The US House of Representatives approved a spectacular project by President Trump

The lower house approved a bill yesterday that includes a magnificent tax reform. No Democrat voted in favor

On Thursday, the United States House of Representatives approved President Donald Trump's ambitious bill by a narrow margin of 215-214, known as the "One Big Beautiful Bill Act," which includes a broad tax reform, cuts in public spending, and strict immigration measures.

All Democrats voted against it, and two Republicans, Thomas Massie (Kentucky) and Warren Davidson (Ohio), joined the opposition. A third Republican, Andy Harris, voted "present."

White House Press Secretary Karoline Leavitt praised the bill's approval as an essential victory for the Trump administration.

She described the Democratic Party as "more radical and disconnected than ever from the needs of the American people" for rejecting what she described as common-sense and widely popular policies. Leavitt assured that this law represents the final piece to inaugurate a "Golden Age of America."

Among the key measures included in the One Big Beautiful Bill Act are:

- Tax cuts: It establishes the largest tax reduction in United States history for middle-class families, workers, and small businesses. It also eliminates taxes on tips and overtime, and creates tax deductions for the purchase of vehicles manufactured in the U.S.

- Immigration measures: Includes the largest investment in border security in the country's history, with funds to complete Trump's border wall, the deportation of at least one million undocumented immigrants per year, and salary increases for ICE and Border Patrol agents.

- Public spending reforms: The bill aims to reduce the national deficit by approximately USD 1.5 billion through significant cuts to government spending.

- Changes to Medicaid: New work requirements for Medicaid beneficiaries are moved up to December 31, 2026, aiming to reduce costs. Additionally, an incentive is created for states not to expand Medicaid coverage.

- SALT (state and local tax deduction): The limit is raised to USD 40,000 for those earning less than USD 500,000 a year, compared to the previous limit of USD 10,000. This concession was key to gaining the support of Republicans from high-tax states like New York and California.

- "Trump" Savings Accounts: The accounts originally named "MAGA Savings Accounts" are renamed "Trump Savings Accounts," with the word "Trump" appearing more than 50 times in the legislative text.

- Clean energy tax credits: The phase-out of certain tax credits implemented under the Biden administration is accelerated, unless projects are initiated within 60 days or are operational before the end of 2028.

- Firearms: The bill eliminates the federal tax on silencers by excluding them from the National Firearms Act.

- Border security reimbursements: USD 12 billion is allocated to reimburse states for costs incurred due to Biden-era immigration policies.

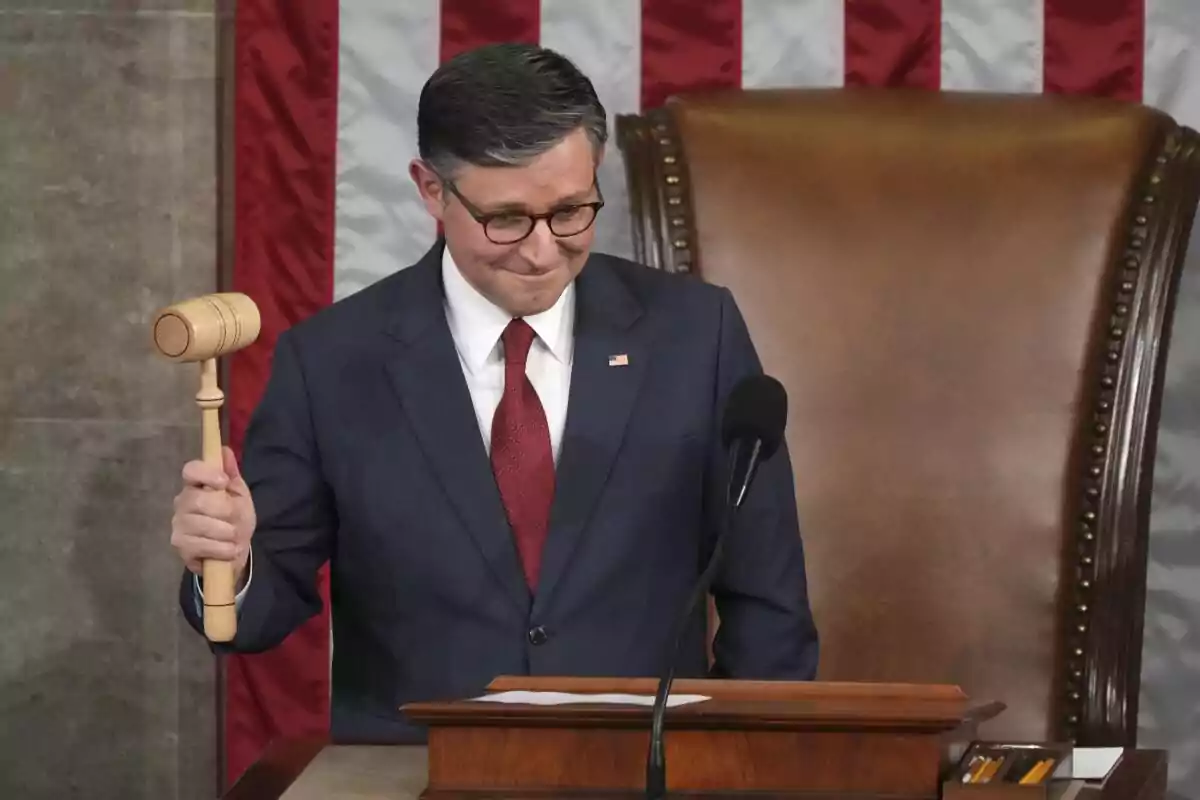

The approval was celebrated by President Trump, who called it "the most significant legislative piece ever signed in our country's history." He congratulated House Speaker Mike Johnson for achieving the necessary consensus despite internal divisions within the Republican Party.

Johnson stated that "it's morning again in America," alluding to Ronald Reagan's slogan, and asserted that Republicans have shown they can fulfill the "America First" agenda.

However, the opposition was strong. All Democrats rejected the bill, and Representatives Massie and Davidson expressed their disagreement with its fiscal and immigration aspects. Leavitt hinted that Trump believes both should face challengers in future Republican primaries.

The bill now heads to the Senate, where there is also a Republican majority, but revisions to the text are anticipated. The coming weeks will be crucial to determine whether the Senate supports the bill as it is or introduces substantial changes.

More posts: