The resounding victory of kirchnerismo in Buenos Aires, where Fuerza Patria prevailed with 47.3% of the votes compared to 33.7% for La Libertad Avanza, shook local and international markets. The defeat of the ruling party in the country's main electoral district triggered a Monday marked in red: the S&P Merval plunged 13.3% in pesos and 16.2% in dollars, falling back to August 2023 levels and wiping out thirteen months of gains.

On Wall Street, Argentine ADRs plummeted as much as 24%. Banco Francés fell 24.4%, Supervielle 24%, Banco Macro 23.5%, and Grupo Galicia 23.6%. Even YPF lost 15.3%, dropping to USD 26.10, its lowest value since April. The abrupt capital outflow reflects, according to analysts, the distrust toward a possible return of kirchnerismo to national power in 2027.

Sovereign bonds under foreign law were not spared either: they tumbled as much as 10%, pushing the country risk above 1,100 points, the highest level since October 2023. "The market suffered a rather strong blow, both in bonds, stocks, and the dollar," summarized Puente's Research team.

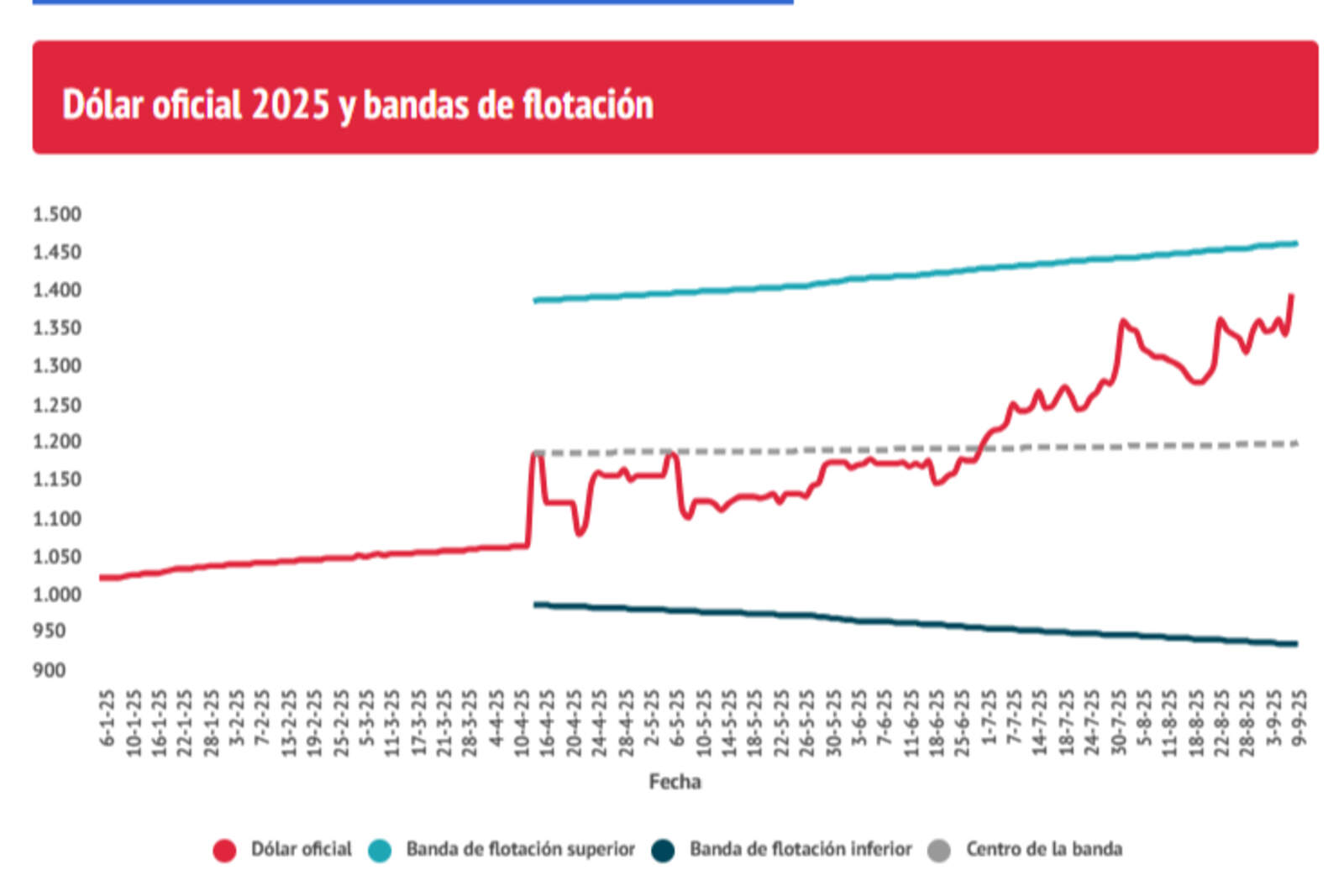

The official dollar closed at $1,425 at Banco Nación, after reaching a high of $1,460 during the session. The wholesale rate climbed 4% to $1,409, while the blue reached $1,385, with an intraday peak of $1,415. The MEP closed at $1,434 and the contado con liqui at $1,441, confirming pressure across all exchange rates.