Chubut adheres to the fiscal transparency regime promoted by Milei's government.

Nacho Torres celebrated the decision and encouraged other provinces to join the guideline promoted by Milei's Government

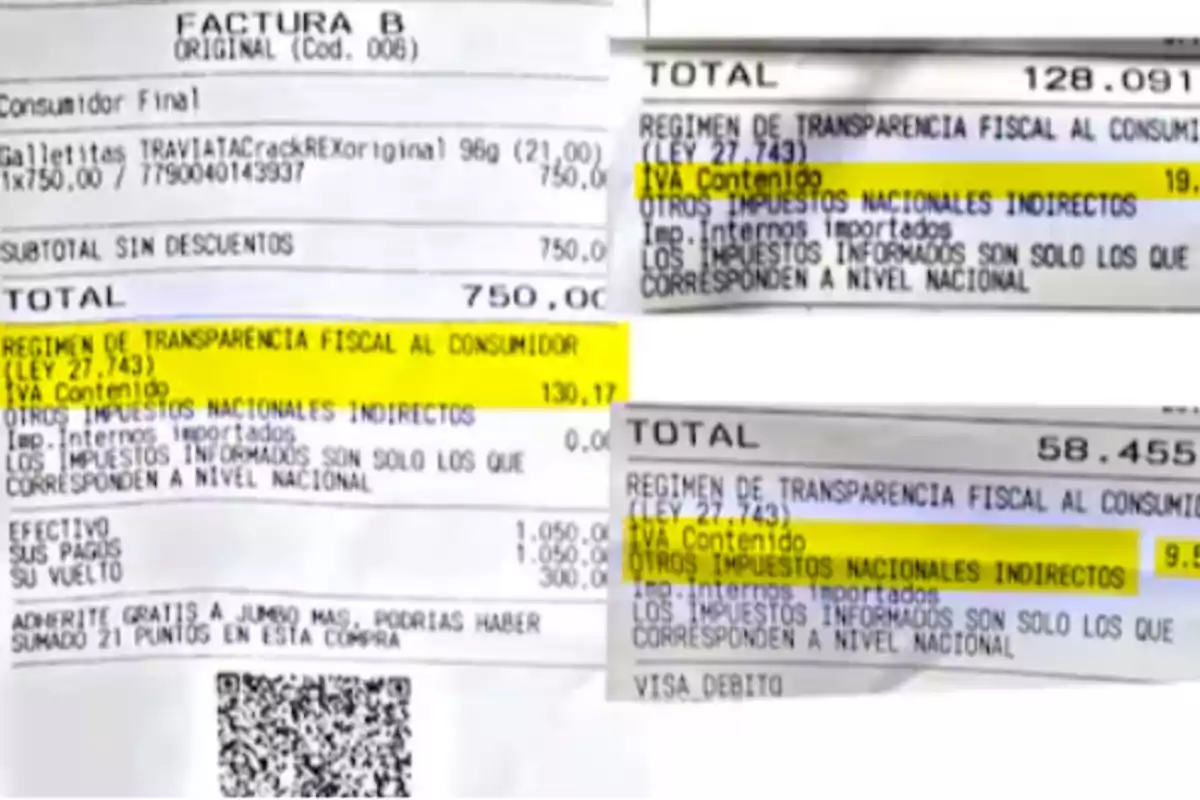

The province of Chubut took a key step in terms of tax transparency by becoming the first jurisdiction to adhere to the Fiscal Transparency Regime for the Consumer, an initiative that seeks to ensure that purchase receipts clearly detail all taxes applied in each transaction.

As a result of this measure, receipts will report gross income, municipal rates, and national taxes such as VAT.

A boost to citizen tax awareness

Governor Ignacio "Nacho" Torres celebrated the decision and encouraged other provinces to join the guideline promoted by Milei's Government: "Each province is autonomous to enact its respective taxes, but it is our minimum obligation to inform the citizen."

Since January, the national Government mandated that large companies display the tax breakdown, and since April, this obligation was extended to other businesses. The measure is part of a cultural change promoted by civil society, especially by the NGO Lógica, the main proponent of the regime.

Support from the Nation and civil society

The Undersecretary of Consumer Defense, Fernando Blanco Muiño, celebrated Chubut's adherence through the social network X: "Congratulations to the Governor and the people of Chubut! A new stage of consumer tax awareness is coming."

Meanwhile, Matías Olivero Vila, president of Lógica, emphasized that this initiative "puts an end to 50 years of tax opacity" and will allow the visibility of taxes usually ignored by the consumer, such as gross income or municipal rates.

"The lack of tax awareness led to citizens not demanding responsible behavior from politicians. Knowing the taxes we bear will empower us to demand logical public services and spending," said Olivero.

Tax transparency: the uneven progress in the country

Lógica reported that they sent two letters to the 24 governors and more than a dozen officials from each province. So far, only CABA, Catamarca, Chubut, Entre Ríos, Mendoza, and Misiones have replied affirmatively. Among them, Entre Ríos would be the next to implement the system.

In another six provinces, there are adhesion projects stalled by local opposition. Olivero emphasized that this adherence doesn't imply giving up revenue, as it only requires informing about existing taxes. Additionally, he highlighted that the National Constitution in its article 42 supports this type of initiative, which transforms this "invitation" into an exhortation with institutional character.

An opportunity to change the relationship with the State

The NGO proposes taking advantage of this "momentum of cultural change" caused by the current political context to consolidate a more informed and active citizenry in tax matters.

The goal: that the debate on taxes and public spending transcends the governments of the day and becomes a topic of civic and cross-cutting agenda.

More posts: