July recorded a current account surplus, the best figure since 2022.

The Central Bank reported that the foreign exchange current account closed with a positive balance in July

The foreign exchange current account closed July with a surplus of US$1,374 million, the second positive result so far in 2024.

The report released by the Central Bank of the Argentine Republic (BCRA)shows that this performance was mainly driven by the trade in goods, which reached its best monthly record since September 2022.

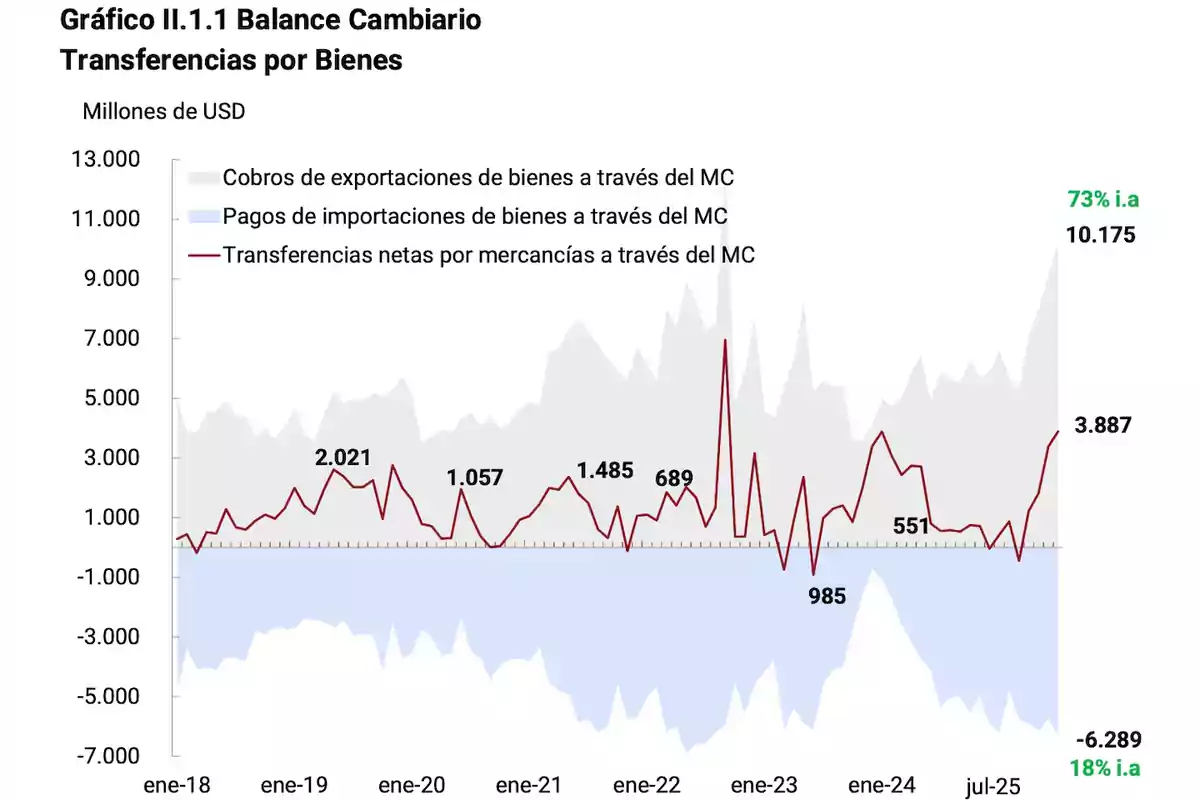

According to official data, July's positive balance was explained by net inflows from the "Goods" and "Secondary income" accounts, which totaled US$3,887 million and US$9 million, respectively. These amounts managed to offset the outflows recorded in "Primary income" and "Services", which amounted to US$1,595 million and US$928 million, respectively.

BCRA indicated that the surplus in the foreign exchange current account shows that more dollars entered than left the country through trade, services, loans, income, dividends, and transfers abroad.

The goods sector contributed the largest share of foreign currency inflows. In July, export receipts totaled US$10,175 million, compared to import payments of US$6,289 million, resulting in a net inflow of US$3,887 million. This was the best monthly performance since September 2022 and was driven by the oilseed complex, which totaled foreign currency sales of US$4,933 million.

The report also highlighted that "this result was explained by export receipts of US$10,175 million, partially offset by import payments of US$6,289 million".

The agricultural export sector maintained a key role in the flow of foreign currency, even with the residual effect of the temporary reduction in export duties that had ended on June 30. The rest of the sectors jointly contributed US$5,242 million in export receipts.

Meanwhile, the services account again showed a deficit, which in July amounted to US$928 million. The explanation lies in outflows related to card spending, travel, and tickets, which totaled US$817 million. Added to this were payments in "Other services" and "Freight and insurance", amounting to US$333 million and US$132 million, respectively.

Primary income also contributed to the deficit. According to BCRA, transactions under this item represented a net outflow of US$1,595 million, mainly explained by interest payments of US$1,563 million.

Within this category, the "General Government and BCRA"made net cancellations of US$1,275 million, while the private sector made payments of US$288 million. In addition, outflows for profits, dividends, and other income abroad amounted to US$32 million.

Finally, secondary income represented a marginal surplus of US$9 million. This reaffirms with data that the goods balance continues to sustain the flow of dollars into the country.

More posts: