Amid the debate over high municipal rates, the libertarian mayor of Tres de Febrero, Diego Valenzuela, reported the existence of unusual taxes in the first electoral section of Buenos Aires province, which generate minimal revenue but directly affect residents, especially business owners and industrialists. According to the municipal leader, these taxes should be permanently eliminated.

Among the examples mentioned are: the tax on inflatable advertising figures (San Martín), the tax for ownership of dangerous dogs (Pilar), the licensing fee for the "train of joy" (Pilar), the tax for advertising on chairs and tables (La Matanza), the tax for selling raffles in public spaces (Tigre), the tax for taxi and remise stops (La Matanza), the tax for animal registration (Pilar), the professional registration fee (Pilar), the tax for the inspection book (Pilar), the licensing fee for electric cars, the tax for installing security booths, the tax for elevators in private residences (Morón), the tax for bicycle racks (Luján), the licensing fee for driving school cars (Escobar), and the tax for gastronomic decks (Luján).

A striking case is the municipal ordinance of San Martín regarding inflatable figures, published in December 2024. It states that "For advertising carried out in public spaces, installing a figure or inflatable figure on a surface, with or without movement, temporarily or with the installation of a stand, tents, umbrellas and/or similar, and up to four (4) people dressed in clothing that represents or is symbolically connected to the advertised product and who distribute free samples of products, objects, brochures, or flyers (in the latter case, having previously paid the rights of subsection F) of this article), payment will be made per day, with prior authorization and without obstructing pedestrian and/or vehicular traffic."

Regarding the dangerous dog tax, the regulation states: "For registration in the Registry of Potentially Dangerous Dog Owners, one-time only."

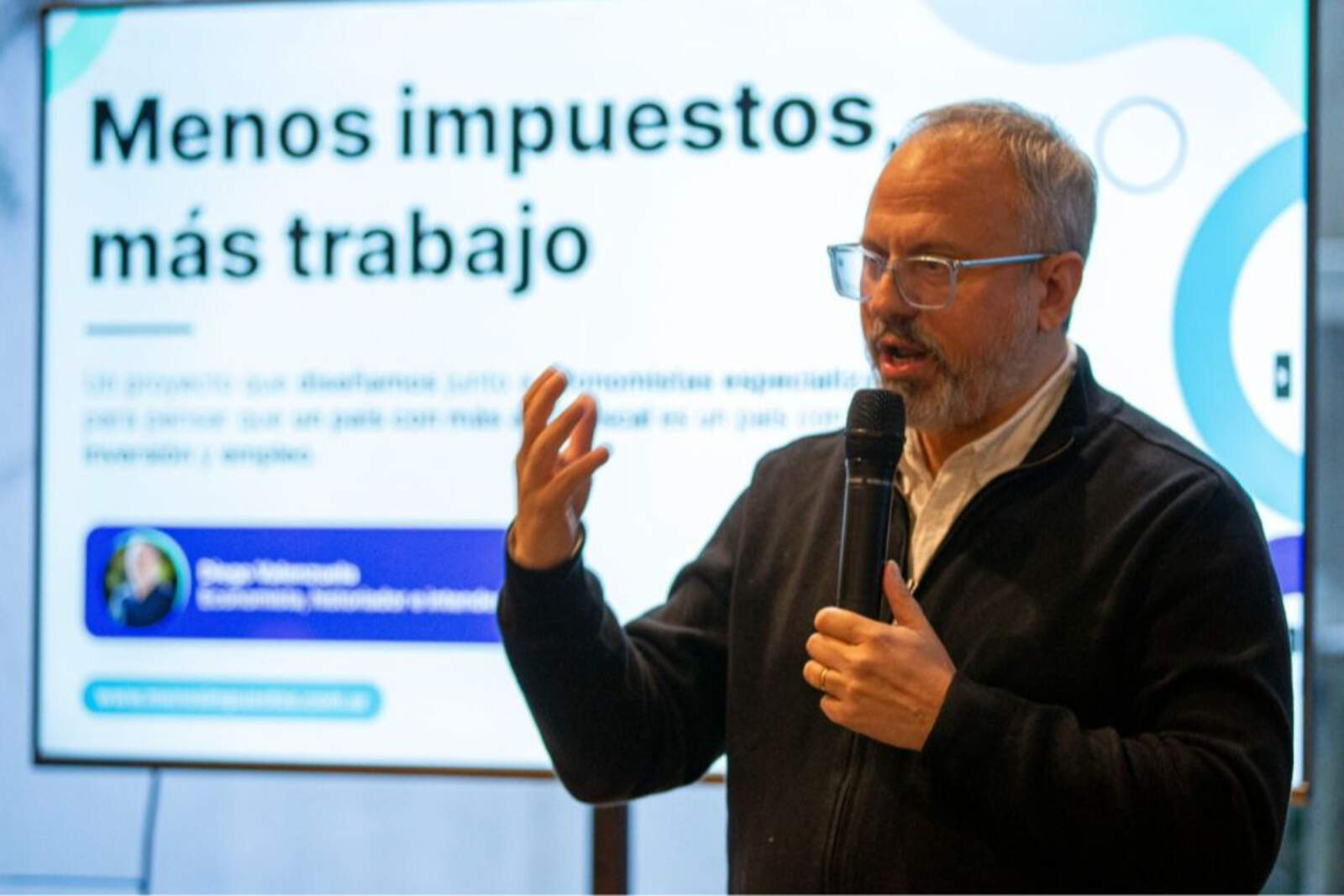

Valenzuela's report

Valenzuela stated: "We always say that fewer taxes, more jobs, lower rates, implementing a municipal RIGI, and not charging for licensing are necessary. It's not about modifying it, but about eliminating it so that tomorrow a mayor doesn't come and say 'I'm going to impose a tax on this.'"