JP Morgan released a new report on the Argentine economy in which it evaluated price dynamics and the effects of the measures implemented by the Javier Milei administration.

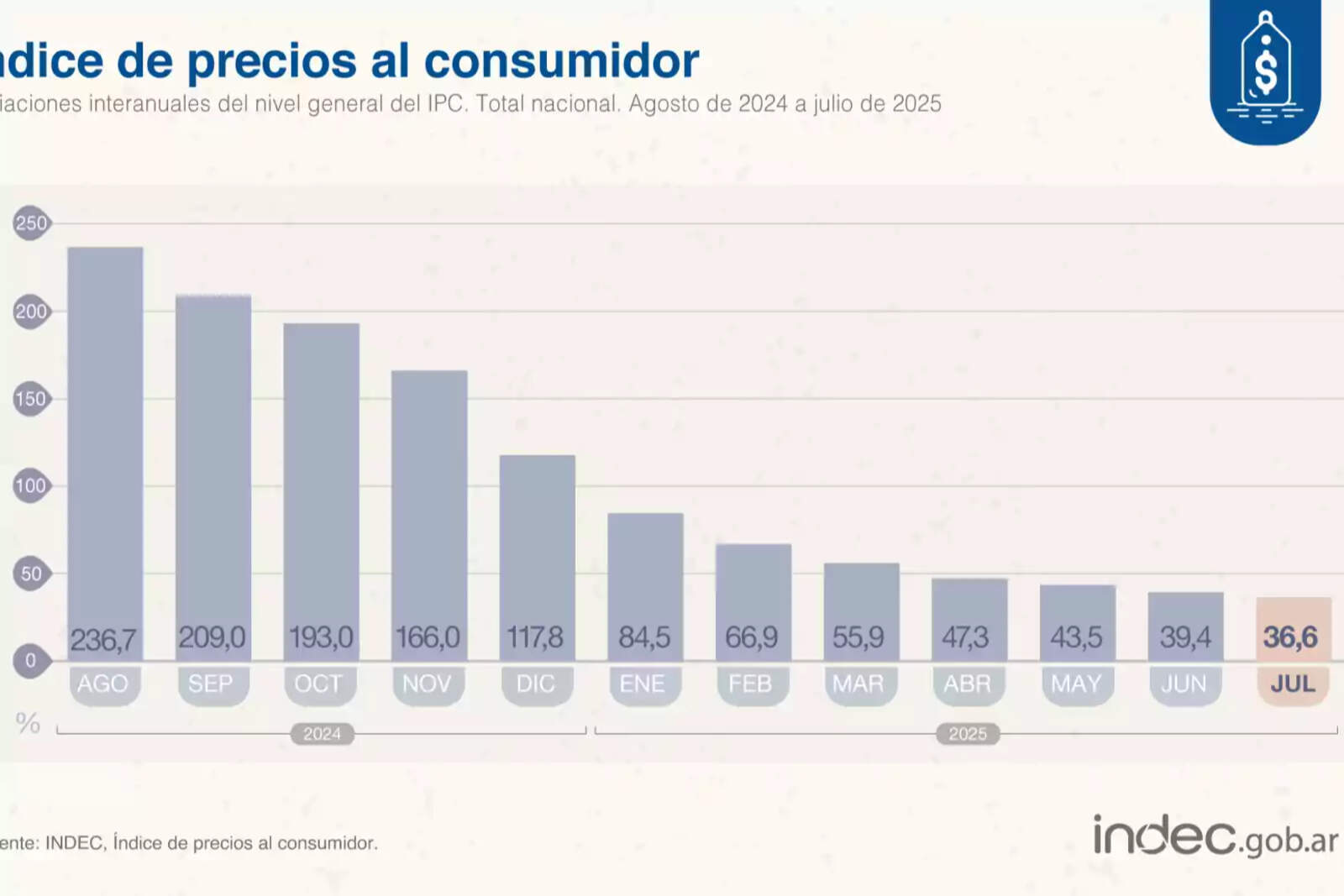

According to the institution, August inflation would show a monthly rebound of 2.1% due to the limited impact of the peso's depreciation at the end of July. However, starting in September, the price index would resume its downward trajectory and close the year with a year-on-year variation of 26.8%.

The projection from the Wall Street giant supports the approach applied by the Central Bank and the Ministry of Economy to absorb liquidity, control the exchange rate, and sustain the decline in inflation.

In this context, JP Morgan stated: "We have revised our estimate for the August CPI slightly upward, to 2.1% monthly, and we expect inflation to resume a downward trajectory in September, projecting a general CPI of 26.8% year-on-year in December 2025".

The survey also indicated that in July, the Consumer Price Index stood at 1.9% monthly, slightly above expectations, although still below the 2.4% average recorded in the first half of the year.