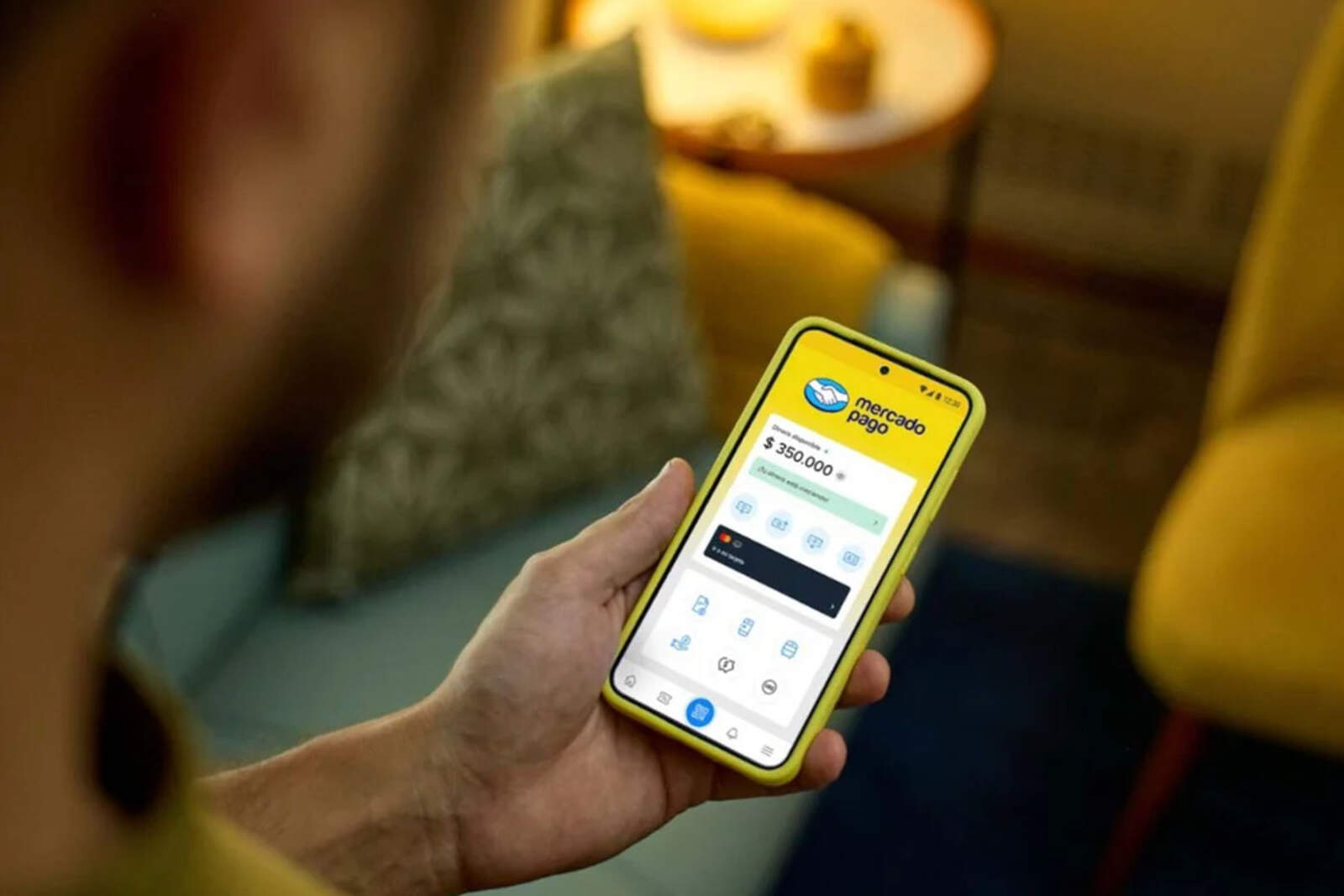

Mercado Pago takes another step forward in its financial strategy and modifies the management of its mutual fund.

Since June, the returns caused by the virtual wallet are no longer managed by BIND, but by its own management company.

What is changing in Mercado Pago's mutual fund?

The digital wallet informed its users that, since June 1, Mercado Pago Asset Management became the new manager of the mutual fund.

This change replaces Industrial Asset Management, the management company of Banco Industrial (BIND), with which Mercado Pago worked for years.

"You don't have to do anything. You keep generating daily returns with your money available at all times," the company stated.

Currently, the wallet offers an annual rate of 26.3% for balances invested in pesos.