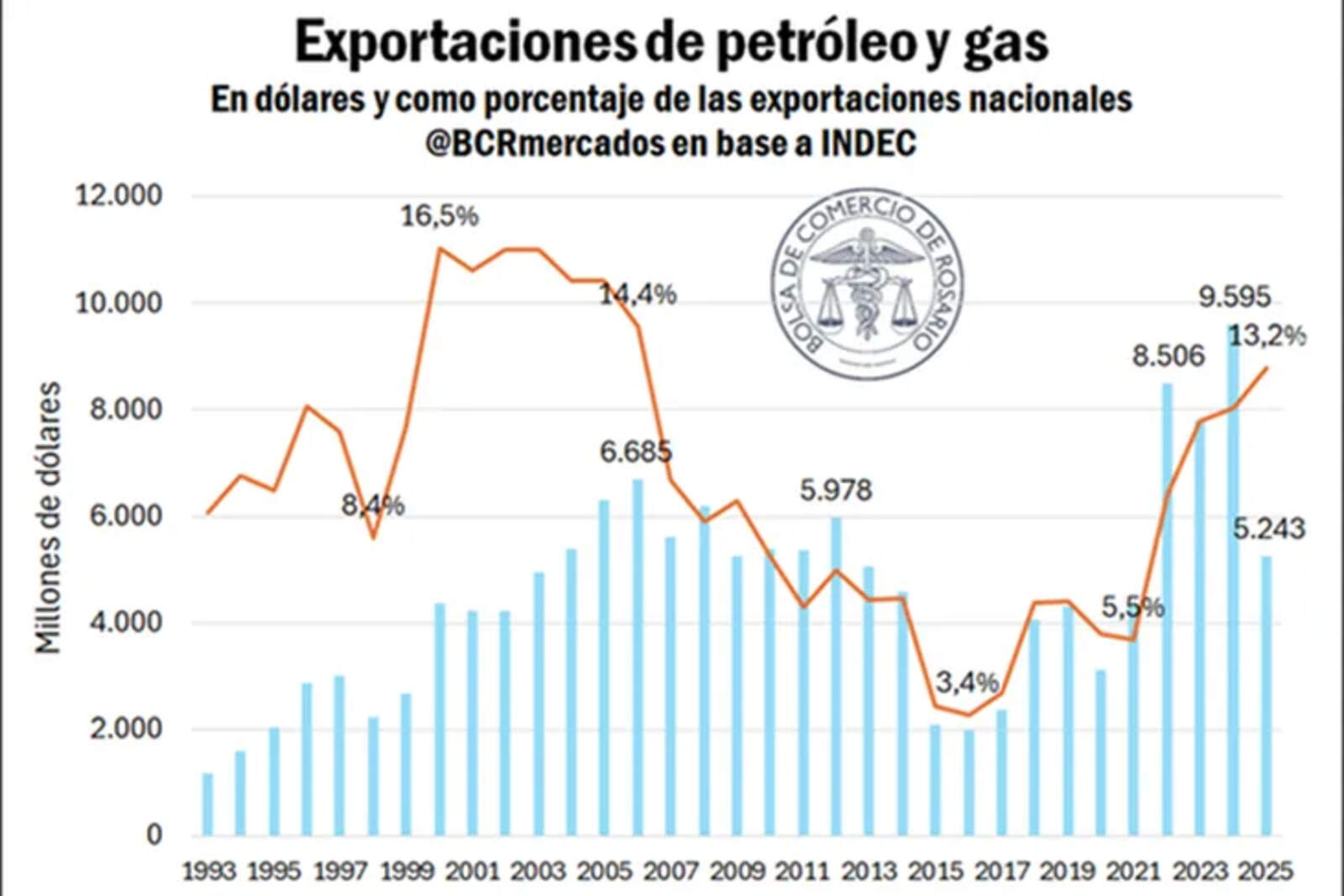

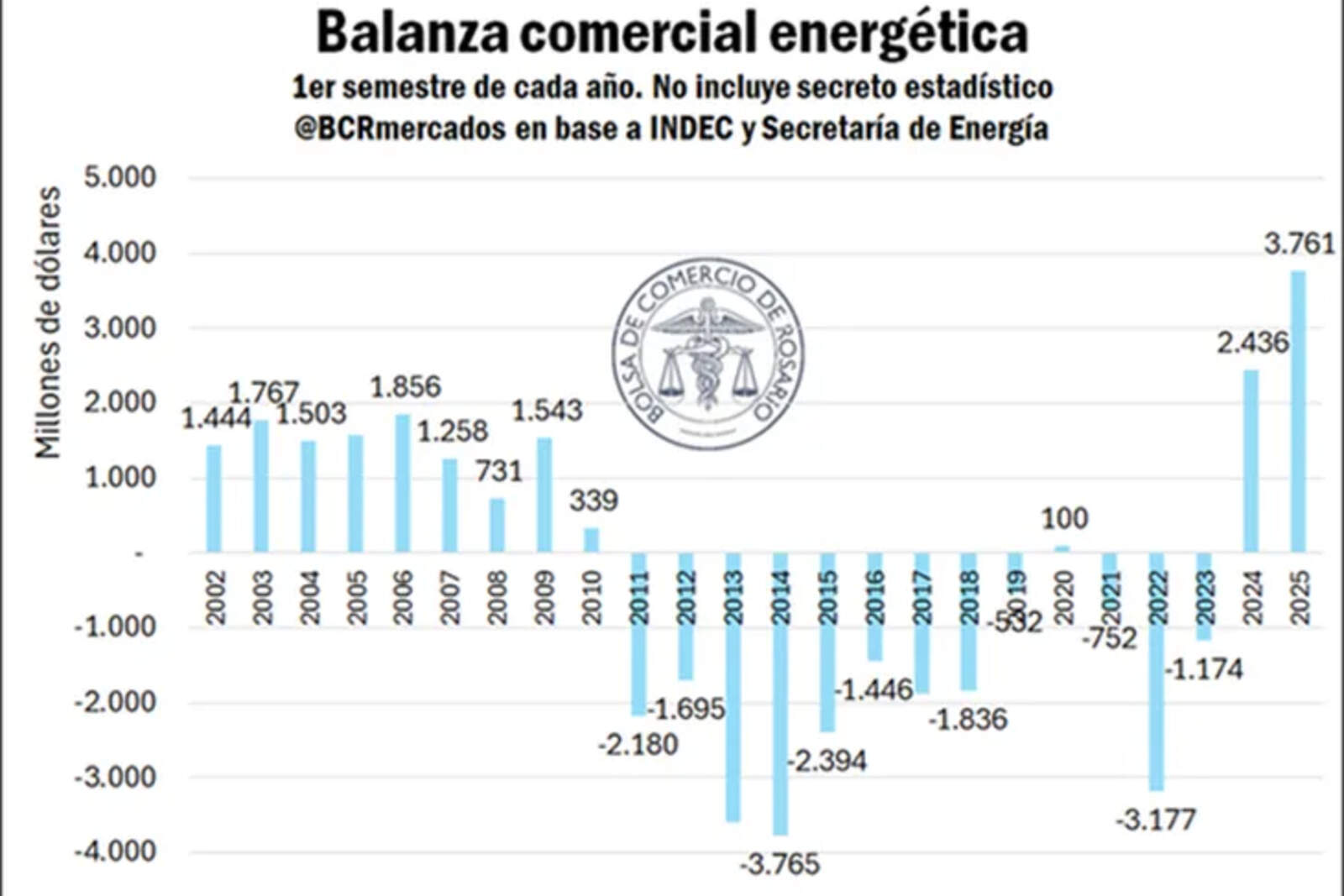

The Argentine energy transformation is accelerating under President Javier Milei's administration, and Vaca Muerta is emerging as the driving force behind a historic change. According to a report by the Rosario Stock Exchange (BCR), 2025 will mark the highest oil production of the century and an unprecedented record in the history of national gas, consolidating Argentina as a major energy player in the international market.

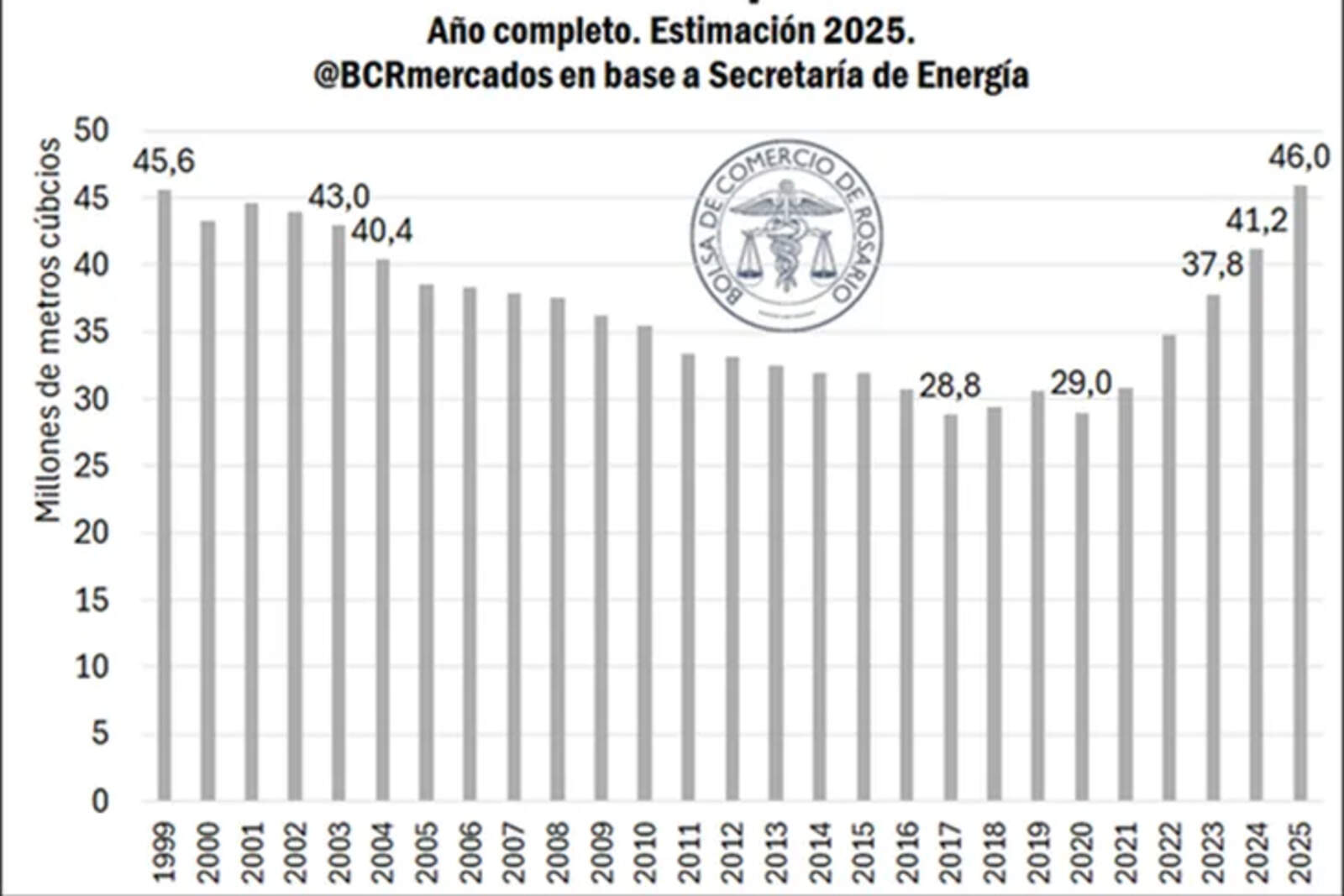

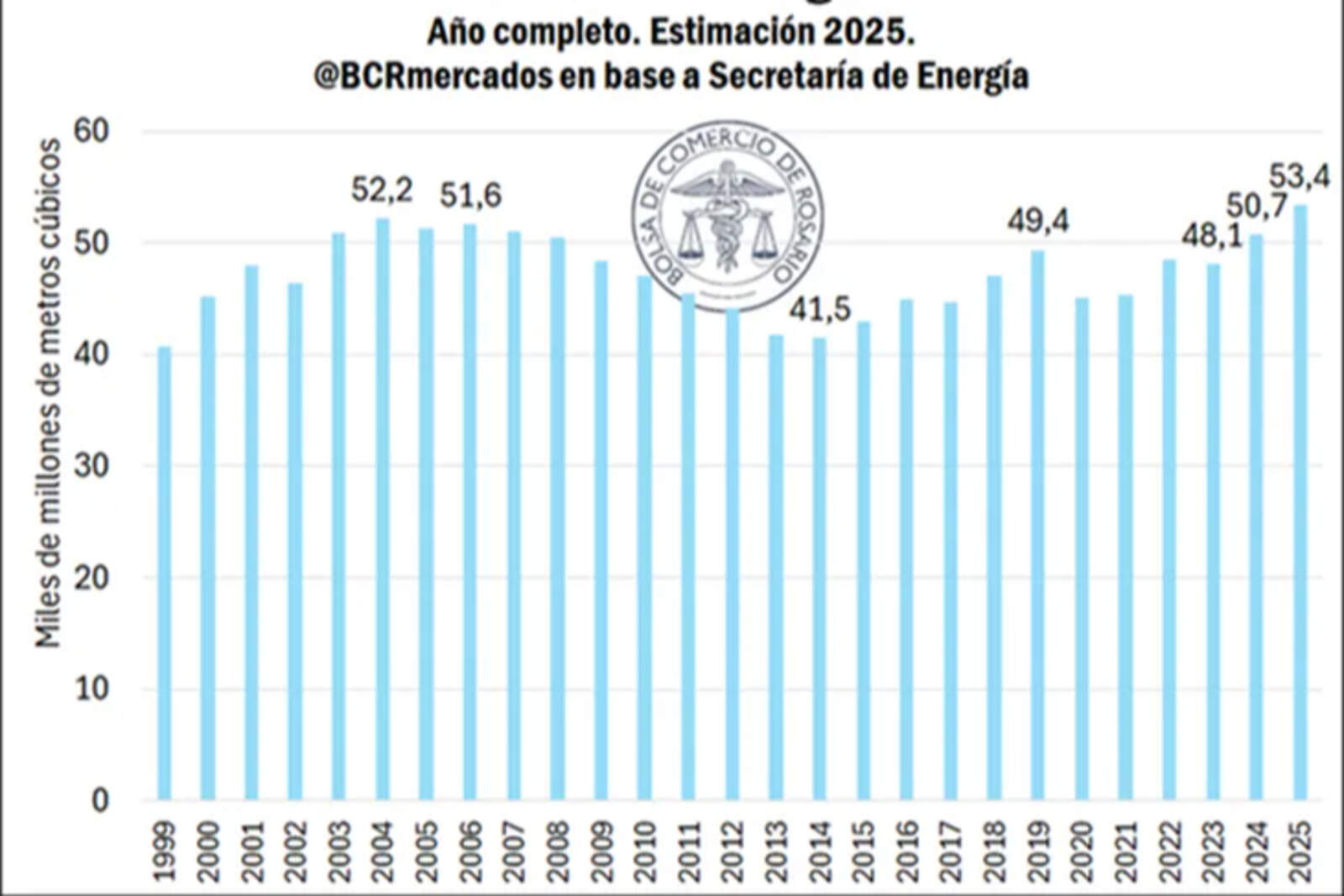

The data speak for themselves: between January and July of this year, oil production grew by 11% and gas production by 4% compared to 2024. "The rise of Vaca Muerta has brought with it a sharp increase in unconventional gas and oil production," emphasized researchers Guido D'Angelo and Emilce Terré, authors of the report.

The structural change is evident. While in 2015 unconventional oil accounted for less than 5% of the national total and in 2020 did not exceed 25%, so far in 2025 it already constitutes 60% of production. BCR projects that this year will reach "the highest oil production of the century, a peak since 1998 and the third highest ever recorded." At the same time, gas production is expected to be "the highest in Argentine history in 2025."

Infrastructure and exports

The production leap is not happening in a vacuum: new energy transportation projects and the opening of regional markets are accompanying the growth. The Perito Moreno Gas Pipeline (formerly GPNK) will allow for deeper supply to the province of Buenos Aires and the Central Region, while the reversal of the Northern Gas Pipeline will guarantee supply to Córdoba, Tucumán, La Rioja, Catamarca, Santiago del Estero, Salta, and Jujuy, later opening the door to exports to Bolivia and Brazil.