Trump signed an executive order to establish a reserve in a popular cryptocurrency.

The President of the United States signed the executive order Thursday night, prior to a 'crypto' summit at the White House

On Thursday, the President of the United States, Donald Trump, signed an executive order to create a strategic Bitcoin reserve, using cryptocurrencies seized by the federal government in the context of criminal or civil asset forfeiture proceedings.

The measure, which was formalized a day before an important cryptocurrency summit at the White House, aims to establish a "digital Fort Knox" for Bitcoin, according to David Sacks, the Trump administration's cryptocurrency czar and billionaire entrepreneur.

This reserve will be capitalized exclusively with Bitcoin already owned by the government, without making new token purchases initially.

Trump's decision to create this reserve has sparked debate, as the measure doesn't contemplate the active purchase of new cryptocurrencies, leading some critics to label it as insufficient.

The cryptocurrency experienced a brief drop of more than 5%, falling from $90,000 to less than $85,000 after Sacks's announcement, who assured that the government would not sell the bitcoin deposited in the reserve, but would keep it as a store of value.

Although the idea of the reserve was received with great enthusiasm by sectors of the cryptocurrency industry, others saw it as a superficial initiative, as it doesn't involve new acquisitions, but rather the use of assets already in the government's hands.

Trump's proposal also includes the creation of a "digital asset warehouse" that will encompass cryptocurrencies other than Bitcoin.

However, Sacks clarified that these assets would only be obtained through forfeiture processes and no new assets would be added to the reserve, reinforcing the idea that the measure will not entail additional costs for taxpayers.

The executive order instructs the Departments of Treasury and Commerce to develop "budget-neutral strategies" for acquiring more bitcoin without incurring additional costs for taxpayers, a point that was a central concern for some in the crypto community.

The news of the creation of the Bitcoin reserve and the President's participation in the cryptocurrency summit, scheduled for Friday, has caused a mix of reactions in the sector, although the vast majority have been positive.

While some consider the measure a positive step toward the legitimization of cryptocurrencies in the governmental sphere, others point out that it lacks a clear strategic purpose.

Some critics within the crypto community argue that cryptocurrency reserves do not have tangible value comparable to gold or oil, and that Bitcoin, in particular, is a volatile asset that should not be used as a strategic government reserve.

This shift in stance by Trump, who previously labeled cryptocurrencies as a "scam," underscores his pivot toward supporting the crypto sector. During his campaign, Trump promised to make the United States the "world capital of cryptocurrencies."

Additionally, he has appointed several cryptocurrency advocates to positions in his cabinet and has formed a presidential task force on digital asset markets within the White House.

The signing of the executive order comes at a time of increasing pressure for the United States government to develop clearer and more crypto-friendly policies.

The crypto market has experienced a significant rebound after Trump's reelection, with Bitcoin prices reaching record levels. However, this momentum cooled somewhat in the following months, although it continues to react quickly to any relevant action or comment coming from Washington.

The cryptocurrency summit to be held at the White House is considered a milestone in the crypto industry's effort to be taken seriously by U.S. lawmakers.

The U.S. government owns an estimated 200,000 bitcoins seized over the years, although a full audit has not been conducted to confirm this figure. Sacks mentioned that the premature sale of these assets has cost U.S. taxpayers $17 billion.

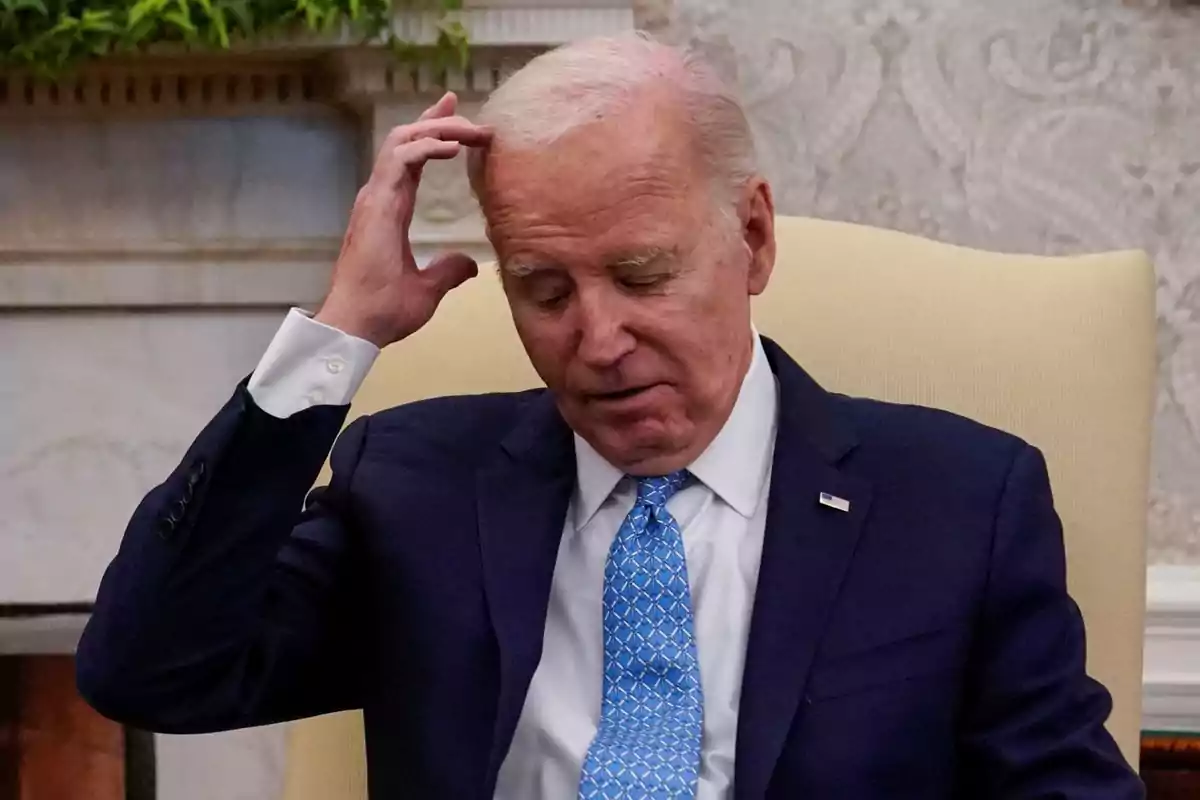

This fact highlights the potential cost of not having properly managed the seized cryptocurrencies during the Biden administration, underscoring the importance of the new strategic reserve.

More posts: