Uruguay: unsolved inflation and the BCU's cooling measures

The scourge of the loss of purchasing power of the national currency

Searching for data from the BCU to update material for my classes on persistent inflation in Uruguay, I found a news item on its homepage from its monetary policy committee: "April 8, 2025: The BCU increases the interest rate to 9.25% to drive inflation to the target of 4.5%."

In a previous post, I mentioned that the then-future Minister of Economy, Gabriel Oddone, proposed de-indexing wages to prevent the increase in inflation. The article was "De-indexation... Correct Measure for Wrong Reasons."

I will explain why inflation will not remain within the target range (post-lag) and how the background of a government with ideas—which I consider wrong—about how the economy works will also produce the usual low growth with high unemployment.

You might also be interested in: Casmu is saved

Persistent inflation in Uruguay, the last 25 years

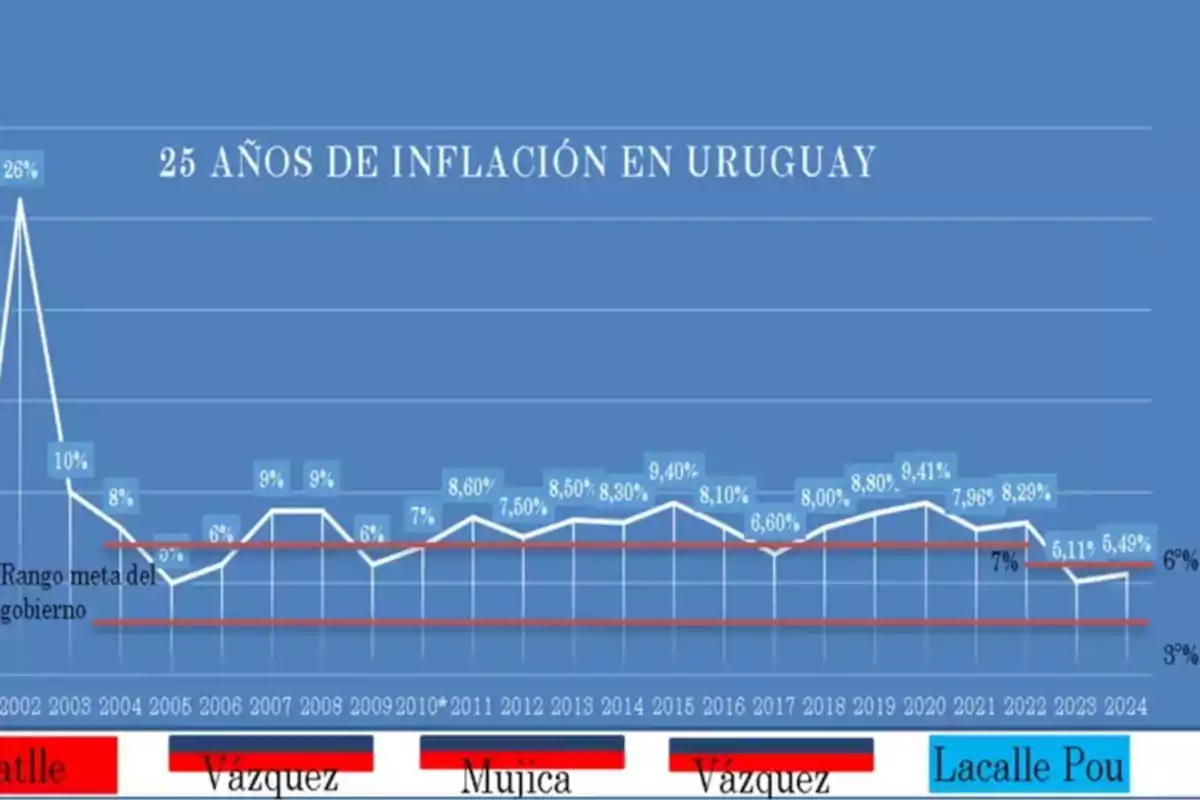

The following table shows inflation in the last five governments, almost always outside the target range since it was implemented, in the 15 years of the same government to the current one, the Vázquez-Mujica-Vázquez period.

About Mujica's role in this period

The largest increase in the CPI was recorded during the 2002 crisis, with 26%. Since 2004, after establishing an annual target range between 3% and 7% (3-6% since September 2022), inflation has rarely been within the bands, although close to the maximum limit.

In times of crisis, as often happens in our case, governments apply Keynesian measures, among others, increase the amount of money as a way to overcome it and encourage recovery. I will also explain this fallacy.

Crisis and insecurity also demand another model

Sole cause of inflation

Inflation is not multi-causal nor a "complex" issue. The cause is the central bank's issuance of money to lend to the government as a means to finance the fiscal deficit. This is not free; we all pay for it with more poverty.

The fiscal deficit occurs every time the government spends more than it collects in taxes.

Erring the causes is never finding the solution

Using economic policies with a wrong diagnosis will not solve the problem and aggravates it.

The allocation of society's scarce resources will continue to be uncoordinated unless a government has the noble goal of withdrawing and refraining from trying to control everything.

Hayek wrote in The Road to Serfdom: "What has always made the state a hell on earth has been precisely that man has tried to make it his paradise."

We come from years of meager growth. Although Uruguay is the best-performing economy in the region, due to the lack of economic freedom, we are moving away up to a fifth of the richest economies.

27 years of low growth

When prices are not free, the signal that guides the efficient allocation of resources is lost. If the price increase reflects a loss of value of the peso and not a real change in the market, the economy becomes uncoordinated.

This generates lower real wages, discourages investment, and hinders wealth creation.

Cooling down by controlling the dollar

The dollar, in contexts of inflation, acts as a refuge and thermometer.

Trying to control the exchange rate only delays the inevitable. When its price is capped, parallel markets appear that reveal its true value.

Conclusion: abandoning a wrong model

When political power sets prices, alters interest rates, or manipulates the dollar, it distorts the essential signals that allow people and companies to coordinate their decisions.

As long as the symptoms are blamed and not the origin—uncontrolled issuance, excessive public spending, and price manipulation—inflation will persist, and the economy will continue to impoverish.

Empirical evidence supports an economy with free price formation, fiscal discipline, and respect for savings.

Only in this way is the lost strength recovered and genuine and sustainable development achieved.

More posts: