Price slowdown: March wholesale inflation closed at 1.5%

Wholesale prices drop and confirm the direction of Javier Milei's plan

INDEC published the report corresponding to the Wholesale Price Index System for March 2025, confirming a marked inflationary slowdown in the Argentine economy, in line with the objectives of Javier Milei's government.

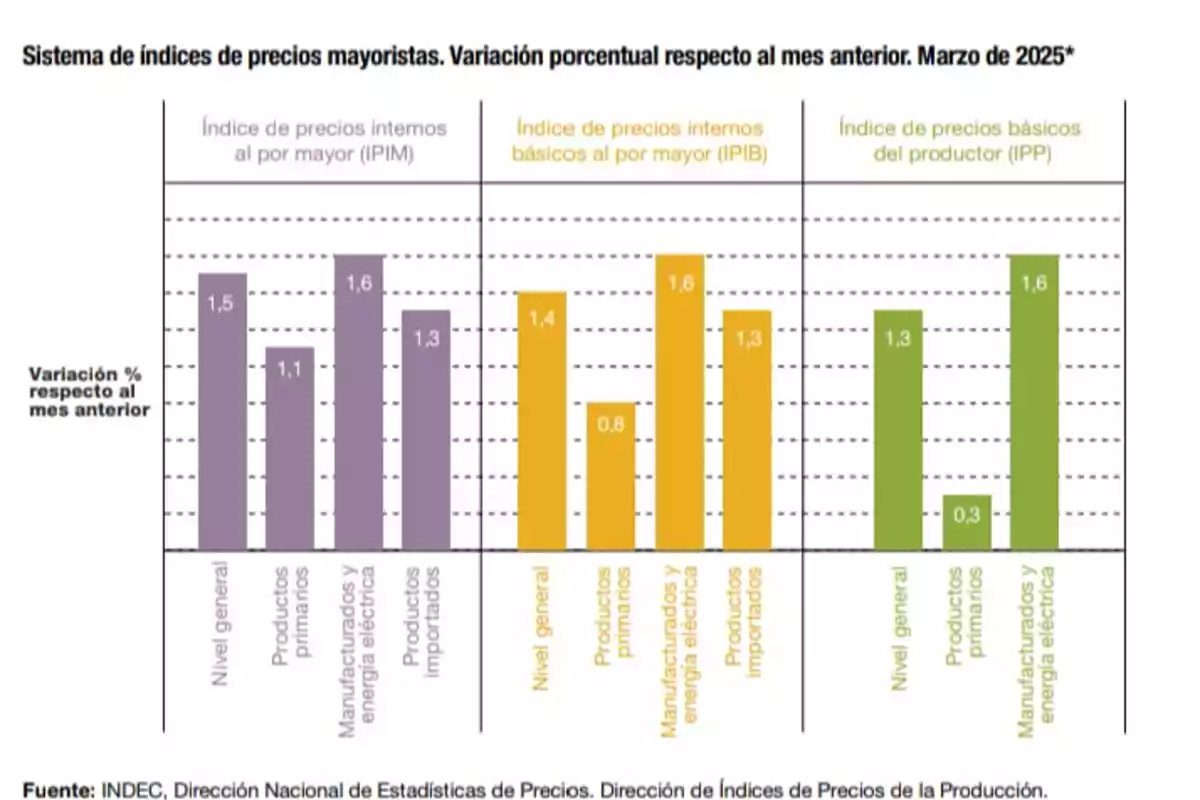

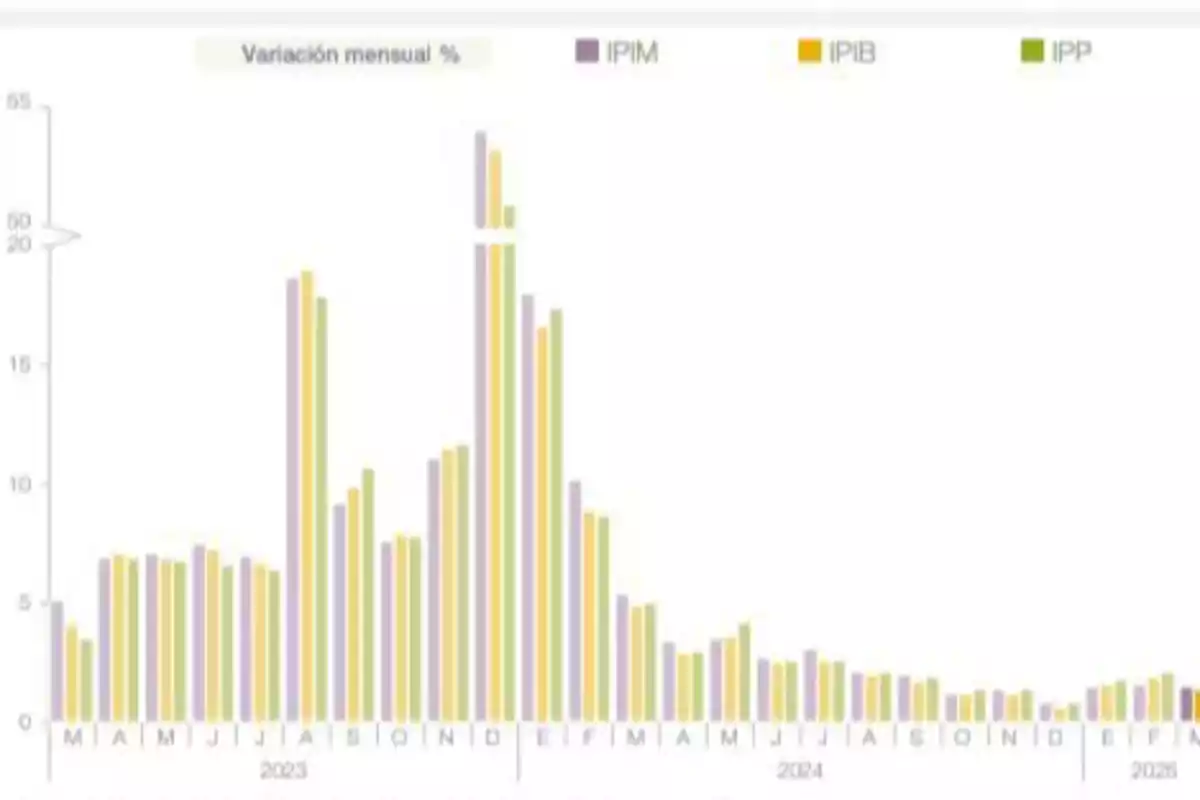

In monthly terms, the Internal Wholesale Price Index (IPIM) recorded a variation of 1.5%, the Basic Internal Wholesale Price Index (IPIB) 1.4%, and the Basic Producer Price Index (IPP) 1.3%. These are the lowest figures since the inflationary peak caused by Massa in December 2023, when monthly records exceeded 54%.

The data is relevant in the context of the libertarian economic program, based on public spending adjustment, elimination of the primary fiscal deficit, and strong monetary restriction. The combination of these measures has managed to contain the inertial and monetary component of inflation.

In year-on-year terms, the IPIM stood at 27.7%, the IPIB at 25.7%, and the IPP at 28.1%. This implies a significant slowdown compared to the records three months ago, which exceeded 100% annually. Particularly, the prices of domestic products varied by 30.6% year-on-year in the IPIM, while imported ones did so by just 18.2%, reflecting the effect of the exchange rate anchor and the normalization of foreign trade.

Sectors with moderate increases and relative price correction

Among the sectors, moderate increases stand out in food and beverages (2.7%), textile products (1.9%), and electricity (1.7%). On the other hand, there are declines in fishery products (-2.3%) and medical equipment and measuring instruments (-0.5%). These sectoral movements respond, in part, to the recomposition of relative prices after years of distortions and controls.

The manufactured products component showed a monthly variation of 1.6% in both the IPIM and the IPIB and IPP, which shows homogeneity in the deceleration process at the industrial level. The increase in refined petroleum (2.6%) and in printing and recording (3.3%) contrasts with the stability in other areas such as leather and footwear (0.3%) and electrical machinery (-0.5%).

The report also includes a graphic analysis showing the strong monthly slowdown since the peak recorded between December 2023 and January 2024. Since then,the three indices have been converging to levels close to 1%, a direct result of the contractionary monetary policy implemented by the Central Bank and the elimination of monetary financing to the Treasury.

Construction sector indicators: moderate slowdown and price readjustment

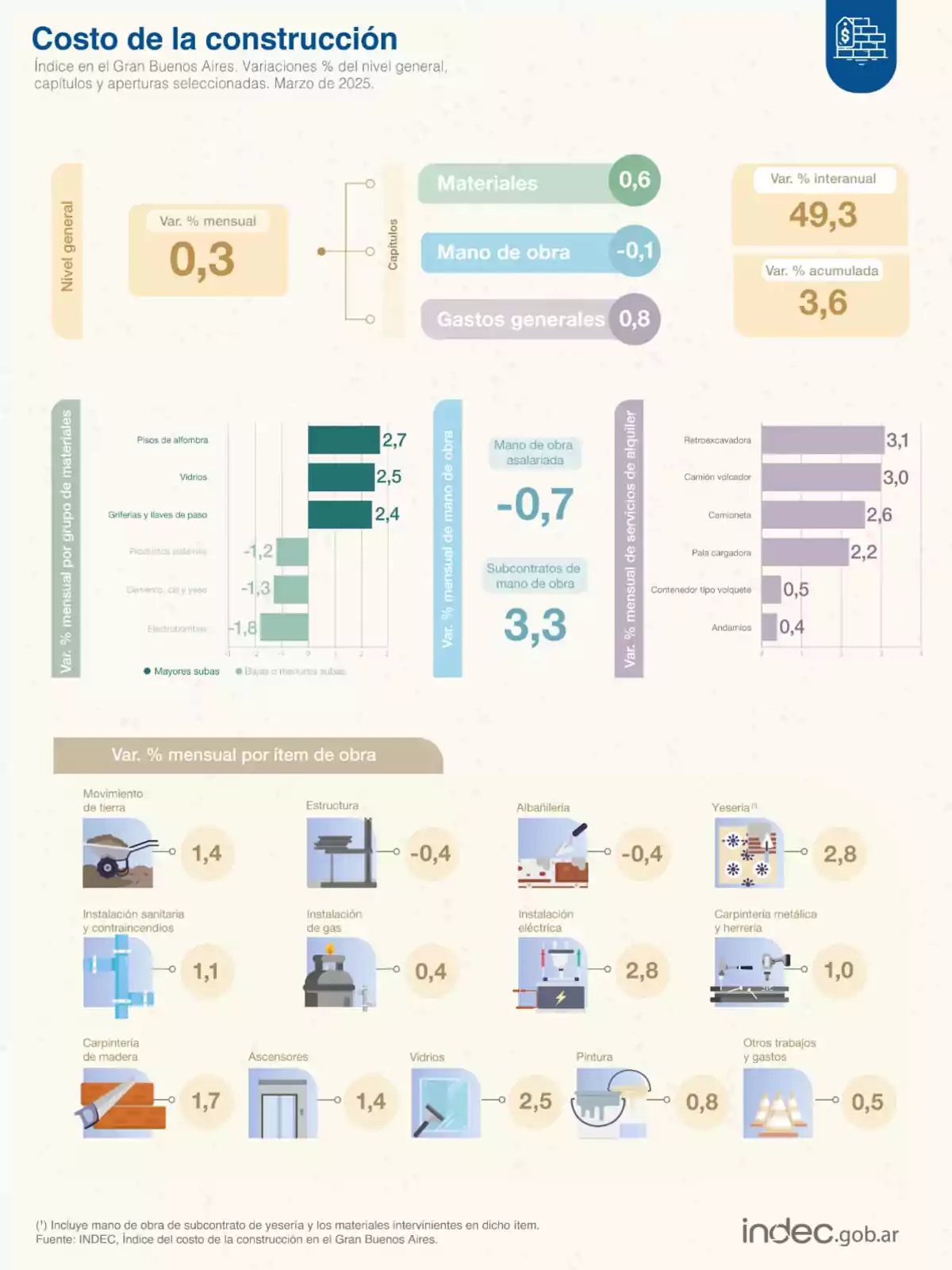

In line with the slowdown in wholesale prices, the construction cost index in Greater Buenos Aires, also published by INDEC for March 2025, shows a monthly variation of 0.3%, consolidating the trend of inflationary slowdown driven by the government's economic plan.

Breaking down by components, materials increased by 0.6%, labor fell slightly by 0.1%, and general expenses rose by 0.8%. In year-on-year terms, the accumulated increase was 49.3%, with a rise of 3.6% so far this year. This combination shows significant containment compared to previous months.

The most notable increases within materials were in floors and carpets (2.7%) and glass (2.5%), while there were decreases in metal products (-1.8%) and cement and lime (-1.3%). Meanwhile, the equipment rental services sector showed moderate increases, with the backhoe (3.1%) and dump truck (3.0%) leading the way.

These data reflect not only the slowdown in the inflationary pace but also an incipient correction of relative prices within the sector, consistent with the general diagnosis of the Argentine economy. As with wholesale prices, the construction cost shows signs of stabilization and a gradual readjustment of its components, driven by the fiscal and monetary discipline policy of the current government.

More posts: