The U.S. created 177,000 jobs in April and kept unemployment at 4.2%.

The package of measures, known as 'Liberation Day,' imposed heavy tariffs on imports

The U.S. labor market showed signs of strength again in April, with the creation of 177,000 new jobs, a figure higher than expected by analysts, while the unemployment rate remained stable at 4.2%, according to the report released by the Department of Labor this Friday.

Job creation above expectations

Official data shows that the world's largest economy created more jobs than anticipated by the market, as economists surveyed by Reuters projected only 130,000 new positions. However, the figure fell short of the 185,000 jobs recorded in March.

The labor market needs to generate about 100,000 jobs monthly to keep up with the growth of the working-age population. "Hiring continues to exceed that threshold, showing the persistent strength of employment in the U.S.," analysts explained to Reuters.

The impact of the tariff war

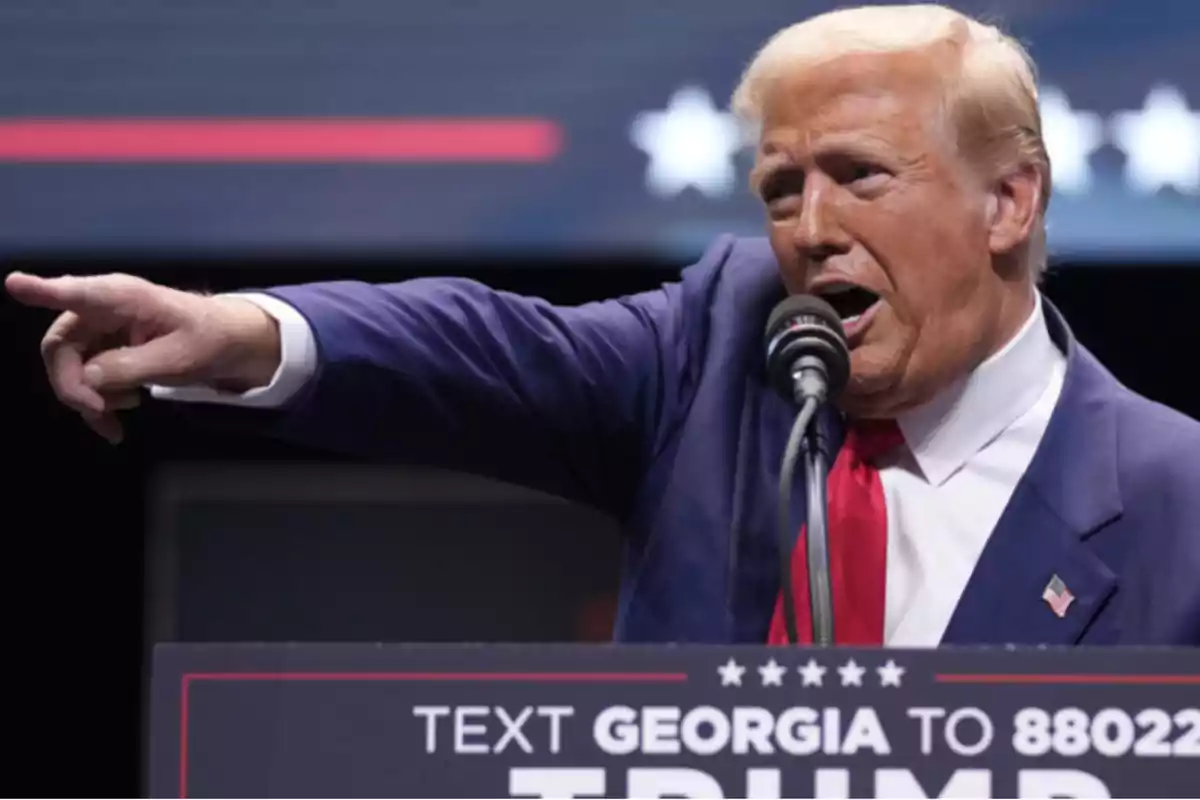

According to specialists, it is still early to measure the effect of the new tariff policies promoted by President Donald Trump, which were announced at the end of the first quarter.

The package of measures, known as the "Liberation Day," imposed heavy tariffs on imports, including Chinese products, with increases reaching 145%. This strategy unleashed a new trade war with Beijing and complicated the financial scenario for many companies.

Although the implementation of some tariff increases was postponed for 90 days, this created an atmosphere of uncertainty that, according to experts, "froze key economic decisions and could trigger a recession if the outlook is not clarified."

Labor resilience, but with warnings

Despite this context, companies continue to show caution when it comes to laying off employees, due to the difficulties they faced in finding staff during the COVID-19 pandemic. However, several indicators raise warning signs:

- Business confidence continues to fall, which could lead to job cuts.

- General Motors reduced its profit projection for 2025, anticipating a tariff impact of between USD 4,000 and 5,000 million.

- Commercial airlines suspended their forecasts for 2025, citing uncertainty over spending on non-essential travel.

- In this scenario, analysts believe that companies might first opt to reduce working hours before making mass layoffs.

Expectations on monetary policy

In this tense climate, the Federal Reserve is expected to keep its benchmark interest rate between 4.25% and 4.50% at its next meeting. The goal will be to continue monitoring the evolution of employment and inflation without exacerbating the economic slowdown.

More posts: