The management of the Kirchnerist Sergio Massa as the worst Minister of Economy in history left a disastrous legacy, not only due to the inheritance received by Javier Milei's government, but also because of the expansion of the currency swap with China, an agreement that today, amid the escalation of the trade war between the United States and China, jeopardizes the reserves of the Central Bank of the Argentine Republic (BCRA).

This mechanism, which reached an amount equivalent to USD 18.7 billion according to official data from 2023, was used for different purposes, such as strengthening gross reserves, facilitating import payments in yuan, or, during the electoral campaign, intervening in the dollar to try to cover up the economic disaster they were creating.

However, with this agreement, Massa and the Kirchnerist government of Alberto Fernández left the country exposed to a currency that could devalue amid global tensions, directly affecting Argentina's financial stability.

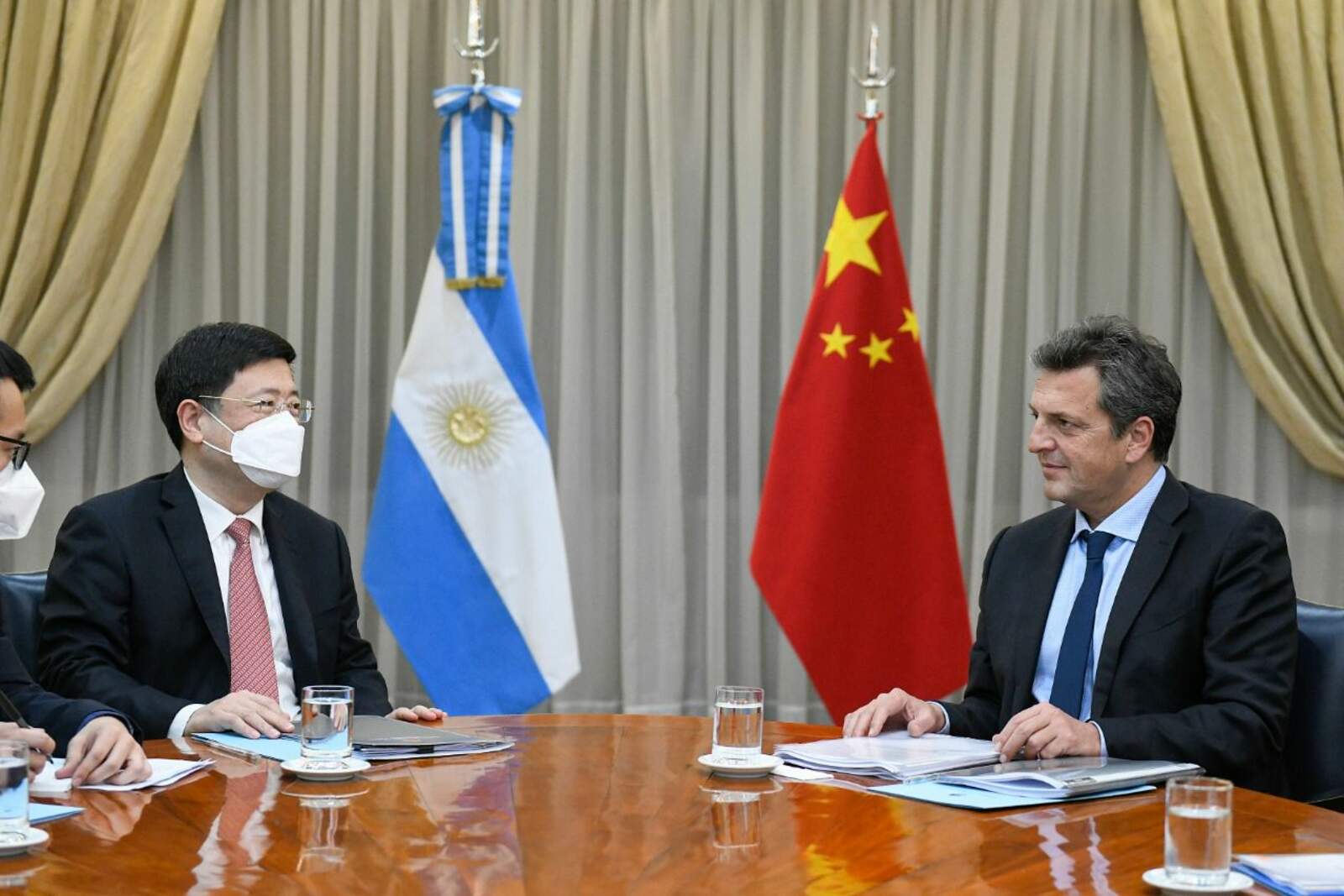

The swap with China, originally signed in 2009 and expanded under Massa in October 2023 by an additional USD 6.5 billion, allowed the BCRA to have yuan to avoid using scarce dollars. At that time, Massa highlighted that the agreement strengthened reserves in a context of drought and commitments with the IMF, which required USD 10.6 billion in payments for 2023.

According to the BCRA, a large part of the gross reserves are composed of the yuan from the swap, not liquid currencies. This "makeup" of the figures hides the fragility of Argentina's position against external risks.