CDMX government offered 'free sex' in LGBT workshop poster for teenagers

The capital government's PILARES program promoted a course on gender and eroticism aimed at young people

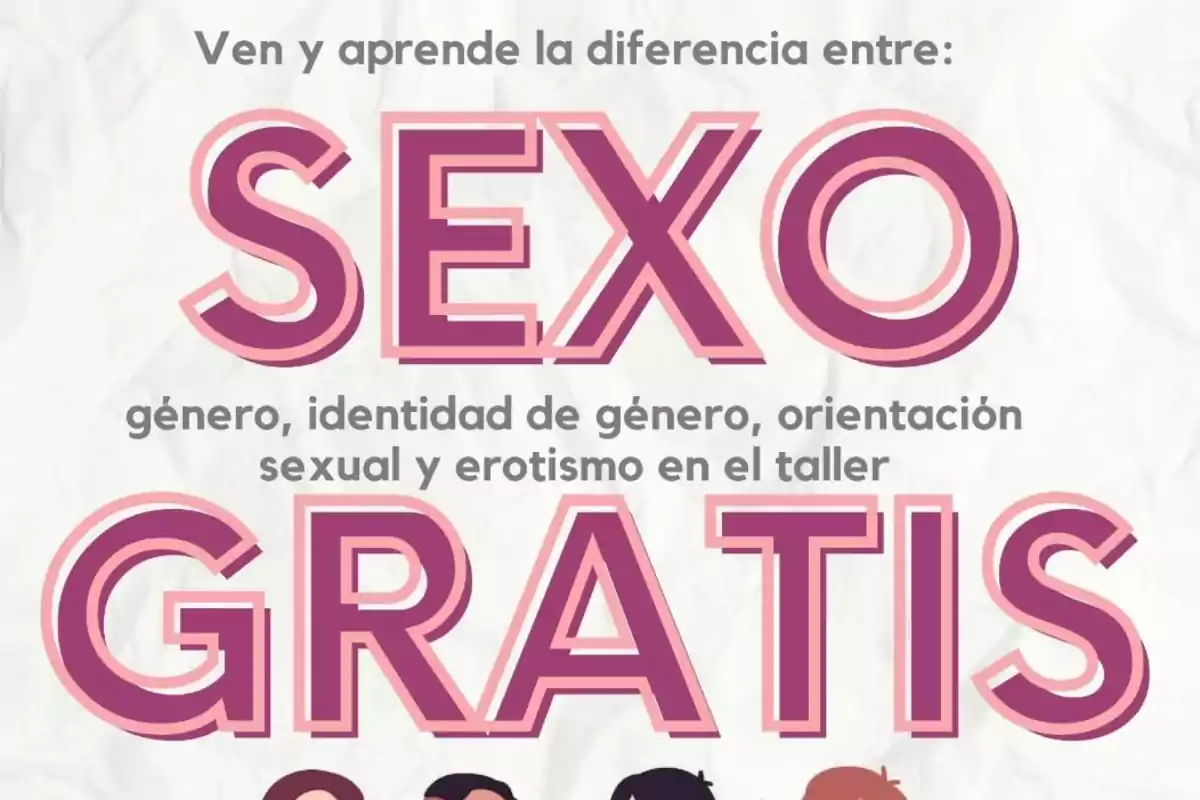

A new controversy erupted in Mexico City over an official poster for the PILARES program. It announces a workshop for teenagers with the provocative title "FREE SEX". The activity is aimed at young people from 13 years old.

Sex education or disguised indoctrination?

The event is organized by the PILARES Colosio center, located in Iztapalapaa. It includes topics such as gender, self-perceived identity, sexual orientation, and eroticism. Parents and citizens questioned the language used.

The poster features striking typography and a design that many consider provocative. The visual message seems taken from an erotic campaign, not an educational program. Several parents expressed their displeasure on social media.

The criticisms accuse the capital government of promoting ideology instead of scientific education. Transparency is demanded regarding the actual contents of the workshop. Some citizens are calling for its cancellation.

An ideological workshop disguised as "emotional skills"

According to the call, the workshop is part of the "emotional skills" axis. But the content addresses differences between biological sex and gender identity. The topic of eroticism is also covered.

The activity doesn't require parental authorization. That has increased the controversy. Parents and specialists denounce the lack of filters. It involves minors from 13 years old.

The language is ambiguous and not very educational. Instead of educating, it confuses and provokes. Concepts are disseminated without a clear pedagogical framework or respect for the family environment.

Criticism of Claudia Sheinbaum and Morena's progressive agenda

The capital faces serious problems. Insecurity, water shortages, traffic chaos, and poverty. But the government of Claudia Sheinbaum allocates resources to promote its gender agenda.

Morena doesn't educate, it imposes discourses. Many parents do not share these narratives. Discontent grows while the real priorities remain unsolved.

Real education is in crisis, but there are funds for indoctrination

Thousands of schools lack materials, infrastructure, and real prevention programs. But there is a budget to print posters with the message "free sex". They are promoted through official channels.

Public education has been displaced by activism. The State turns children into ideological targets. The government promotes this line without social consensus. Meanwhile, it ignores the country's real needs.

More posts: