YPF leads a key financing of USD 1.7 billion to expand Vaca Muerta

The energy sector seeks to strengthen the VMOS project, which aims to double crude export capacity from 2027

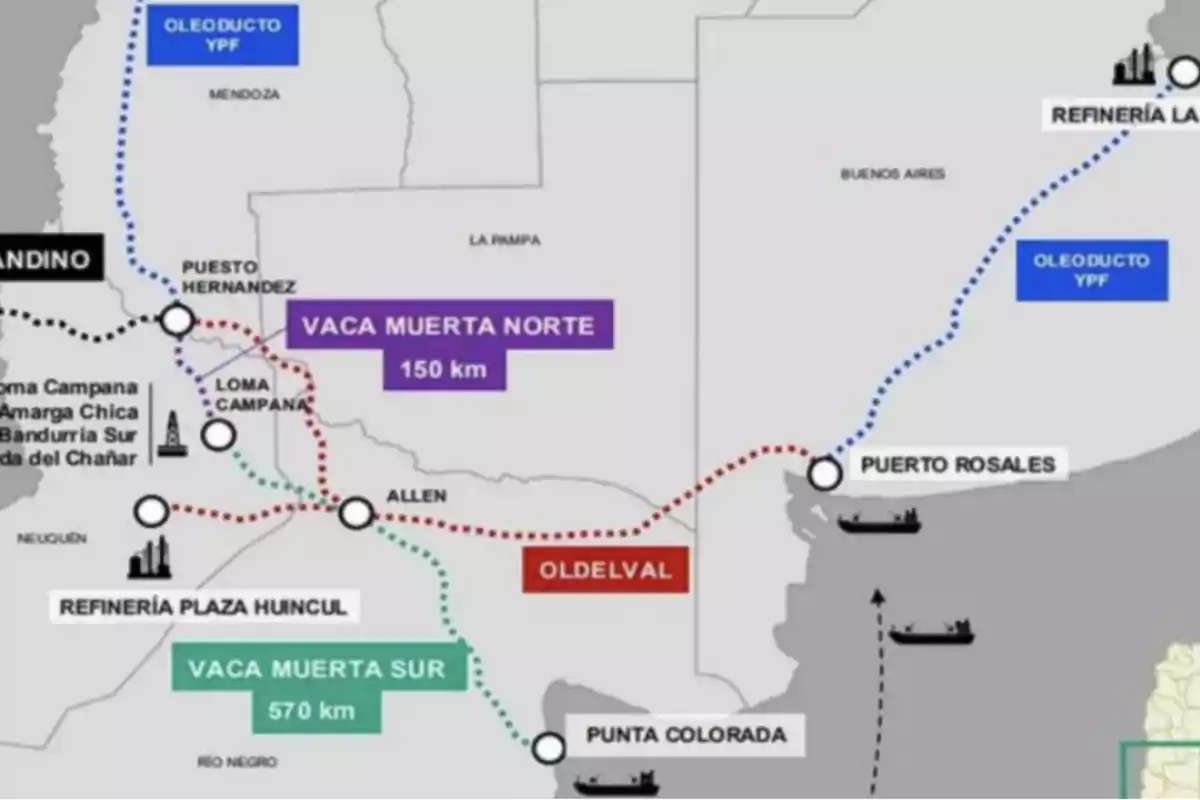

YPF and a group of the country's main oil companies are finalizing the details to secure a syndicated loan of USD 1.7 billion over five years with global financial entities. The goal is to finance a substantial part of the Vaca Muerta Oil Sur (VMOS) megaproject, which includes the construction of a 267-mile (430-kilometer) pipeline between Neuquén and Río Negro.

YPF's Chief Financial Officer, Federico Barroetaveña, confirmed the operation at the Annual Congress of the Argentine Institute of Finance (IAEF). The executive detailed that the total estimated investment is USD 3 billion, of which 70% will be financed with debt and the remaining 30% with own funds.

International loan and local issuances

"We seek to close a syndicated loan of USD 1.7 billion over five years with top-tier international banks. It's a milestone because there hasn't been financing of this type for real economy investments in Argentine companies for many years," stated Barroetaveña.

The banks involved in the operation are Citi, JP Morgan, Deutsche Bank, Itaú, and Santander. According to market sources, the final rate of the loan is still under discussion, but it will be structured based on the SOFR index plus a competitive spread.

Additionally, the consortium plans to issue USD 400 million in Negotiable Obligations (ON) in the local market. "It's a well-accepted instrument because YPF has never defaulted, we have a solid growth plan, we offer a good rate, and it's more profitable than keeping money under the mattress," added the CFO of the state oil company.

A strategic project for the Argentine economy

The project has already been included by Javier Milei's government in the Incentive Regime for Large Investments (RIGI), which grants tax and exchange benefits. According to YPF, construction began in January, and contractors are already being mobilized, earthworks are being carried out, and pipes are being delivered.

The VMOS pipeline will allow the transport of up to 550,000 barrels of oil per day from 2027, with the possibility of scaling up to 700,000 barrels. Its design will facilitate competitive exports to Asia through connection with VLCC vessels, thus reducing logistical costs.

Export potential and relief to the external front

The projected impact is significant: by 2028, Argentina is expected to achieve oil exports of USD 15 billion annually. Additionally, VMOS could consolidate Vaca Muerta as one of the main energy platforms in the southern hemisphere.

Horacio Marín, president of YPF, projected that by 2031 the country could reach combined exports of USD 30 billion annually between oil and LNG. "It's a contribution equivalent to what the agricultural sector generates in a good year, and it can be a structural solution to the dollar deficit," he stated.

More posts: