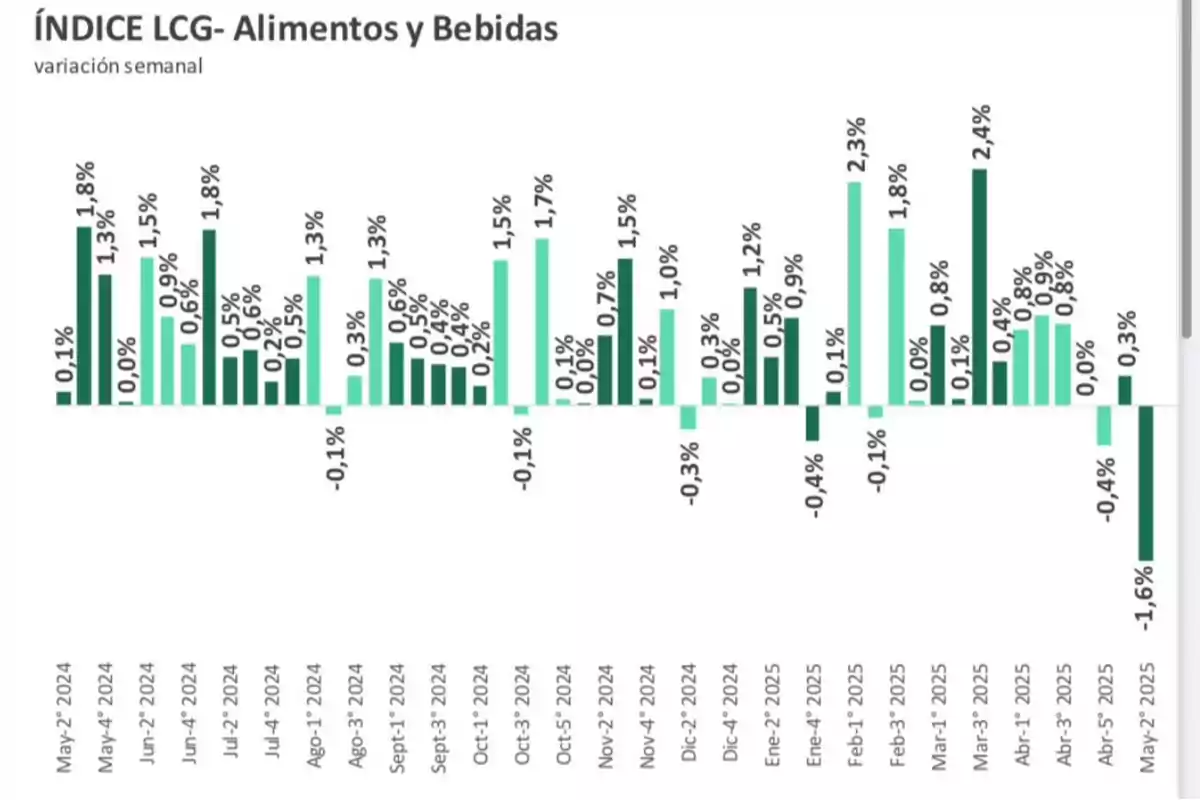

The second week of May experienced a deflation in food and beverages of -1.6%.

This unbelievable fact allows us to anticipate that the general price index could show a sharp drop in May

The prices of food and beverages in supermarkets recorded a significant drop in the second week of May, with a deflation of -1.6%, according to data collected by the consulting firm LCG.

This is the most pronounced weekly drop so far this year and represents a continuation of the marked slowdown that had already been observed in the first week of the month, when prices rose by just 0.3%, the smallest increase since November.

These data are, without a doubt, excellent news for both the Government of Javier Milei and consumers, who see concrete relief in the price of basic products. The drop reflects a clear change in trend compared to previous months, when food —one of the most sensitive categories in the basic basket— was the main driver of inflation.

The process of price stabilization in supermarkets, if confirmed in the coming weeks, could consolidate a scenario of monthly inflation well below previous projections.

In fact, this evolution allows us to anticipate that the general price index could show a sharp drop in May, with the concrete possibility that monthly inflation starts with "1." Although key data from INDEC is still missing, what has been observed in the behavior of food —a category that has a central weight in the consumer price index— marks a promising trend. The slowdown, driven by policies of fiscal balance, exchange rate stability, and zero issuance, is becoming increasingly noticeable.

The projections of the mandrills

This outlook strongly contrasts with the predictions of several economists and consulting firms who, just weeks ago, warned of a possible reversal of the declining inflation. In fact, many of these analysts, whom President Javier Milei often refers to as "mandrills," were forecasting inflation of up to 5% for April.

However, the official data released by INDEC on May 14 was conclusive: April's inflation was 2.8%, a drop of almost 1 point compared to the previous month and below even the 3.2% estimated by the Central Bank's Market Expectations Survey (REM).

With these data in hand, Milei's Government is strengthened for the coming months, showing that, for the first time in decades, inflation could once again be just a bad memory.

More posts: