highlighted that seasonal products fell by 2.7%, a drop mainly explained by fruits and vegetables. This phenomenon helped core inflation (excluding seasonal and regulated items) to be 2.2%, one point lower than in April and also the lowest since 2020.

Tiscornia attributed the success to a triple combination: a macroeconomy consistent with the disinflation objective, the drop in fuel prices, and the correction of previous increases in fresh food, in addition to the impact of the Hot Sale on consumption. However, he warned that June could show a slight increase: "Partial data from our survey for the GBA region suggest that this month's inflation will be higher than May's."

Meanwhile, Antonio Aracre also celebrated the news: "It was foreseeable. The fiscal anchor, no monetary issuance, and the free floating of the dollar at an almost cruising level of $1,200 allowed us to infer that the economic plan is very solid." He anticipated: "On Monday, wholesale prices could, for the first time, show a figure starting with zero, maybe 0.9. It is a symbol and a very important achievement for the Government and in record time."

The consulting firm LCG also highlighted the key role of the Food and Beverages sector, which went from increases of 5.9% in March, to 2.9% in April, and only 0.5% in May. They noted nominal drops of -1.7% in fruits and -9.8% in vegetables in GBA. This sector explained 0.7 percentage points of the moderation in the general index.