Personal loans in virtual wallets: how to access them in August 2025

Fintech and virtual wallets offer personal loans in fixed installments, with no need for a bank or formal employment

In August, virtual wallets and fintechs allow access to personal loans with fixed installments, in pesos, and without the need for a traditional bank account. These options are useful for purchases, unexpected expenses, or personal investments.

The platforms adjust amounts, rates, and terms according to each user's financial history and behavior. Among the most notable options are Cuenta DNI, Mercado Pago, and Naranja X, according to a survey by TN.

Loans with Cuenta DNI

Available for users of the Cuenta DNI app. If the option doesn't appear, it can be requested from home banking. The amount and term depend on the applicant's credit profile.

- Limits: up to $50,000,000, maximum term 72 months, fixed annual rate 98%.

- Requirements: be over 18 years old, Cuenta DNI user, active relationship with Banco Provincia, accept digital contract.

- How to apply: enter the app → "Loans" → choose offer → accept contract → facial validation → credited within 24 hours.

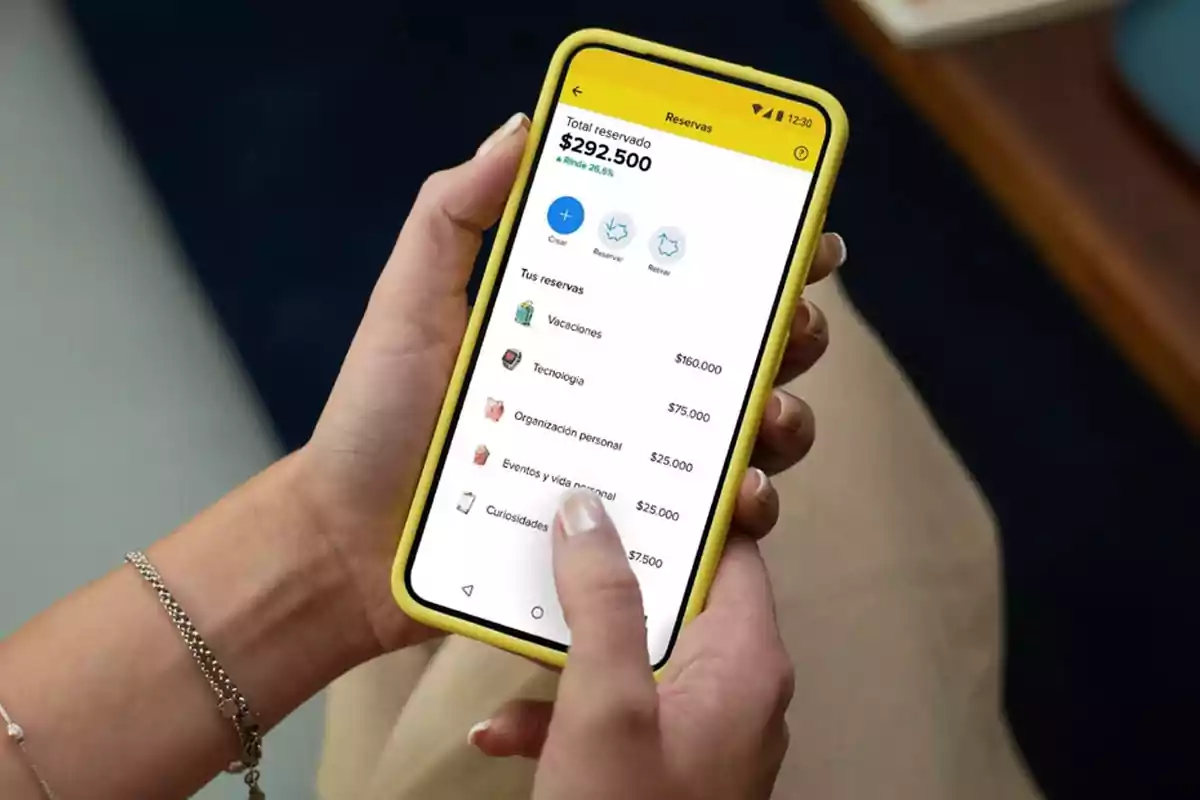

Loans in Mercado Pago

Ideal for personal or business projects, with fixed installments and no penalty for early repayment. Includes two modalities:

- Fixed Installment Loan: up to $92,000,000, up to 18 installments, automatic debit.

- Dinero Plus: short-term credit, automatic renewal, terms of 7, 14, 21, or 28 days, up to $10,000,000, immediate crediting.

Requirements: invoice more than $50,000 per month via Mercado Pago or Mercado Libre, positive payment history, and good reputation as a seller.

Loans for self-employed and freelancers in Naranja X

Intended for entrepreneurs and small businesses, with no in-person procedures. They allow customization of amount and term according to the profile.

- Limits: $10,000 minimum, up to $9,000,000 depending on profile, maximum term 30 months.

- Rates: nominal annual rate from 72%, effective annual rate from 101.22%, French amortization system.

- Requirements: Naranja X or Tarjeta Naranja client, active monotributo, no critical debts, facial verification in the app.

- How to apply: open app → "Request loan" → simulate amount and term → validation with selfie → confirm → immediate crediting or up to 48 hours.

More posts: