Salary account with interest: banks' move against virtual wallets

Banks seek to compete with fintech and are starting to pay interest for depositing salaries

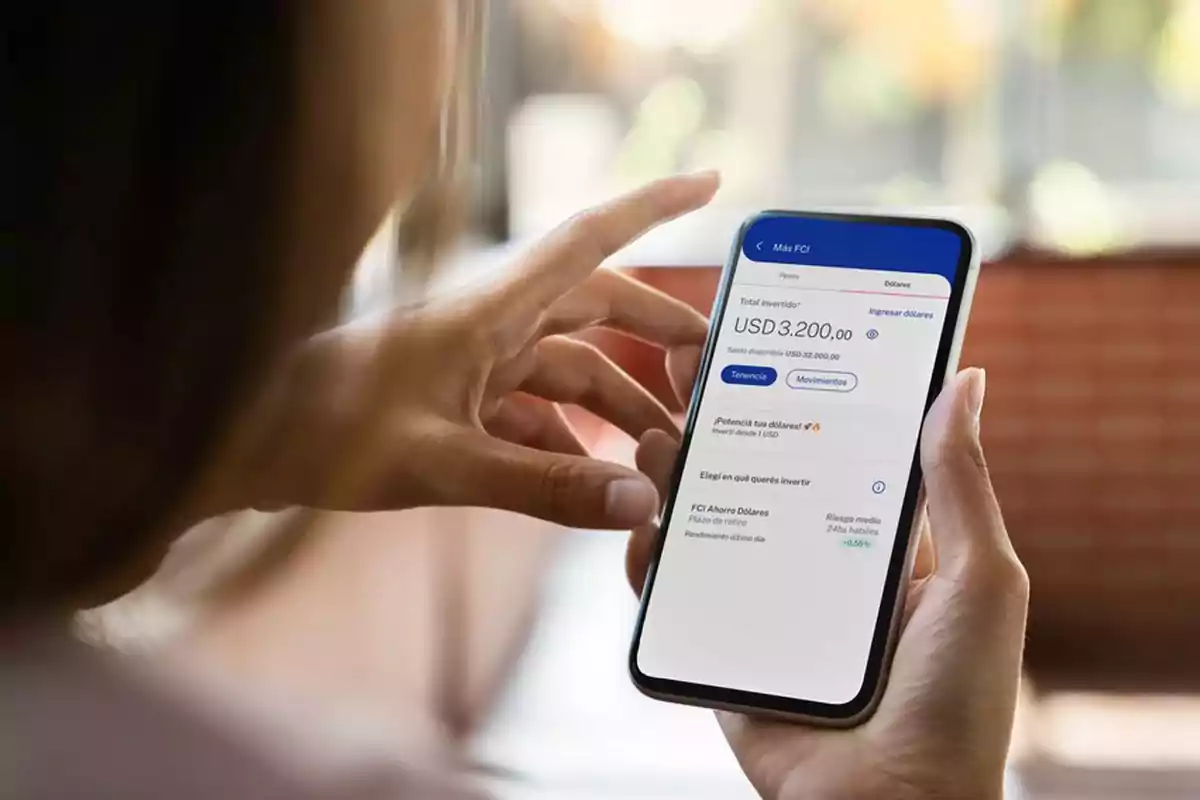

Supervielle launched a salary account that pays interest in pesos and dollars, marking a shift in the strategy of traditional banking.

The move aims to attract and retain customers in the face of pressure from virtual wallets and the increased demand for loans.

With fewer opportunities to turn to Central Bank debt and decreasing inflation, banks have returned to their classic function: intermediating between savings and credit. Loan demand has grown strongly, and institutions need more pesos to sustain it. This has led to rethinking how to attract deposits.

Direct competition with digital wallets

Fintechs like Ualá and its digital bank Uilo popularized remunerated accounts. With attractive rates and easy access to funds, they have become a tempting option for many users.

In this scenario, Supervielle replied with its new remunerated salary and SME account, both in pesos and dollars.

How much does Supervielle's account pay?

- 32% nominal annual rate in pesos up to $1,000,000

- 2% nominal annual rate in dollars without immobilizing funds

- 18% nominal annual rate in pesos for SMEs with more than $25 million

- 1.5% nominal annual rate in dollars for SME accounts

The key advantage is that the money remains available, unlike fixed-term deposits.

A strong bet to gain users

Currently, Supervielle has 200,000 salary accounts. Its goal is to triple them in two years. The idea is for new customers to also use other products: loans, investments, or cards.

"We want to be the first choice for our customers," explained the entity.

The perspective of specialists

For Javier Okseniuk (LCG), banks are trying to compete with fintechs without giving up liquidity: "Remunerating accounts is a way to adapt."

Guillermo Barbero (First Capital Group) summarized it this way: "Banks feel the pressure from wallets. Many users prefer to have their money where it yields every day."

More posts: