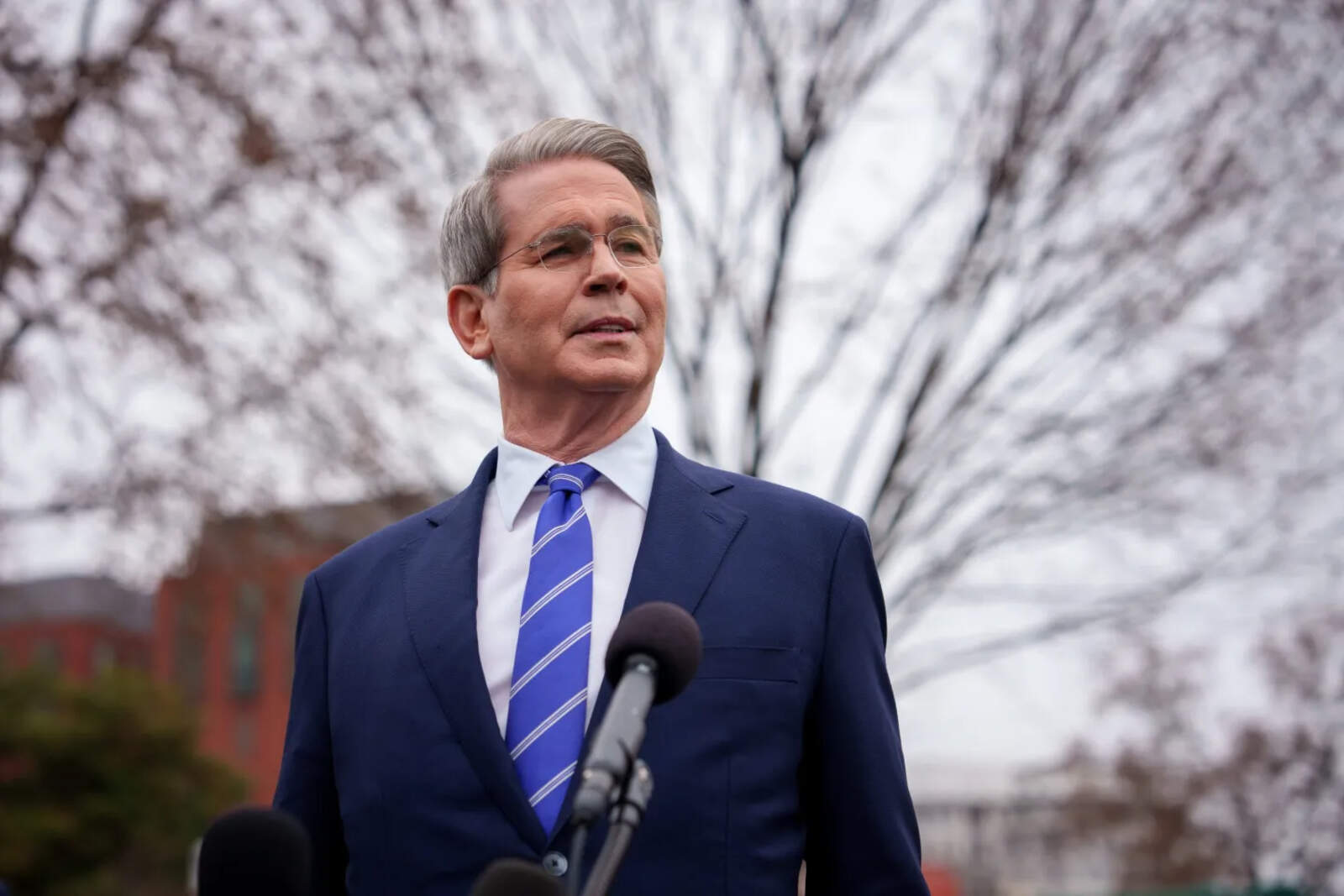

The United States Treasury Secretary, Scott Bessent, stated that trade negotiations are actively underway following the implementation of tariffs by the Trump administration.

According to Bessent, approximately 70 countries have contacted the White House since the announcement of "Liberation Day". This comes amid increasing volatility in financial markets and global tensions stemming from the reciprocal tariffs imposed between the United States and China, which has heightened uncertainty around global supply chains.

In a morning interview, Bessent replied to China's decision to impose an additional 50% tariff on United States imports, stating that, although China can increase its tariffs, this wouldn't have a significant impact. "China can increase the tariffs, but so what?" said Bessent, suggesting that the United States remains firm in its stance.

The secretary also highlighted that, although tensions continue to rise, the United States is open to dialogue, but emphasized that China must be the one to come to the negotiating table instead of continuing with retaliations.

Bessent made it clear that all policy options are on the table, including the possibility of excluding Chinese companies from U.S. stock exchanges. This has become a hot topic amid the growing trade war between both countries.

However, Bessent made it clear that the final decision on this matter rests with President Trump. This comment comes after the U.S. president increased the total tariff on Chinese imports to 104%, which led to a response from China, raising its tariffs to 84%.