On April 4, 2025, China announced restrictions on the export of rare earth elements as part of a response to the tariffs imposed by the President of the United States, Donald Trump, which increases trade tensions between the two largest economies in the world.

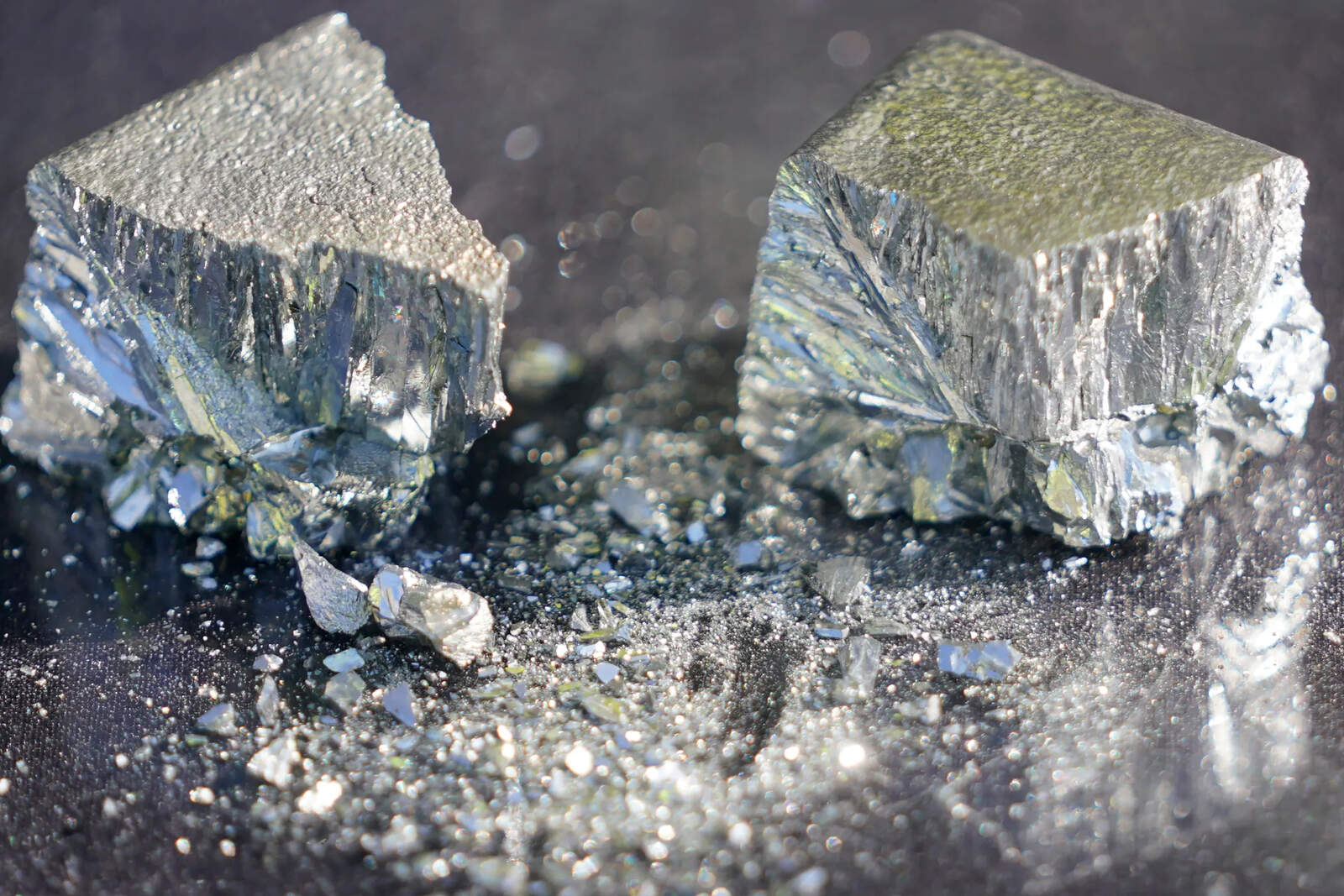

These restrictions mainly affect seven critical rare earth elements: samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium-related elements. These minerals are essential in various industries, from defense to electronics and renewable energy.

China, which produces about 90% of the world's rare earths, positions itself as a dominant player in this market, giving it significant capacity to influence global supply flows.

The restrictions not only affect exports to the United States but also the rest of the world. In particular, the affected products include both extracted minerals and finished products, such as permanent magnets, which are crucial for sectors like aircraft manufacturing, missiles, and communication systems.

This puts American companies like Lockheed Martin, Tesla, Apple, and others in a difficult situation, as they heavily depend on Chinese rare earths in their supply chains.

China has signaled that it could take unpopular measures like this for years, especially as trade tensions with the United States intensified under the Trump administration.

In response to the 54% tariffs imposed by the United States on most Chinese products, Beijing opted to implement stricter controls on essential minerals for manufacturing a variety of products, from smartphones to electric vehicles and advanced defense systems.

These elements are also vital for cutting-edge technologies like satellites and hypersonic weapons.

The impact of these restrictions is not limited to the American industry; the global rare earth supply chain could be severely affected, with markets like Japan and South Korea becoming key alternative sources of these materials.

However, production capabilities outside China are limited, which increases Western countries' dependence on Chinese supply. Economist Ryan Castilloux, founder of Adamas Intelligence, noted that China's drastic restrictions will trigger a "scramble for access" to alternative supply sources.