Uruguay under fiscal threat against savers: 'Kirchnerist tax'

Legislators warn that the government's plan could replicate the confiscatory policies of Argentine Kirchnerism

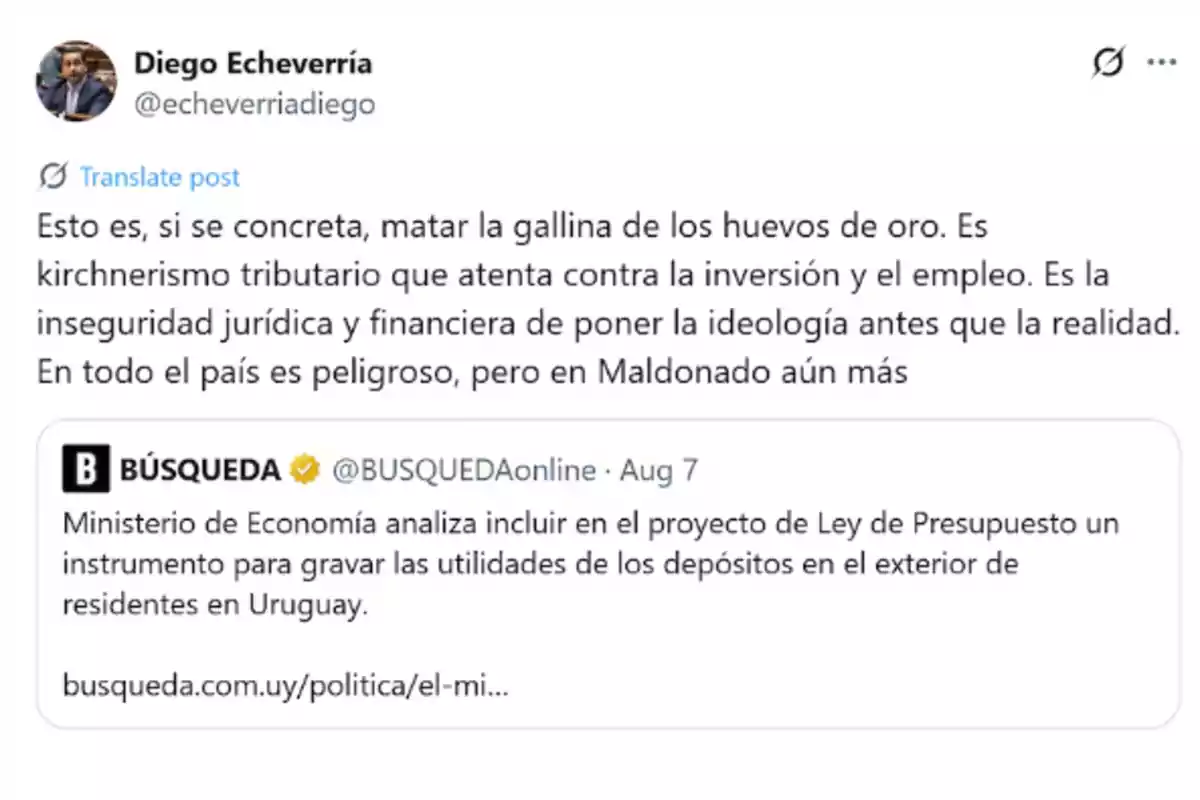

The climate of tax stability that for years characterized Uruguay could face a drastic shift. The Ministry of Economy and Finance (MEF) is considering including, within the Budget Law project, a tax on the profitability of deposits and investments abroad belonging to Uruguayan residents. The measure, revealed by the weekly publication Búsqueda, aims to modify the current Personal Income Tax (IRPF), which since the 2007 tax reform has not taxed capital gains obtained outside the country. The scope of this possible reform is highly significant: according to official figures, the assets of Uruguayans abroad totaled in 2023 about 62 billion dollars, which is equivalent to 79% of the national Gross Domestic Product. The increase compared to 2019, when the amount was 27.171 billion, shows the growing magnitude of this capital.

More posts: