141 cases of forced disappearance contradict Noroña and Morena

Cases of enforced disappearance have been documented by independent organizations and by the federal government

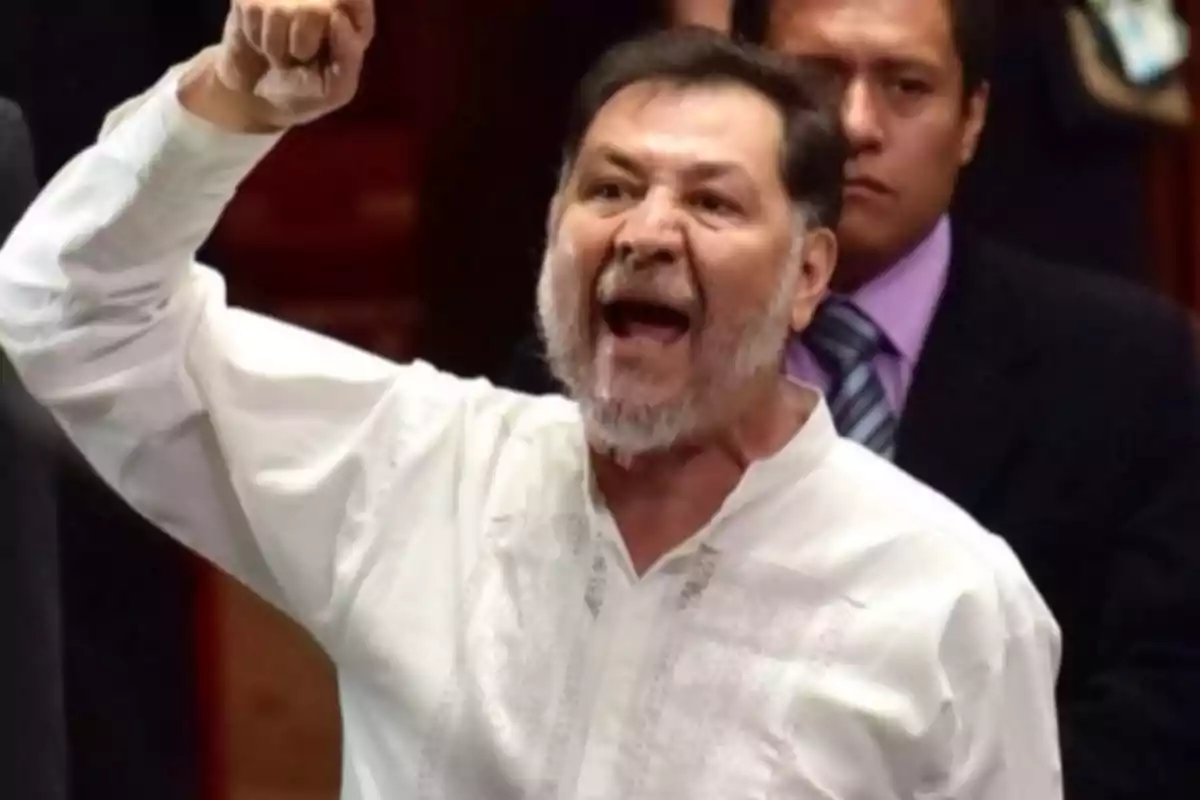

On April 4, a specialized UN body announced that it will review the concerning accumulation of forced disappearances in Mexico. The reaction of the president of the Senate, Fernández Noroña, was to deny the existence of these practices during the current government.

Additionally, he challenged the international body to present a single case that occurred under his administration.

Official data contradicts this stance.

The National Search Commission, a dependency of the Ministry of the Interior, documented at least 141 victims of forced disappearance between December 2018 and August 2023. These cases involve police or military corporations as direct perpetrators and are distributed across 25 federal entities.

Of the 141 forced disappearances, 68 occurred in states governed by Morena or its allies (such as the Green Party in San Luis Potosí and the Social Encounter Party in Morelos).

This demonstrates the involvement of public officials in these crimes even under governments allied with the ruling party.

It is worth noting that this figure doesn't represent the totality of cases, only includes those that the Commission agreed to register. It left out those that occurred after the last update in 2023.

Two emblematic cases illustrate this issue.

The first is that of activist Claudia Uruchurtu Cruz, disappeared on March 26, 2021 by employees of the Morena-led city council of Nochixtlán, Oaxaca. Uruchurtu, who openly supported Morena, was kidnapped after denouncing acts of corruption by Mayor Lizbeth Victoria Huerta.

Three officials were sentenced for forced disappearance and the mayor was convicted of obstruction of justice. Despite the sentence, Claudia's whereabouts remain unknown and her case is not listed in the official list of missing persons.

Another case is that of José Alberto Serna Rojas, disappeared and murdered by Mexico City police on September 4, 2021, during the government of Claudia Sheinbaum.

The young man was detained after arguing with his ex-partner, but was never presented to the Public Ministry. Instead, he was beaten to death and his body was hidden in a ravine in the Chapultepec Forest.

His body was found three days later, and the three responsible police officers were sentenced to 60 years in prison for aggravated forced disappearance. Like the case of Uruchurtu, Serna also doesn't appear in the official record.

These events contradict the official discourse that there are no forced disappearances under the current government.

Official figures and court sentences demonstrate that these crimes continue to occur. Many times with the direct involvement of state agents and in entities governed by the ruling party.

More posts: