ARCA sets how much money can be transferred without issues in September

ARCA established new limits for transfers in September 2025 and may require documentation from taxpayers

The Revenue Collection and Customs Control Agency (ARCA), formerly known as AFIP, set new thresholds to monitor banking transactions during September 2025. Taxpayers who exceed those amounts fall under the agency's radar.

The measure aims to strengthen the traceability of funds and prevent irregular maneuvers. Both individuals and legal entities must take the limits into account to avoid being exposed to audits.

What current amounts does ARCA monitor?

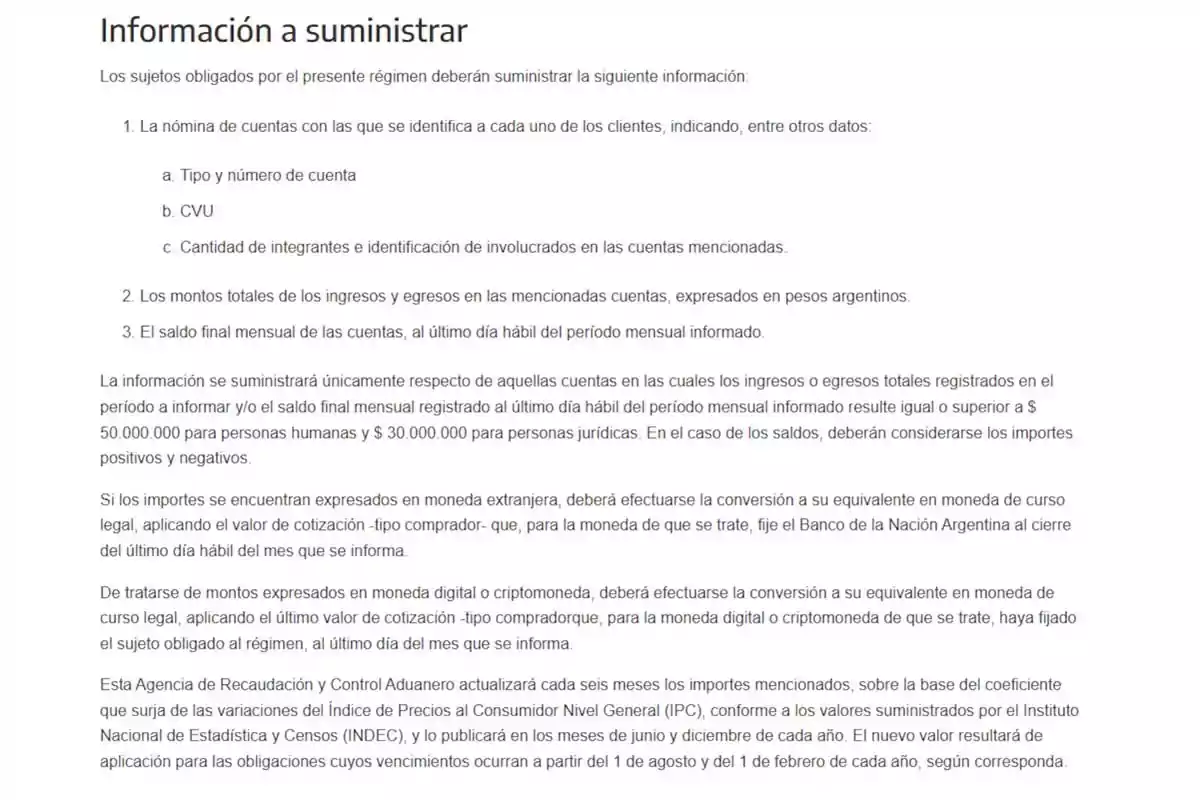

During September 2025, ARCA may conduct checks on those who record a monthly balance equal to or greater than:

- $50,000,000 in the case of individuals.

- $30,000,000 in the case of legal entities.

If the funds are in foreign currency, they must be converted to pesos using the buyer's exchange rate from Banco Nación at the end of the period.

What documentation can ARCA require?

If the established amounts are exceeded, the agency is authorized to request supporting documentation that justifies the transactions. The main requirements include:

- Purchase and sale receipts.

- Documents regarding share transfers or company sales.

- Pay stubs or proof of pension income.

- Invoices for the last few months.

- Certificate of registration in the simplified tax regime.

- Fund report issued by a certified public accountant.

More posts: