Economic milestone: revenue surpassed inflation for the second time this year

The most prominent sectors for generating this milestone were exports, security, profits, and fuels

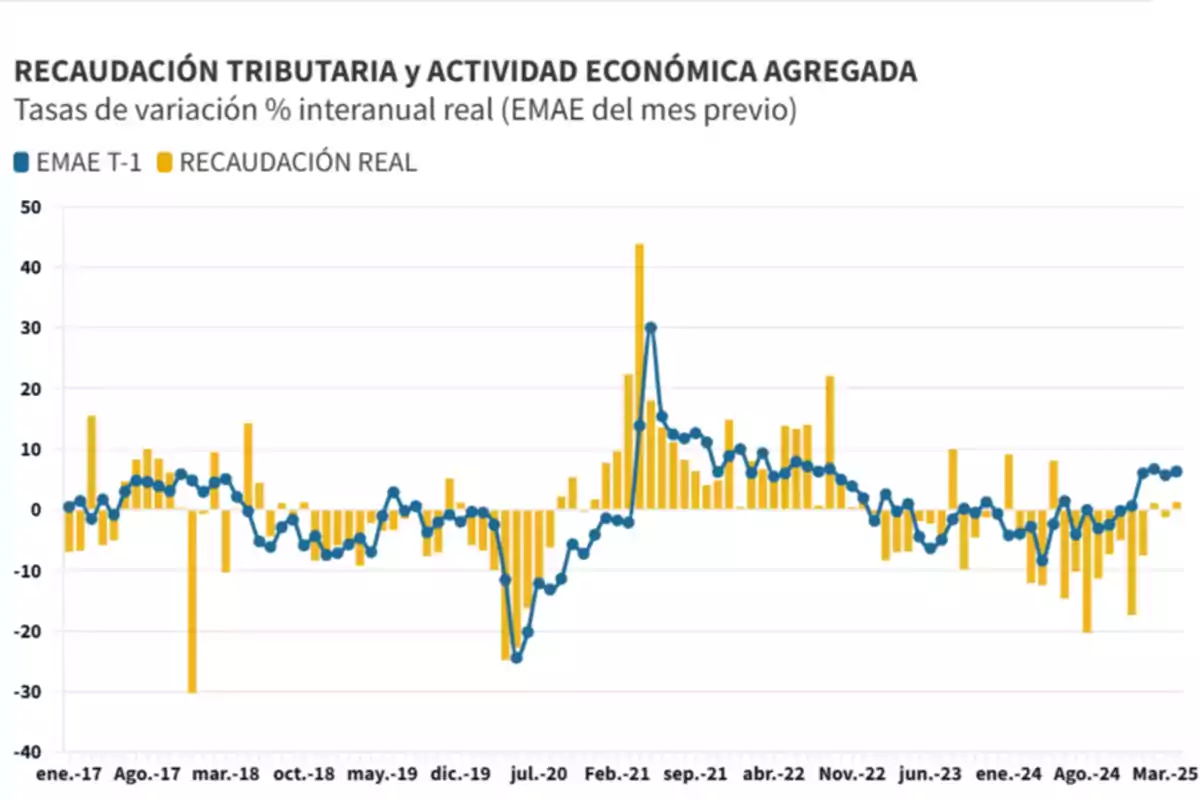

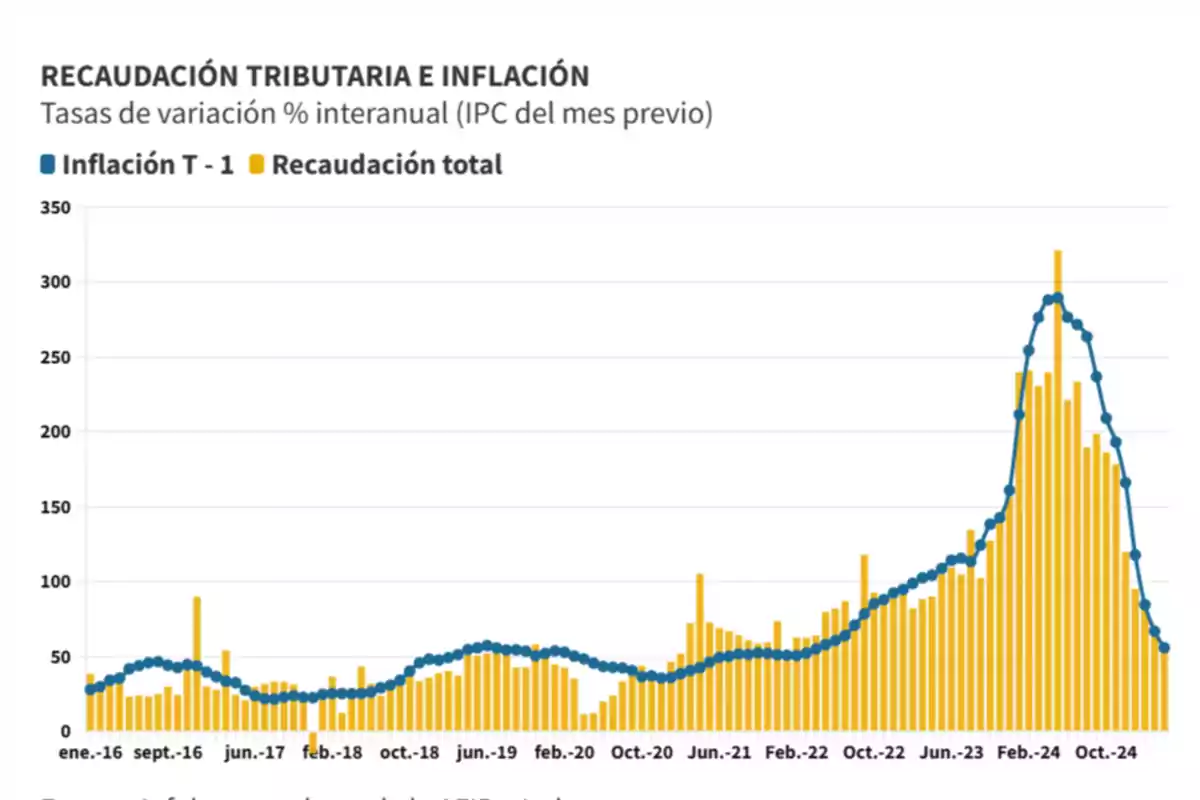

In a new indication of the solidity of the economic course undertaken by the Government of Javier Milei, tax revenue in April reached $13.68 trillion, registering a year-on-year increase of 57.9%, thus surpassing the latest available inflation data —corresponding to March—, which was 55.9%. This is the second time this year that tax revenue has grown above the general price increase, a clear sign of macroeconomic stabilization and improvement in formal activity.

This data is particularly relevant because it occurs in a pivotal month, divided into two well-differentiated stages: a first half marked by the inertia of uncertainty inherited from March and the expectation of a new understanding with the IMF; and a second stage, starting April 14, with the lifting of the exchange rate cap and the entry into a managed float regime within a 40% band, without official intervention, with a 1% monthly divergent update (upward for the selling rate and downward for the buying rate).

According to a report by the Revenue and Customs Control Agency (ARCA), "the changes in the exchange rate scheme that began on April 14 —including the removal of restrictions for the purchase of foreign currency by resident individuals, the easing of foreign trade operations, and the floating regime within bands— impacted the performance of tax resources."

One of the keys to the good fiscal performance was the reactivation of exports. The Argentine Oil Industry Chamber (Ciara) and the Cereal Exporters Center (CEC) reported that during April, companies in the sector liquidated foreign currency amounting to USD 2.524 billion, representing a jump of 34% compared to March and 325% compared to the same month in 2024, when the "soy dollar" was still in effect and the harvest had been smaller.

This impressive inflow of foreign currency is explained by three key factors:

The temporary reduction of export duties established by Decree 38/25, in effect until the end of June by presidential decision.

The new exchange rate scheme, which significantly improved export conditions.

The start of the main harvest, especially soybeans, which began to enter with greater volume toward the end of April.

Meanwhile, consumption showed signs of segmentation. While families maintained a more cautious attitude toward essential goods, the durable goods sector showed a clear reactivation. According to data from the Association of Automotive Dealers of the Argentine Republic (Acara), 54,001 vehicles were registered, implying a 63.9%year-on-year increase. Motorcycle sales also grew (35.5%) and investment in housing, reflecting renewed private sector confidence in the economic outlook.

Another decisive component was the growth of the Income Tax, driven by the end of the special regime for high incomes. ARCA explains: "The growth is explained by the higher withholdings from employees in a dependent relationship and retirees, due to a lower comparison base: in April 2024, the cedular tax on high incomes was in effect, with a non-taxable minimum equivalent to 15 minimum wages ($2,340,000) and a differentiated scale for affected remunerations." Salary increases also had an impact and —negatively— the adjustment of parameters in effect since January 2025.

The reactivation of economic activity brought with it an increase in average wages, which led to higher contributions to social security. Added to this was the increase in the maximum cap of the taxable base for employee contributions, which is updated monthly and was higher than the previous year.

Regarding the Bank Debits and Credits Tax, it also showed a positive performance, with an increase almost 15 percentage points higher than inflation, despite having one less business day and the refund of balances in favor of certain perception agents of the PAIS Tax.

Unlike the aforementioned taxes, the VAT Tax had a more contained behavior. ARCA technicians attribute this decline to the extraordinary payments recorded in April 2024 corresponding to obligations extended under the Fiscal Relief Measures promoted by the previous government. Additionally, there were higher VAT refunds to exporters and the Grain Marketing Regime. Regarding Customs VAT, revenues were limited by one less business day of collection and the repeal in March 2025 of the suspension of exclusion certificates.

The improvement in revenue also had a positive impact on provincial finances. During April, the national government transferred$4.33 trillion to the provinces and the Autonomous City of Buenos Aires in terms of revenue sharing, special laws, and compensations, implying a nominal growth of 62.9% compared to the same month in 2024, when transfers were $2.66 trillion.

After discounting a preliminary inflation of 46% for April, the real increase was 10.9%, a key data point for the fiscal strengthening of most jurisdictions. In the accumulated first four months, the transfers totaled $17.4 trillion, with a nominal increase of 80.1% and a real improvement of 11.4%, reflecting the strength of the national revenue rebound under Milei's administration.

More posts: